-

The bank has recouped part of the payment, which it blamed on a clerical error, but some of the lenders say they were owed the money in connection with an ongoing dispute.

August 14 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

The mortgage insurer is receiving $528 million of coverage in the event of defaults in a $44 billion loan pool.

July 2 -

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

April 6 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

In announcing the central bank’s emergency rate cut, Chairman Jerome Powell warned that the Fed can only do so much.

March 3 -

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

February 24 -

Investors are reacting skeptically to the auto lender's deal to acquire CardWorks for $2.65 billion.

February 19 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

The agency’s semiannual report warned institutions to be mindful of operational risks from the innovation in core banking systems, and detailed supervisory steps to monitor the adoption of a new reference rate.

December 9 -

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

November 15 -

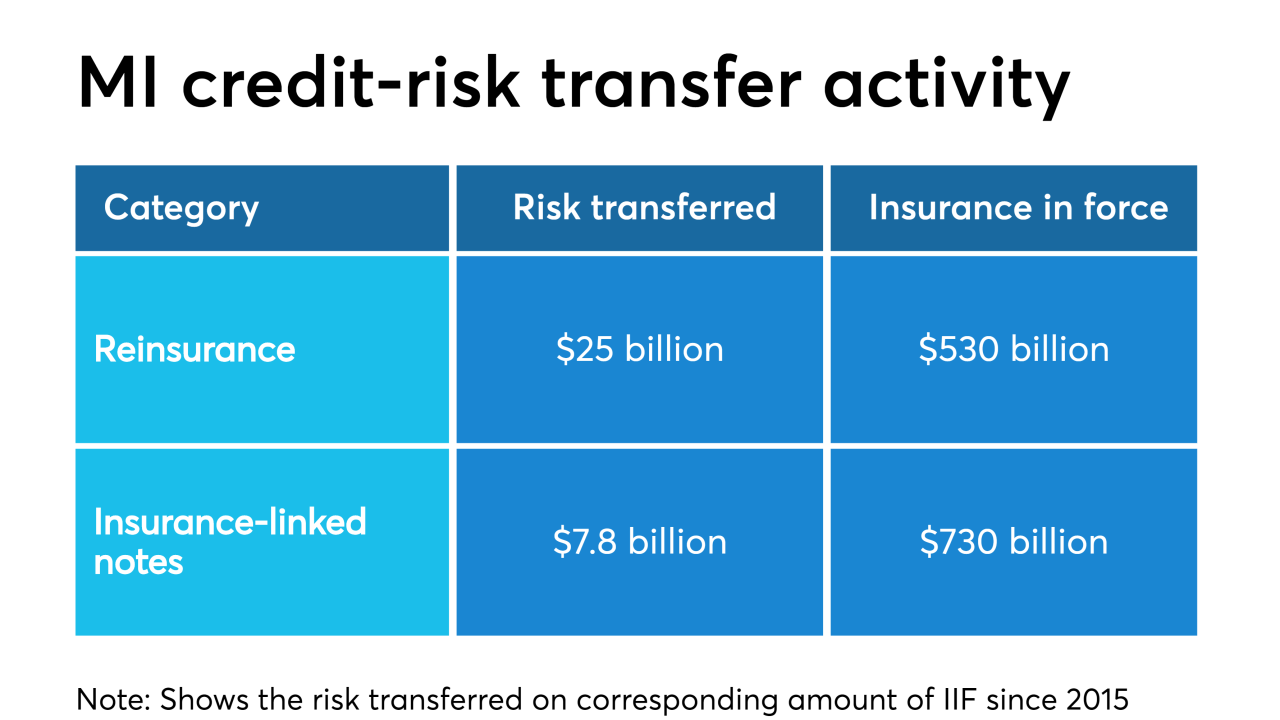

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22