The Blackstone Group is refinancing two adjacent luxury hotels in Orlando, Fla., in the commercial mortgage bond market.

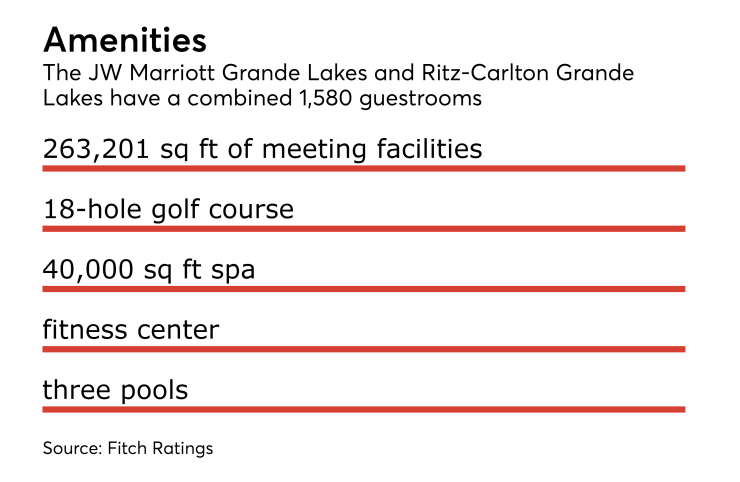

The private equity firm obtained a $540 million loan on the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes, which are situated on 500 acres at the headwaters of the Everglades and share amenities including an 18-hole golf course, indoor and outdoor meeting facilities, a full-service spa and fitness center, from Barclays and Wells Fargo. Proceeds were used to pay off existing debt and cover closing costs.

The loan, which pays only interest and no principal, has an initial term of two years and can be extended by one year up to five times. It is being securitized in a transaction called BBCMS 2017-GLKS Mortgage Trust. Fitch Ratings expects to assign an AAA to the senior tranche of notes to be issued, which benefit from 66.48% credit enhancement.

Among the primary credit considerations for Fitch are the quality of the hotels, their location within Orlando’s entertainment district (SeaWorld Orlando, Universal Orlando Resort, and Walt Disney World Resort are all five to 15 minutes away) and stable performance.

The property has benefited from $67.2 million (or $42,533 per key) in capital improvements since 2011. Of that, Blackstone has invested $37 million ($23,418 per key) since acquiring the hotels in 2015.

However, several newer luxury hotels have opened in Orlando since the economic recovery began. The Waldorf Astoria Orlando and the Four Seasons Resort Orlando opened in 2009 and 2014, respectively. And there’s more on the way: The 516-room JW Marriott Bonnet Creek, which will be located 11 miles southwest of the subject property, is scheduled to break ground in 2017 and open in 2020.

The two Grande Lakes hotels are also heavily indebted. In addition to the $540 million first mortgage, the properties are also encumbered by two mezzanine loans totaling $90 million. Fitch puts the debt service coverage ratio at 0.88X and the loan to value ratio at 117%.

The properties sustained some damage from Hurricane Irma in September that Fitch describes as "minimal." While they never closed, the hurricane resulted in cancellations totaling $700,000 in lost room revenue and the Ritz-Carlton and $800,000 at the JW Marriott. Sixty rooms, or 3.8% of total keys, were offline when the rating agency visited in early November, with 15 at a time receiving comprehensive remediation.