The Department of Banking and Insurance in New Jersey is warning that enforcement of a 2019 residential mortgage servicer licensing law will begin later this year.

Applications for licenses must be submitted starting Jan. 13 through the Nationwide Multistate Licensing System. The Department plans to issue licenses on or after April 13.

Licensable companies not covered by exemptions in the Mortgage Servicers Licensing Act will be able to continue operating if they submit an application for a license by April 13, pending that application's approval.

Mortgage servicers that are subject to the law and otherwise remain unlicensed after that date "may be subject to enforcement action," the department warned in a recent bulletin.

The law is of primary concern to most nonbank servicers of home loans that do not already hold a mortgage lending license, but it also imposes some additional requirements on licensed lenders.

Licensed home lenders are exempt from servicing licensing requirements under the new law, but they will need supplemental bonding and insurance coverage applicable to mortgage servicing, according to a separate bulletin issued by the Mortgage Bankers Association of New Jersey and other local trade groups.

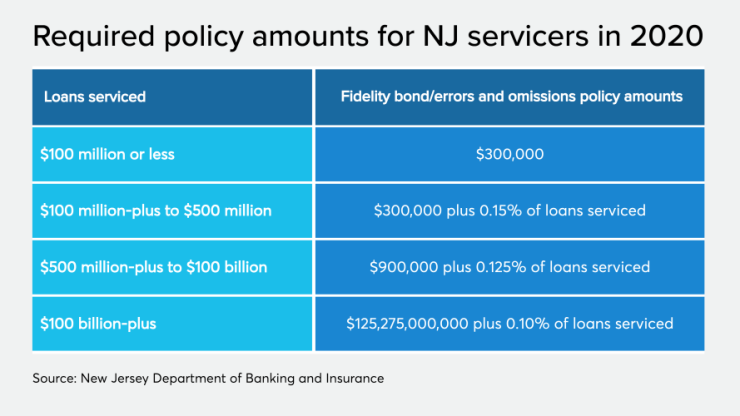

Calculations for required fidelity bond and errors and omissions policy amounts are based on the dollar volume of New Jersey residential mortgages serviced. For $100 million or less in loans, a $300,000 policy is required; for $100 million to $500 million in loans, the policy amounts required are $300,000 plus 0.15% of loans serviced; for $500 million-plus to $100 billion in loans, the policy amounts required are $900,000 plus 0.125% of loans serviced; and for $100 billion-plus in loans, the policy amounts required are $125.27 billion plus 0.10% of loans serviced.

Other states that have imposed new requirements on nonbank mortgage servicers in recent years include Pennsylvania and Ohio.