-

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

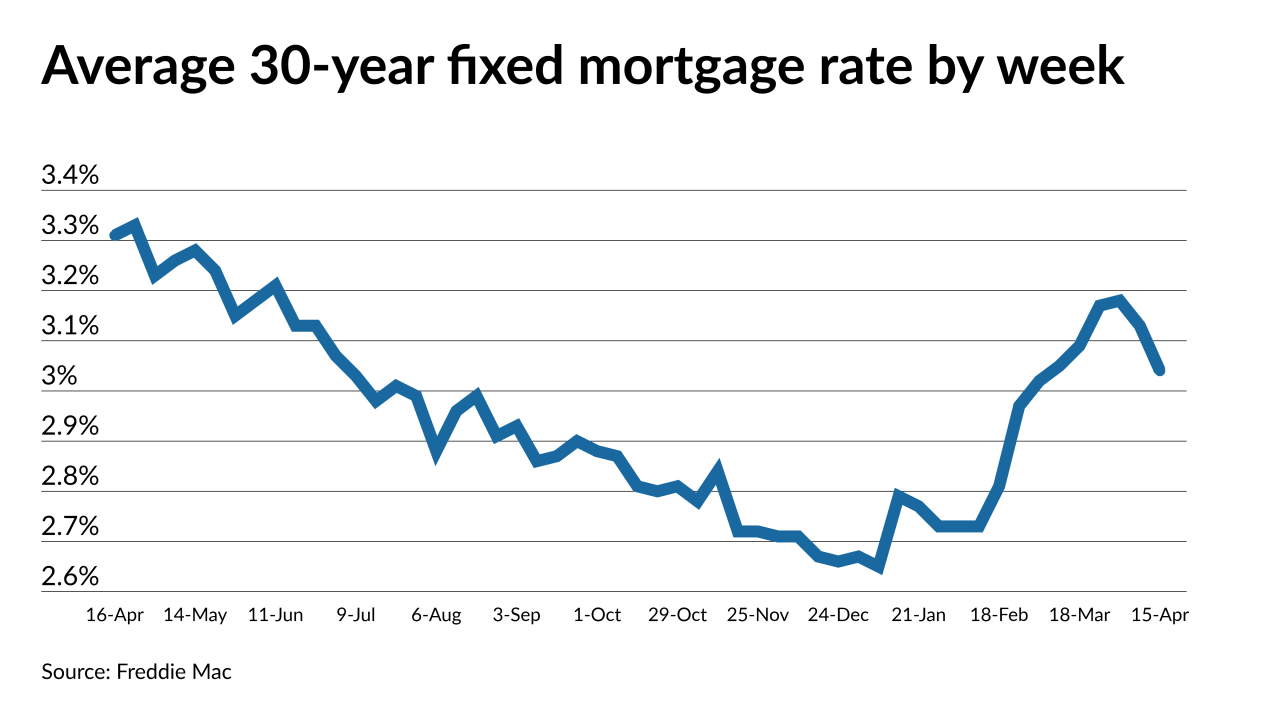

Rising cases and vaccine issues caused bond yields to fall, but inflationary pressures will likely reverse that course.

April 15 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

While the economic recovery and stimulus checks drove upward movement in purchases, it wasn’t enough to offset tumbling refinance activity.

March 17 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

Servicers could be dealing with approximately 1.8 million distressed properties when the latest forbearance extension ends in June, Black Knight said.

February 24 -

Between the dip in refis and the approach of the spring buying season, mortgage lenders are likely to start paying a little more attention to the purchase market, which is less rate-sensitive.

February 17 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

Investors were also reacting to the inauguration of Joe Biden and uncertainty over additional fiscal relief, Freddie Mac’s Chief Economist Sam Khater said.

January 28 -

Mortgage applications decreased 1.9% from one week earlier as rising rates started to affect refinance activity, according to the Mortgage Bankers Association.

January 20 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15 -

Mortgage rates, whose movements until now had not reflected gains in the benchmark 10-year Treasury yield, rose 14 basis points this week, according to Freddie Mac.

January 14 -

Falling interest rates more than canceled out median home listing prices, reaching an all-time time high during the month, Redfin said.

December 24 -

Mortgage rates yet again have dropped to a record low, even as the yield on the benchmark 10-year Treasury flirts with breaking back above the 1% mark, according to Freddie Mac.

December 24 -

With coronavirus inoculations underway and government stimulus likely to come, the outlook for next year’s housing market and lending environment grew more optimistic in December.

December 15 -

Weaker consumer spending data coming into the holiday season, as well as a resurgence of the COVID-19 spread, pushed mortgage rates to a new low, Freddie Mac said.

November 19 -

Rates could be 50 basis points steeper than the MBA’s current projections, which anticipate the 30-year mortgage will average 3.3% next year, up from nearly 3% this year.

November 16