Wyndham Worldwide plans to sell $325 million in securities that are backed by a pool of fixed-rate timeshare loans, according to Fitch Ratings.

Sierra Timeshare Receivables 2014-3 will offer $255.2 million in A’ rated class A notes and $69.7 million in BBB’ rated class B notes. The notes are due October 2031.

Royal Bank of Scotland in the lead underwriter.

Wyndham Vacation Resorts, Wyndham Resort Development and Shell Vacations Club originated the loans included in the pool. All three entities are indirect, wholly owned operating subsidiaries of Wyndham Worldwide.

Wyndham's previous securitization, the Series 2014-2, was the first transaction to include receivables from the newly acquired (July 2013) Shell Vacations, which have been integrated within the WVRI platform. Of the total pool, Shell receivables account for 1.7% of the 2014-3 pool, halved from 3.4% in the 2014-2 pool.

Approximately 64.9% of Sierra 2014-3 consists of WVRI-originated loans; the remainder are WRDC loans.

Wyndham has increased the volume of longer term loans in 2014-3 pool —approximately 5.0% of the pool is comprised of 15-year loans compared to only 0.24% of the 2014-2 transaction pool. Timeshare securitizations are typically backed by 10-year loans that have historically performed better than the longer-term loans, according to Fitch.

But the issuer has also increased credit enhancement on the And B notes: credit enhancement for the class A and B notes is 33.00% and 14.00%, respectively, up from 30.50% and 11.50% for the class A and B notes in the 2014-2 transaction.

So far this year, almost $2 billion of timeshare securitizations have been priced, in line with volumes seen in 2007 (a record issuance year for the asset class).

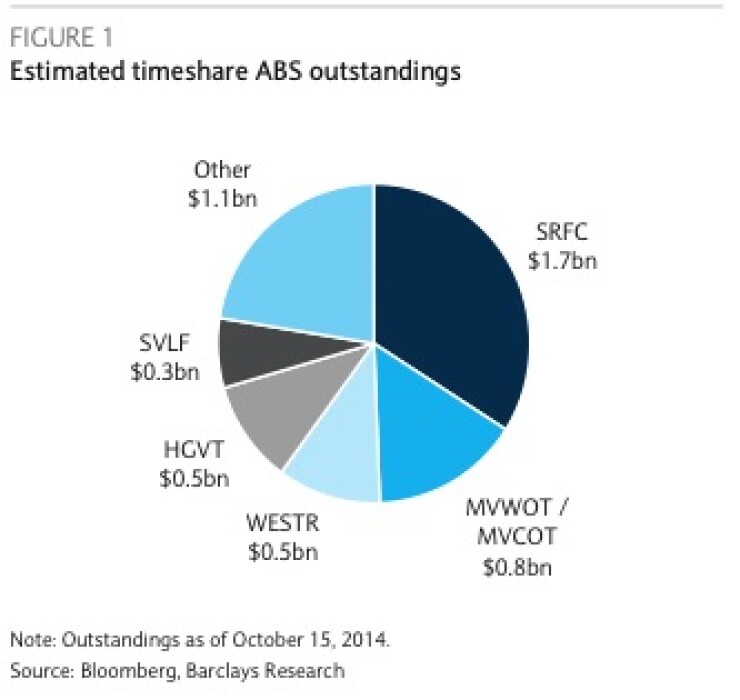

In the chart below, Barclays lists the timeshare bonds that have been issued by Sierra Receivables Funding (SRFC), Marriott Vacation Club Owner Trust (MVCOT/MVWOT) serviced by Marriott Ownership Resorts, Westgate Resorts (WESTR) serviced by Westgate Resorts, Hilton Grand Vacations Trust (HGVT) serviced by Grand Vacations Services LLC, a subsidiary of Hilton Resorts Corporation and Silverleaf Finance (SVLF) serviced by Silverleaf Resorts.