American Credit Acceptance's third subprime auto loan securitization of the year includes some highly seasoned collateral, and that is boosting the credit metrics of the overall pool.

According to ratings agency presale reports, approximately 8.5% of the loans backing the $256.2 million American Credit Acceptance Receivables (ACAR) Trust 2018-3 come from its ACAR 2015-1 transaction, which was recently called.

Including these more seasoned loans, some dating back to 2012, allowed ACA to slightly reduce credit enhancement for the new deal, to 65% from 66% for its prior deal completed in June. In addition, S&P Global Ratings also lowered its loss-range expectations by 100 basis points for the new transaction (27%-28%) compared to ACAR 2018-2 (28%-29%).

While ACA commonly adds called collateral to its deals (including six since 2015), it provided none to its prior transaction.

Seven classes of notes will be issued in the new transaction, including a $102.2 million Class A tranche with preliminary triple-A ratings from S&P and DBRS. The Class A notes benefit from the subordination of the other classes, an initial 8.5% overcollateralization level and a 1.5% reserve account.

The next four subordinate classes have a ratings ranging from double A to double B. In addition, for the third time this year, there will be a single-B-rated Class F tranche totaling $18 million. The single B has become a staple for several issuers this year, with over $200 million in single-B subprime auto ABS notes issued so far in 2018, according to S&P figures.

The Spartanburg, S.C., lender is backing the notes with an initial pool of $155.6 million in loans, with plans to add another $56.4 million by Nov. 30 through a prefunding account amounting to 22% of the final pool size.

The pool of primary used-car loans has a lower average outstanding loan balance of $13,519, down from the two prior transactions this year (exceeding $15,000 each).

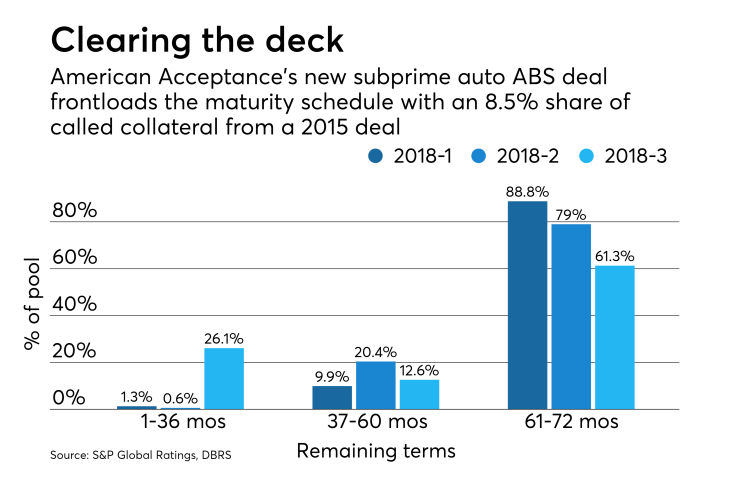

That is likely a result of the addition of older loans from the called deal, which have partially amortized. The the weighted average seasoning of the pool is seven months, compared with one month for the 2018-2 transaction. More than 26% of the loans in the 2018-3 pool mature within three years; no loans shorter than 37 months were included in June’s transaction.

American Acceptance primarily underwrites used-car loans at independent and franchised dealerships, as well as through an exclusive arrangement with CarMax used-vehicle chain stores. CarMax taps ACA to finance borrowers with limited or troubled credit history who cannot qualify for CarMax’s own captive-finance products.

Most borrowers are financed with higher-value, lower-mileage cars through ACA’s Tier 1 (CarMax originations) and Tier 2 (franchised auto dealer) programs for cars with wholesale values up to an average of $15,000. Compared to the two prior deals this year, however, ACAR 2018-3 has a higher percentage of borrowers (8.1% of the pool) who were originated through its lowest “Core” financing tier of car buyers, who are usually placed into higher- mileage, lower-priced vehicles on shorter-term contracts.

The average borrower FICO is 545, with about 12% of the pool’s loans originated to borrowers with no credit score.

As of June 30, ACA had a $2.4 billion managed portfolio with 183,000 contracts.