Foreclosure activity picked up to start the year, even as repossessions saw their first decline since summer 2021, according to real estate data intelligence provider Attom.

January foreclosure filings, which include notices of defaults and auctions in addition to repossessions, increased 36% on an annual basis to a total of 31,557 units, which could be a concerning sign for the rest of the year, according to Attom CEO Rob Barber. The number edged upward by 2% compared to December's 30,822.

"While both completed foreclosures and foreclosure starts have stalled slightly over the past month, the annual increase in overall activity seen over the past 21 months may indicate a more substantial trend that could continue into 2023," Barber said in a press release.

January's number reflected a filing rate of one in every 4,425 U.S. properties, with the highest in Delaware at one in every 2,109. Illinois came in at one in every 2,279 units, followed by Michigan, which recorded foreclosures on one in every 2,617 properties.

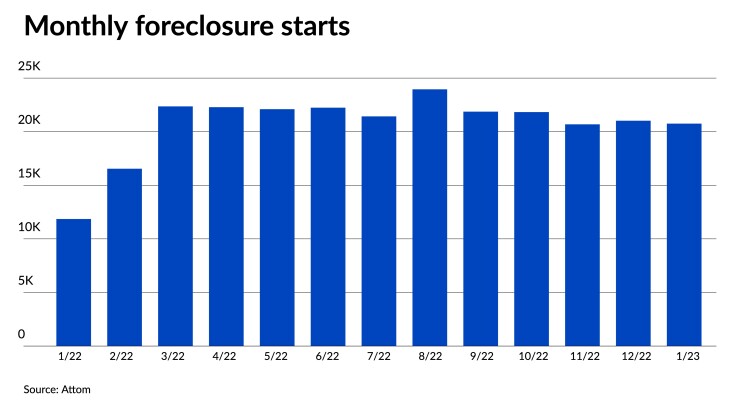

Foreclosure starts were initiated on 20,752 units in January, representing a 75% surge from a year ago. The number was 1% higher from December, with starts up in 31 states and the District of Columbia. California accounted for 2,513 of the filings, followed by Texas and Florida at 2,136 and 1,725.

But while starts were up, completions resulting in repossessions fell 19% to 3,896, the first annual drop since June 2021. January's number, though, represented a 6% increase from December.

Data released by several organizations toward the end of last year, which showed widespread declines in home equity values, may help to explain the recent upward-trending numbers and illustrate the early-default stress some borrowers currently are seeing. Mortgages originated in early 2022, especially Federal Housing Administration-guaranteed loans, were

But the U.S. economy has continued to exhibit strength based on recent

Among cities with more than 1 million residents, Midwestern markets topped the list in the rate of foreclosure filings. Cleveland saw one in every 1,557 housing units in foreclosure, followed by Detroit at one in 1,575. They were followed by Chicago, where one in every 2,074 properties had a foreclosure following, Riverside, California, at one in every 2,123, and Las Vegas with one in every 2,341.