-

Both Kroll and S&P expect losses on collateral in the subprime consumer lender's latest deal to be higher than its 2017 deals; Kroll alone assigned a lower rating to the senior tranche.

November 5 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

October 31 -

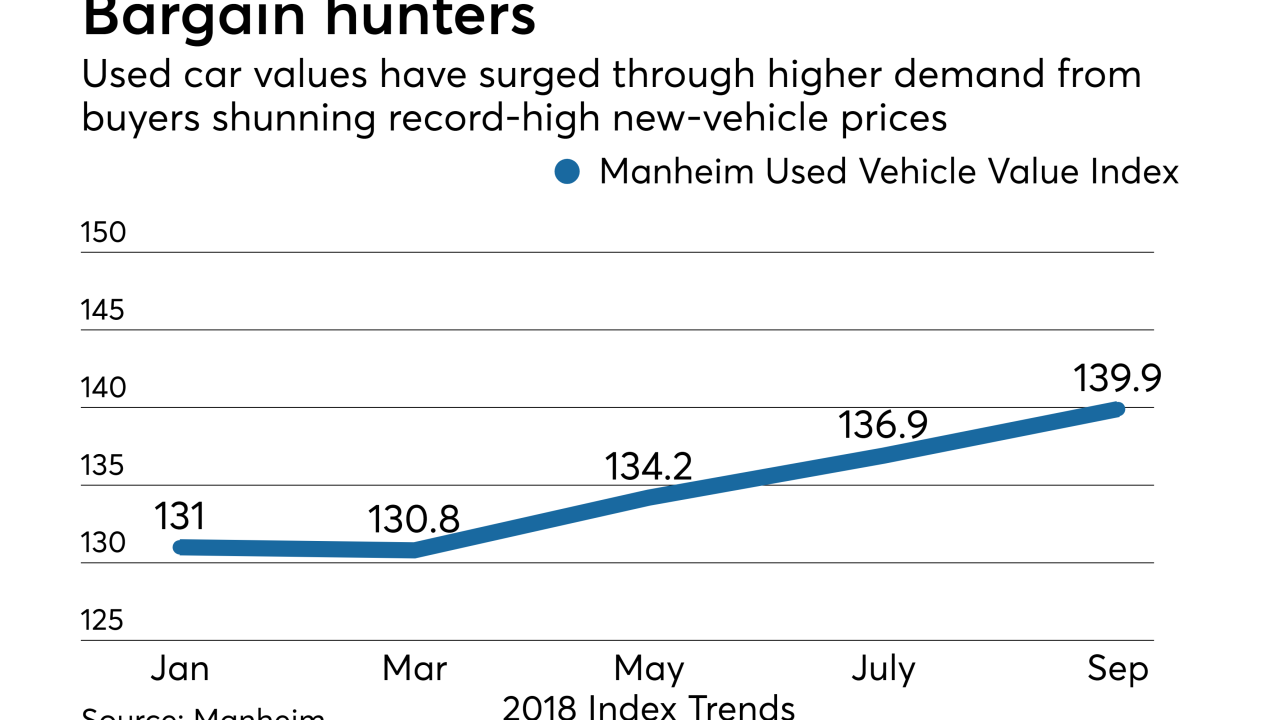

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

October 29 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Both S&P and Moody's have cut expected losses on $732 million deal, yet credit enhancement on the senior tranches is unchanged from the prior deal.

October 22 -

The credit quality of loans backing the Cailfornia-based lender's $183 million securitization is better than that of its inaugural deal, which was only rated 'A' by Kroll.

October 18 -

The California-based CDFI has a growing portfolio of renewal loans from prior borrowers eligible for higher credit limits.

October 11 -

The fifth SDART deal of the year benefits from the same improvement in credit quality as other recent transactions from the platform.

October 11 -

Consumer Portfolio Services' fourth auto-loan securitization of the year has a 3.97% share of loans previously assigned to CPS asset-backed portfolios, compared to an 11.97% share in its last transaction.

October 4 -

DriveTime is making less-risky loans under a $750 million contract purchase agreement with Ally Financial; it appears that the sponsor is also funding some of this lending through its own securitization platform.

October 4 -

Gov. Jerry Brown’s administration sent letters Wednesday to 20 nonbank lenders that charge triple-digit annual percentage rates to try to determine if their use of online referrals is steering borrowers into larger loans than they want or need.

