More and more mortgage servicing portfolios are going on the block, and PennyMac is uniquely positioned to scoop them up.

Rising interest rates are reducing refinancing activity, depressing both revenue and profit margins; this is encouraging many lenders to unload their servicing rights in order to free up capital. A slowdown in refinancing also boosts the value of MSRs, and this allows PennyMac, already one of the larger servicers of mortgages for government-sponsored enterprises, to borrow against its existing holdings in order to fund additional purchase.

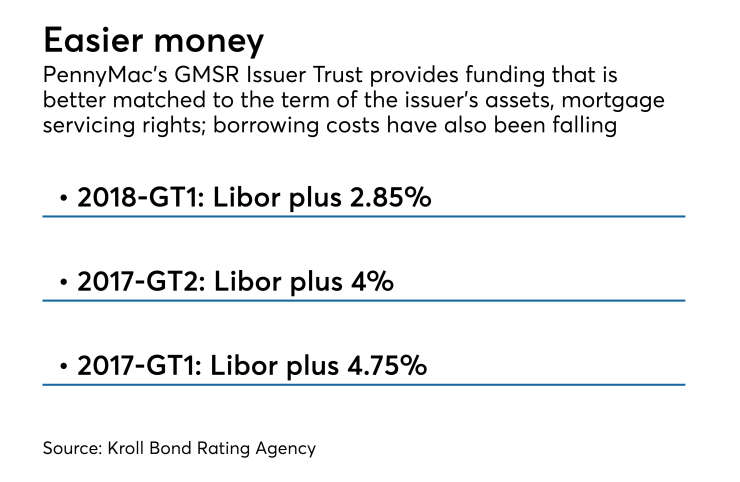

But PennyMac has another ace in the hole: Its funding costs are falling, rapidly. In February, the company refinanced $400 million of bonds backed by MSRs that it had issued just one year prior, reducing the interest rate to 2.85% over Libor from 4.75% over Libor — or nearly 2.0 percentage points. The new offering was also $250 million larger, providing funds to acquire additional MSRs.

Now PennyMac is back in the market with another $550 million of notes from the same master trust; proceeds will be used to repay $500 million of notes issued in April 2017. The notes to be retired pay 4% over Libor, offering the potential for further savings.

When the latest deal is completed, another $1.65 billion of notes backed by PennyMac’s MSR portfolio will remain outstanding, the $650 million of term notes issued earlier this year and $1 billion of variable funding notes issued in 2016 that pay Libor plus 3.75%.

All of the notes carry the same low investment-grade rating of BBB- from Kroll Bond Rating Agency; that’s a notch above PennyMac’s BB+ issuer rating.

The new notes will have the same 60% advance rate, at issuance, as the previous three transactions. However, they feature a lower “step-up rate,” or increase in interest should the notes not be repaid upon maturity in August 2023. This is falling to 0.75 of a percentage point from 1.0 percentage point, further reducing PennyMac’s funding costs. Other notable changes include a provision providing for the interest rate to be pegged to a “successor” benchmark should Libor no longer be available, according to Kroll.

The platform allows PennyMac to draw very quickly against the value of its MSRs as it acquires new portfolios (or as its holdings grow organically). The trust can issue additional series of notes, which may include variable funding notes, term notes or some combination, in the future without the consent of any existing noteholder.

PennyMac reported last week that its loan servicing portfolio grew to $263.5 billion in unpaid principal balance at the end of the second quarter, up 3% from the prior quarter and 15% from the second quarter of 2017.

Some of that growth was organic, as lower prepayment speeds increased the valuation of existing MSRs. Prepayment speeds on the portfolio were 12.2%, a modest increase from 11.8% the prior quarter, mostly due to seasonally higher prepayment activity, but lower than 14.4% a year ago.

PennyMac has also become more active in acquiring MSRs from other servicers in bulk. After the end of the second quarter, it completed or agreed to acquire $13.9 billion in UPB of bulk MSR acquisitions sourced from six different sellers. The company disclosed last week that it had entered into agreements to acquire in bulk another $7.4 billion in MSRs from three additional sellers; these deals are expected to close by the end of the third quarter.

Generally, term notes issued under PennyMac’s master trust pay only interest, and no principal, for their entire terms. However, certain events trigger early amortization. One of the key risks to these transactions, according to Kroll, is the possibility that Ginnie Mae could terminate PennyMac's rights to service the loans, with or without cause. This would cause the trust’s borrowing base to be reduced to zero, which is considered to be an event of default. For noteholders, this would be the equivalent of a prepayment of all the mortgage loans subject to the servicing agreement, according to Kroll. However, they would be dependent on PennyMac and Credit Suisse, the deal’s administrative agent, to comply with their obligations to repay the outstanding principal and interest on their notes.

However, Kroll thinks that the size or PennyMac's servicing operations, as well as its "broad expertise" servicing Ginnie Mae-backed mortgages, provide the GSE with a "disincentive to effectuate a servicing transfer to alternate servicers," even if should fall out of compliance.

The rating agency also pointed out that Ginnie Mae servicer terminations due to events of default have been “rare.” Since fiscal year 2012, there have been seven, and not all terminations “result in extinguishment” of the servicer’s MSRs.

In the event, Credit Suisse’s affiliate Select Portfolio Servicing, which is an approved Fannie Mae, Freddie Mac and Ginnie Mae servicer, could potentially act as a replacement servicer, Kroll noted.