Gap Inc.’s planned store closures could impact some $7.2 billion of commercial mortgage bonds. However the loss of tenancy would hit mall properties in secondary and tertiary markets harder.

The retailer announced this week that it will shutter 175 of its 672 stores, 140 of them by the end of its current fiscal year ending in January 2016.

Gap is listed as a top five “current” tenant (with leases expiring in June 2015 or later) in mall properties backing 77 loans in 76 private-label CMBS with a total current balance of $11.9 billion. However, the retailer has said it will not close any of its 300 outlet stores. This reduces the potential exposure 64 loans securitized in 62 CMBS totaling $7.2 billion, according to Trepp.

Of the stores with exposure, $4.2 billion are in CMBS completed since the financial crisis, including several large class A retail properties. “Which stores [GAP] would target for closure was not clear at this time, but we would be most concerned for class B/C malls already struggling to maintain occupancy,” Barclays stated in a report published Wednesday.

These so-called class B and class C mall properties might find it more difficult to lease vacant space. J.P. Morgan estimates that 52% of leases for Gap locations securitized in private label CMBS are scheduled to expire through the end of 2017, and 71% through 2018.

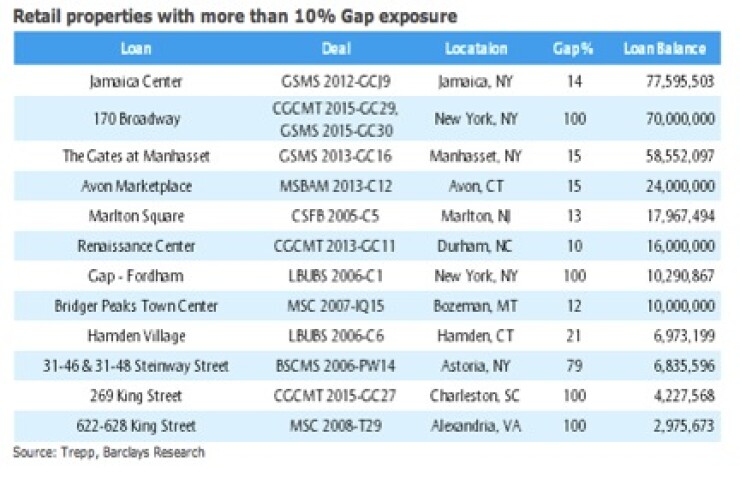

Barclays’ report states that, since GAP will continue to operate amid the store closures, it must still honor lease agreements. The retailer has also set aside money to buy out leases where necessary. “This may lessen initial loss of income from a Gap store departure but the long-term stability of the property would remain an issue," stated analysts in the report. "A few properties have more than 10% exposure to Gap”.

In the chart below, Barclays lists properties with than 10% exposure.