September 26 -

The nation's fifth-largest bank on Monday rolled out a three-month consumer loan that is far less expensive than the typical payday loan. The move comes as regulators are encouraging banks to reach out to the subprime market, which they largely abandoned.

September 10 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

Moody’s expects losses on Drive Auto Receivables Trust 2018-4 to reach 25% of the original balance over the life of the deal, down from 26% for its prior deal.

September 7 -

Investor appetite for deeply subordinated debt is increasing even as the industry starts to consolidate; problems at Honor Finance demonstrate the limits of relying on overcollateralization to offset losses.

September 6 -

About 8.5% of loans backing the $256.2 million transaction were reassigned from a 2015 deal; this boosted the weighted average seasoning to seven months from one month for ACA's prior deal.

September 5 -

S&P says extended term loans and "liberal" collection policies are pushing losses and amortization toward the tail end of some lenders' securitizations — making cross-comparing performance between lenders and an issuer's own outstanding vintage deals more difficult.

August 26 -

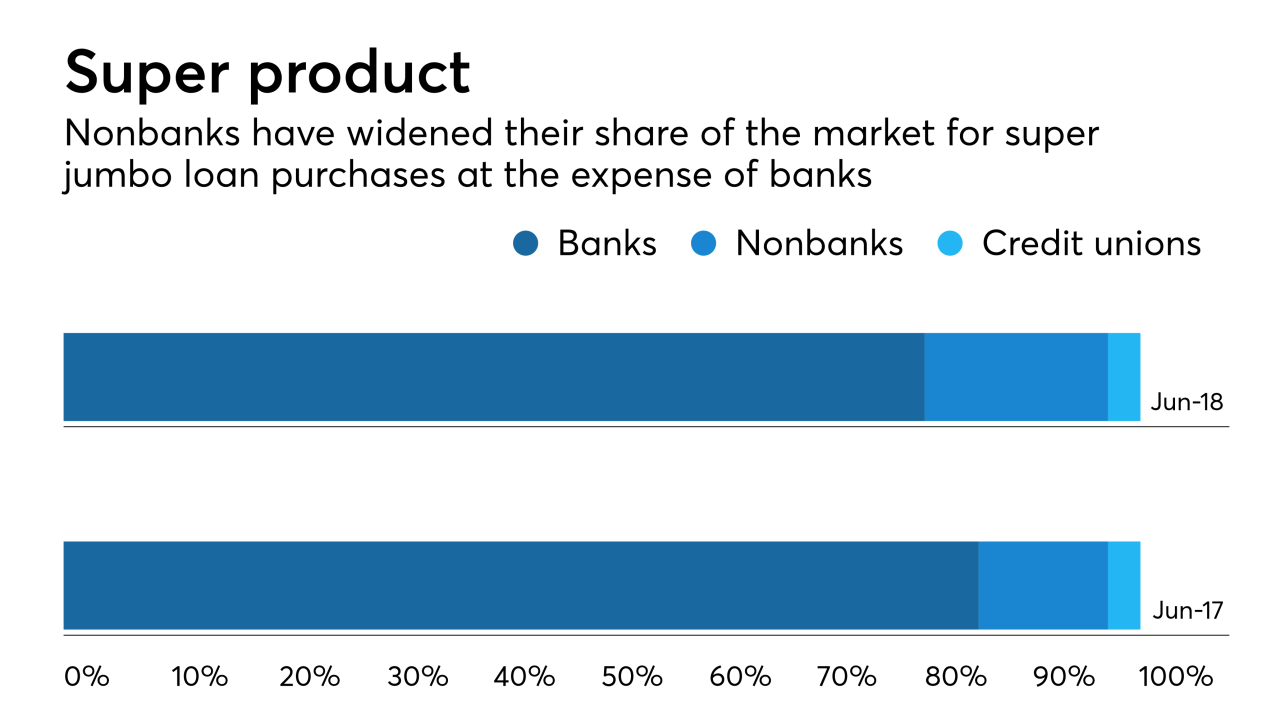

New investor appetite for mortgages over $1 million is motivating more nonbank lenders to offer super jumbo loans, often with weaker credit terms than traditional banks.

August 20 -

Similar to the sponsor's prior transaction, however, the collateral includes a large portion of loans underwritten using bank statements to verify borrower income: 49%.

August 17 -

The investors initially won the right to sue as a group in 2015 before an appeals court reversed the ruling; the $13 billion lawsuit can now proceed as a class action.

August 15