The securitization market went into 2023 with tempered expectations for production and the first half of the year went largely as expected. ABS issuers did $130.8 billion in new business through June 29, a 44.7% decrease from the $236.4 billion in production recorded through June 30, 2022, according to data compiled by Asset Securitization Report.

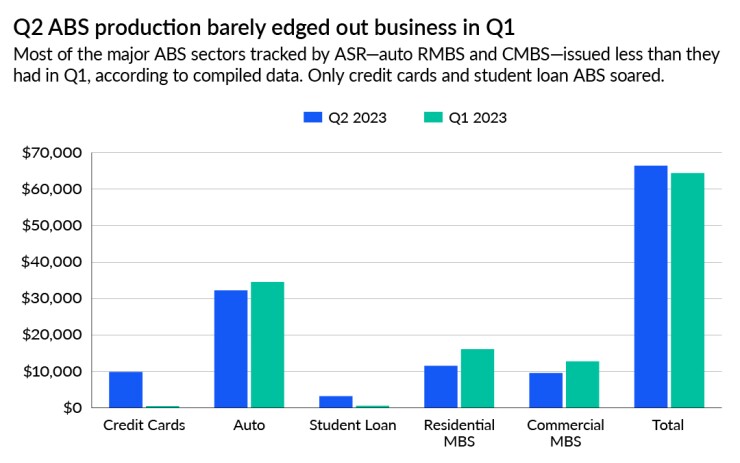

Broken out by quarter, Q2 saw about $66.4 billion in new ABS issuance, and although it was an increase in production over Q1 2023, it wasn't much, just 3.1%, according to the ASR's deal database.

The credit card and student loan sectors had the best increase in securitization production in Q2, with $9.8 billion and $3.1 billion in new ABS business, respectively. The first quarter set the bar very low, with only $478 million and $579 million in new business issuance for credit card and student loan ABS, respectively. In any case, they did clear them, with credit card issuers seeing an increase of 2,062% in new business and the student loan sector increasing business by 552%, according to ASR's data.

The securitization market got support from an influx of new investors, but that wasn't enough to lift the residential- and commercial-mortgage-backed securities sectors or auto ABS. They all endured double-digit slumps in new business. New RMBS business in Q2 fell 28.36% to $11.5 billion in new Q2 from the previous quarter's $16.0 billion. Like the RMBS sector, CMBS issuers were beset by rate increases and slackening demand for space—especially in the office sub-sector—that complicated or delayed efforts to refinance outstanding debt or raise new capital. Second-quarter CMBS issuance came in at $9.5 billion, a 24.8% decrease from $12.7 billion in Q1.

The auto ABS sector slowed to a lesser degree as auto issuers fueled $32.2 billion in new business, 16.6% less than the $34.5 billion done in the previous quarter.

Amid the upheaval in the securitization market, Wells Fargo Securities came out ahead of the pack among lead managers, helping issuers bring $12.7 billion in new ABS business to market. J.P.Morgan Securities, the top manager at the end of 2022, was next with $10.7 billion. Rounding out the top five among managers were BofA Securities, Citigroup and Barclays, with $9.3 billion, $8.0 billion and $7.3 billion, respectively, in new business.