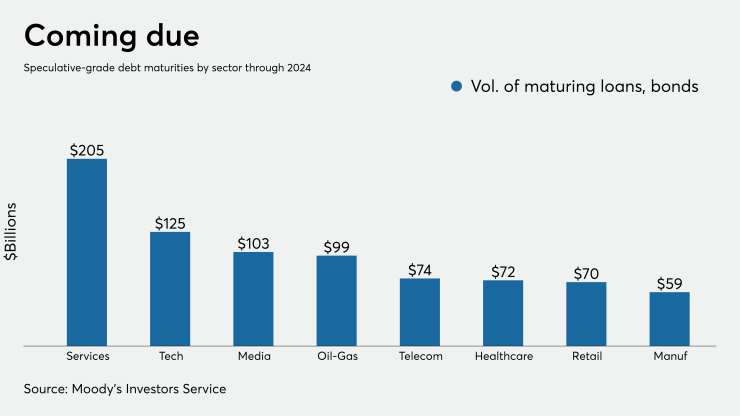

Moody’s Investors Service says nearly $1.2 trillion in speculative-grade corporate debt is set to mature over the next five years – a record level for Moody’s annual outlook on forthcoming non-financial corporate maturities.

Most of the maturities are backloaded to 2023-2024, meaning little near-term refinancing pressure on companies. But Moody's expects firms to examine refinancing options over the next two years, if interest rates remain low.

In a report published Thursday, Moody’s said the amount of junk-rated debt (including leveraged loans and high yield bonds) maturing between 2020 and 2024 is 14% higher than the amount of total maturities ($1.04 trillion) in last year’s study covering 2019-2023.

“The increase was driven by rising speculative-grade loan maturities, which climbed 27% to $750 billion,” according to a Moody’s release.

The bulk of the maturities are in 2023-2024, peaking at $467 billion in the final year. Only $39 billion of spec-grade companies’ debt will come due this year, according to Moody’s.

“Though companies’ near-term refinancing needs are low, market conditions are better than a year ago, with Moody’s therefore expecting companies to refinance debt due in later years if high-yield interest spreads don’t widen,” the report stated.

Moody’s is concerned, however, that declining credit quality in speculative-grade debt “points to potentially higher defaults during the next downturn.” The $750 billion, five-year maturity window for leveraged loans and revolving credit facilities grew 27% from last year's five-year outlook, and is at its highest level since Moody’s began tracking those number

“At the same time," the report noted, "loans issued by companies with corporate family ratings of B3 or lower rose to 36% of total bank maturities, up from 33% last year.”

A Moody’s B3 rating is just one notch above the highly speculative “triple-C” corporate and/or debt junk category, the lowest-quality rating above default status.