The Volcker Rule doesn’t apply on their turf, but European CLO managers are nearly as eager to come in line with the regulation as their U.S. counterparts.

While not as dependent on U.S. banks as buyers of their triple-A tranches, several European CLOs—including the 595 million Harvest CLO IX fund that private equity investment manager 3i Group priced in June—have garnered attention this year as the first breed of self-professed Volcker-compliant issues from Europe, designed to attract U.S. bank investments or meet the regulatory requirements of a U.S.-based parent bank.

In the case of the Harvest CLO, the route taken was the “loans-only” strategy to issue a vehicle without fixed-rate bond instruments. But other European CLOs have chosen alternatives in attempts to clear Volcker rule hurdles, including stripping shareholder voting rights from underlying notes securities or tapping a rarely used type of exemption for issuing CLOs without regulatory filing requirements.“I wouldn’t say we’re heading for CLO 3.0,’ but certainly we’re in for a period of significant structural transition,” said Gareth Old, a New York-based partner with law firm Clifford Chance, which advises institutions on both sides of the pond on structured debt.

In a securitized products strategies report issued this week, Bank of America Merrill Lynch analysts noted the emergence of loan-only CLOs in Europe and discussed in depth the “wide-reaching consequences” of the Volcker Rule in Europe. “The regulation (including affecting many U.S. related activities of non-U.S. banks) means that changes have also taken place in the European market, with new features designed to address the requirements.”

The restrictions brought about by the Volcker rule are very familiar to U.S. CLO managers, who have responded this year by issuing new “CLO 3.0”-type vehicles that exclude bond buckets in portfolios, over concerns of tripping bank exposure to “covered funds,” or proprietary trading assets that the Volcker Rule within the 2010 Dodd-Frank Act prohibits banks from holding.

Federal regulators such as the Federal Reserve and the Office of the Comptroller of the Currency have ruled that U.S. CLOs containing bonds are covered funds for Volcker purposes, due to the fact the paper bestows ownership rights to shareholders including—of chief concern to regulators—the right to replace a CLO manager.

No such prohibition exists within Europe, although CLO managershave strict retention rules that require them to hold on to 5% of portfolio assets.

That rule is considered more punitive than the U.S. regs and raises the possibility European CLO sponsors and originators are looking at U.S. investors to widen a market base constrained by their own complex regulatory regime. Issuers have “one of four ways to be able to sell their deal to European banks and regulated investment firm investors,” according to a June Citigroup securitized research paper. “For CLOs, only two ways (a 5% vertical slice across all tranches, or a 5% horizontal equity slide) are practical.”

Although European spec-grade corporate loan volume is pace to exceed the 2013 level of 191 billion, some have questioned whether the persistence of a strong high-yield market (63.2 billion through mid-September, per Thomson Reuters) would keep CLO managers focused on retaining fixed-rate notes despite the conflict with the Volcker rule. Or that there enough loans to supply a bustling CLO market.

“Harvest IX was the biggest European CLO to date and that was loan only, so it seems to contradict that somewhat,” said Matthias Neugebauer the managing director of Fitch Ratings’ structured credit group for Europe.

According to Standard & Poor's, 19 CLOs have been issued in Europe this year, totaling 8.01 billion, compared to 21 deals in 2013 totalling 7.9 billion.

Clifford Chance’s Old still believes the Volckerization of loans may be a tough sell to the traditional European debt market, “You have a more limited supply, less diversification, and greater challenges in terms of replenishment and repayment,” he said. “The investment manager is much more constrained.”

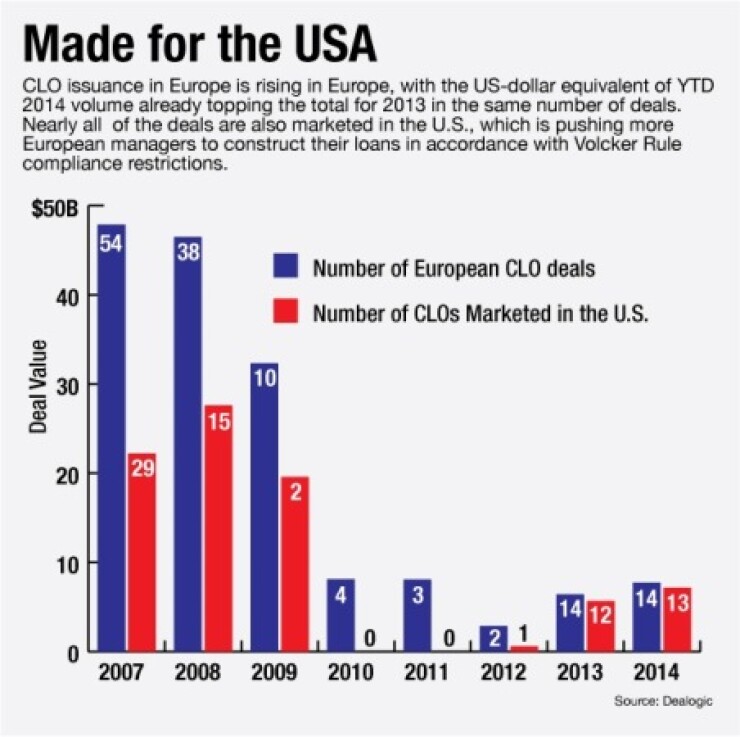

According to Dealogic, 13 of 14 European CLO deals this year tracked by the firm are marketed in the U.S. Some of the CLOs considered Volcker compliance include Alcentra’s Jubilee CLO XI and Jubilee XII issues, Avoca’s CLO XI fund and the Harvest CLO.

Alcentra and Avoca each turned to a different path to Volcker compliance —using the rare 3(a)7 exemption of the Investment Company Act instead of the 3(c)7 clause most CLOs use. The difference is that a manager of a 3(a)7 CLO cannot trade a position in order to realize gains or avoid losses, but must instead base it on a credit analysis of portfolio performance, said Old. “The 3(a)7 is going to be a much more deliberative process,” and could make U.S. banks uncomfortable as to the Volcker-compliant status.

Another approach to Volcker compliance in Europe is to include multiple sets of notes, with some stripped of voting rights of the investor. BAML noted in its report this is a more common means to meet Volcker regulations.