- LIBOR

Concerned that some troublesome financial contracts won’t be able to switch to replacement benchmarks, the Financial Conduct Authority plans to publish a “synthetic” London interbank offered rate.

March 26 -

Two banking bills signed by Gov. J.B. Pritzker carry implications for payday lenders, auto title lenders, credit unions and nonbank mortgage lenders. Pritzker, a Democrat, said the bills will address racial-equity gaps in the state.

March 23 -

Just over 12 billion euros ($14.6 billion) of new issue, refi and reset paper has priced so far this year, surpassing a previous high of 7.3 billion euros in the first two months of 2018.

February 24 -

The Japanese lender will back $526 million in U.S. dollar-denominated notes with receivables of domestic new- and used-car loans from domestic borrowers.

February 10 -

The receivables will flow from payments on UK monoline credit-card accounts for nonprime borrowers.

January 25 -

A real estate firm focused on gentrifying neighborhoods is showing cracks after a group of its apartment buildings in New York’s Upper West Side and Harlem filed for bankruptcy.

December 30 -

HomeEquity will sell an as-yet undetermined volume of notes to finance forthcoming originations by the bank sponsored by Birch Hill Equity Partners Management.

December 8 -

The ballot measure, which would allow local jurisdictions to expand rent control, had concerned mortgage companies who worried the law would result in a patchwork of different policies that could complicate underwriting and discourage lending.

November 4 -

Lenders pushed back against the notion that city dwellers' pandemic-driven flight to suburbia would hurt them. They say fewer landlords have sought deferrals as vacancy rates remain low and rent collections have stabilized.

October 29 -

The European Union's first social bond sale, totaling 17 billion euros, was 14 times oversubscribed, meaning the EU could have sold 200 billion euros worth of bonds. That indicates a market that’s structurally underserved.

October 22 -

Gov. Andrew M. Cuomo on Monday announced he will extend the eviction moratorium — set to expire Oct. 1 — to next year, continuing protections for tenants as well as homeowners who have been unable to pay rent and mortgage during the public health crisis.

September 29 -

The transaction would affect about 54% of the government's outstanding bond debt.

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31 -

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

August 28 -

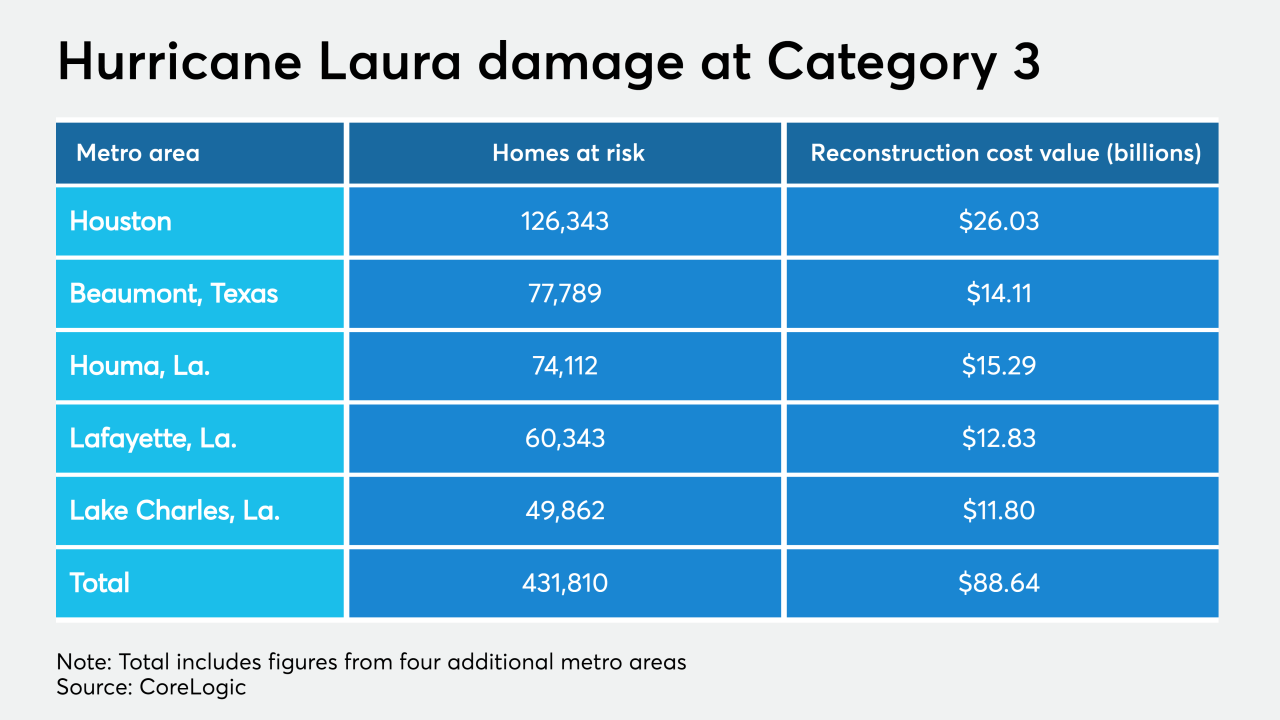

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

Brookfield Property Partners, in a JV with Qatar's sovereign wealth fund, is securitizing a commercial mortgage for the newly constructed, 70-story tower near New York's revitalized Hudson Yards district.

August 17 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

he report concluded that the industry should fare well compared with its peers, but that loans to mid-sized European companies remained vulnerable to fall-out from Covid-19.

July 15 -

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

July 13