Fannie Mae and Freddie Mac's regulator is allowing multifamily borrowers to extend coronavirus-related forbearance agreements on loans another three months for a maximum of six months.

Landlords must continue to suspend evictions for renters who can't pay in order for borrowers to receive forbearance, according to the Federal Housing Finance Agency. The FHFA also

Borrowers who have multifamily loans from the government-sponsored enterprises will get up to 24 months to make up their missed payments.

In the event that the repayment schedule is changed or a new forbearance plan is entered into, tenants must get at least a 30-day notice to vacate and can't be charged late fees or other penalties for nonpayment of rent.

Tenants also must be given flexibility to repay back rent over time rather than as a lump sum.

"During the pandemic, FHFA has been focused on protecting renters and borrowers while ensuring the mortgage market functions as efficiently as possible," said Director Mark Calabria in a press release. "The multifamily mortgage forbearance extension announced today will help renters stay in their homes and help property owners retain their properties."

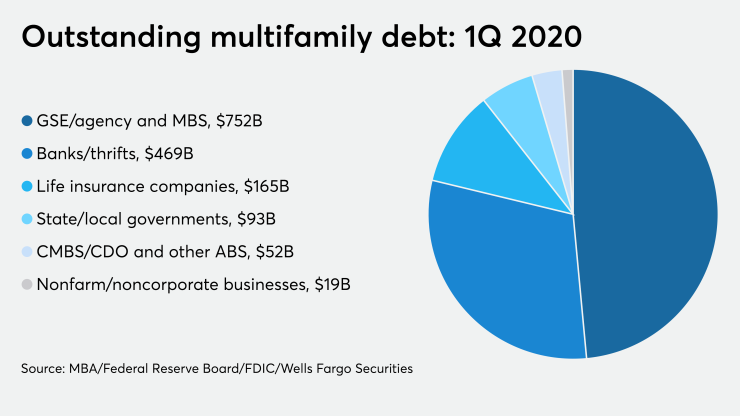

Agency/government-sponsored enterprise portfolios and mortgage-backed securities represented nearly half of the multifamily debt market in the first quarter, according to the Mortgage Bankers Association. The dollar volume of debt in this category also constituted 20% of the larger commercial/multifamily market during that period.

The MBA's figures are based on an analysis of data from the Federal Reserve Board's Financial Accounts of the United States report, the Federal Deposit Insurance Corp.'s Quarterly Banking Profile report and information from Wells Fargo Securities.