Improved performance on its deep subprime securitizations has lowered comparable loss expectations on Santander Consumer USA’s next $1 billion securitization of deep subprime auto loans.

Moody’s Investors Service expects losses on Santander’s Drive Auto Receivables (DRIVE) Trust 2018-4 to reach just 25% of the original balance over the life of the deal; that's down from 26% for the first three transactions from the DRIVE platform this year.

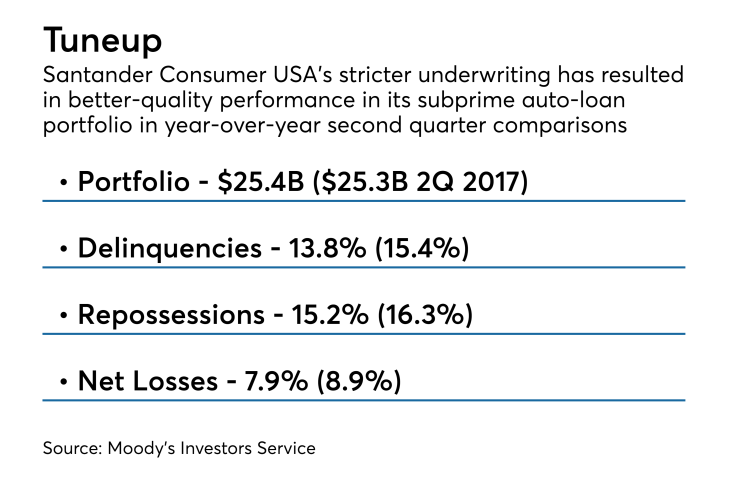

In its presale report, both Moody's and S&P Global Ratings noted that the early performance of DRIVE 2018-3, 2018-2 and 2018-1 appears to be better than that of 2017 and 2016 vintages. Santander is experiencing declining levels of managed portfolio delinquencies and net losses on its other outstanding securitizations.

It marked another recognition of Santander’s tightened underwriting standards that has resulted in higher weighted average FICOs in recent deals and allowed for lower credit enhancement levels in its two most recent DRIVE transactions.

In DRIVE 2018-4, Santander is proposing to go to market with a $1 billion notes offering, potentially upsizing to $1.26 billion. The $1 billion pool will include 68,706 loans totaling $1.3 billion, while the upsized pool would be backed by $1.6 billion in loan collateral across 85,279 obligors.

The $1 billion bond package includes a senior note stack consisting of a $145 million Class A-1 money-market tranche, a $220 million Class A-2 tranche of two-year fixed- and floating-rate notes, and a $147.5 million in Class A-3 notes due November 2021.

If the deal is upsized by its closing date, the tranches would be increased to $180 million in Class A-1 notes, $273 million in Class A-2 and $182.8 million in Class A-3. The split between the A-2 notes is to be determined, although the fixed-rate notes would not make up less than half the Class A-2 balance.

All of the term notes carry preliminary triple-A ratings from Moody’s and S&P, while the A-1 notes carry short-term Moody’s P-1 and S&P A-1+ ratings. Three subordinate Class B, C and D classes round out the note offerings in either pool, totaling between $500 million and $621 million.

For the second time in the last seven transactions on its deep subprime securitization shelf, Santander Consumer USA is excluding non-investment-grade notes from capital stack. In most deals since the DRIVE 2015-B securitization in May 2015, Santander has included Class E notes that were double-B rated even though they were ultimately retained, according to Finsight deal data.

Santander removal of the Class E notes tranche excised a 4.45% loss buffer available for the senior notes in the DRIVE 2018-3 collateral, thereby reducing the subordination support on the senior notes to 38.4% from 43%. But S&P notes that in DRIVE 2018-4, Santander will boost both initial (22.3%) and targeted (29.5%) overcollateralization levels compared to the prior deal’s levels (17.4% and 24.7% respectively) to maintain a nearly 62% credit enhancement on the Class A notes. The CE level for both deals is below that of earlier transactions that were between 65.25% and 65.35%.

Both proposed pools have similar credit metrics, with a weighted average FICO of 577, a loan-to-value ratio of 108% and average borrower APR of 18.96%. The loans average $19,427, are seasoned an average of four months on original terms of 71 months, and were issued for both new (44% of the pool collateral) and used (56%) vehicles.

What may have led to higher reported loss levels in 2016-2017 deals were changes in Santander’s collection policies and how it measured delinquencies. In 2016, Santander began including the costs associated with repossession of vehicles with loans allocated to the trust – meaning that historical losses for DRIVE transaction in 2015 were lower than what would be experienced with Santander’s current practices.

Another complication is the different delinquency standards Santander held between its origination channels. Loans through the Chrysler Capital partnership, for example, are delinquent if the borrower pays less than 90% of a scheduled monthly payment. Consumers who took out loans through Santander’s standard origination channel before Jan. 2, 2017, need only pay 50% of the payment due to be considered current.