Citigroup and Goldman Sachs have teamed up to offer $958.4 million of commercial mortgage backed securities, according to Fitch Ratings.

The transaction, called CGCMT 2015-GC33, pools 64 loans that are secured by 92 properties.

It is characterized by low amortization and high leverage, two features that are becoming increasingly common.

The pool of loans has a debt service coverage ratio (DSCR), as measured by Fitch, of 1.15x; that is below the 1.20x average for all of the deals that Fitch has previously rated this year; it is also above the 1.19x average for all of the deals that Fitch rated in 2014.

Fitch puts the pool’s loan-to-value (LTV) ratio at 111.5%, which is above both the average for the year to date 2015 (109.2%) and the average for all of 2014 (106.2%).

More than half of the loans in the pool pay only interest, and no principal, for at least some of their terms. Five loans (13.4% of the pool) do not amortize at all; another 38 loans (58.2%) pay only interest for part of their terms; the remaining 21 loans (28.4%) require a larger-than-usual, one-time payment at the end of their terms. That means that just 11.4% of the initial pool balance will be paid off prior to maturity, which is below the averages for 2015 to date (12.4%) and 2014 (12.0%).

One strength of the deal is the diversification of the collateral. The loans are secured by a several property types, led by offices, at 26.5% of the pool; followed by hotels, at 22.8%; retail, at 22.5%; and multifamily, at 13.1%. Three of the top 10 loans (23.5%) are office properties. Overall, the office properties have a diverse mix of geographic locations, including both central business district and suburban markets.

However the largest 10 loans in the pool account for 54.6% of the balance. This is greater than the year to date 2015 average of 47.0% and the 2014 average of 50.5%.

Fitch assigned preliminary ratings of ‘AAA’ to the super senior class A notes benefitting from 30% credit enhancement as well as to senior notes with 25% credit enhancement. At the subordinate level the transaction will offer notes rated from ‘AA-’ to ‘B-’.

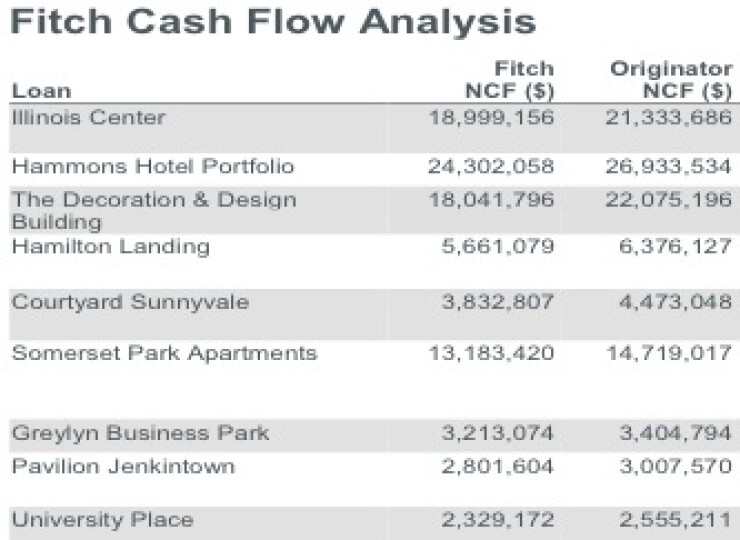

Fitch lists the 10 largest loans in CGCMT 2015-GC33 below: