A pool of commercial equipment leases extended to middle-market firms, largely in the machinery, medical and information technology hardware, will support $141.5 million in asset-backed securities (ABS) through the Avtech Equipment Receivables Funding 2026-1.

The deal is the inaugural equipment ABS transaction for Avtech Capital, the sponsor. The Scharman family owns the company, which is familiar to the securitization market for its subprime auto loans and securitizations, according to Kroll Bond Rating Agency.

Avtech 2026-1 will issue notes through four tranches of A, B, C, and D notes.

The deal is supposed to close on February 27, according to Asset Securitization Report's deal database, and KBRA says the notes all have a final maturity date of Feb. 15, 2033.

A three pre-funding period is included in the transaction after closing, KBRA said, when it can purchase additional receivables, if they meet eligibility criteria and the transaction adheres to concentration limits while approving purchases.

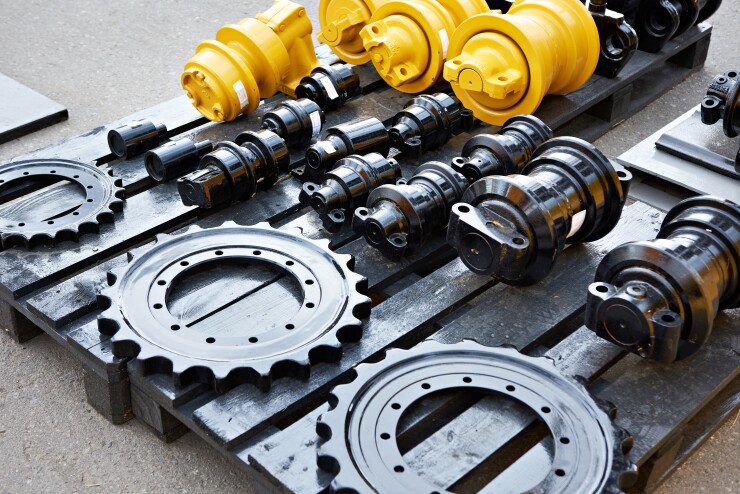

The machinery, medical, IT hardware, vehicles and the industrial sectors make up the top five categories in the pool, both in terms of the number of initial receivables and the percentage of aggregate discount receivables balance, KBRA said.

Avtech Capital and AVT CAP Titling Business Trust originated the 228 receivables in the collateral pool. The former will service the underlying contracts, working with 134 obligors to ensure cashflow to the notes, according to KBRA. The rating agency also notes that GreatAmerica Financial Services is on the deal as backup servicer.

THe structure confers initial credit enhancement levels representing 24.45%, 13.65%, 7.94% and 4.50%, respectively, KBRA said. Immediately after the deal closes, Avtech will have overcollateralization that represents 3.00% of the pool balance, which will build to either 5.00% of the current adjusted pool balance, or 1.50%, whichever is higher, the rating agency said.

Avtech will repay noteholders sequentially, which will create subordination to the senior notes from the junior classes, according to KBRA. If the cumulative default ratio exceeds the trigger level, all available cashflow–after interest, priority principal and fees–will be used to make principal note payments sequentially, the rating agency said.

KBRA assigns AAA, A, BBB and BB to tranches A, B, C and D, respectively.