-

Gov. Andrew M. Cuomo on Monday announced he will extend the eviction moratorium — set to expire Oct. 1 — to next year, continuing protections for tenants as well as homeowners who have been unable to pay rent and mortgage during the public health crisis.

September 29 -

The transaction would affect about 54% of the government's outstanding bond debt.

September 1 -

The California plan to create a new, tougher state regulatory agency is at the finish line after lawmakers agreed to key exemptions for banks while maintaining strong enforcement measures for payday lenders and other firms.

August 31 -

The legislation, which would apply to both banks and nonbanks, would give borrowers the right to sue for damages when servicing violations occur.

August 28 -

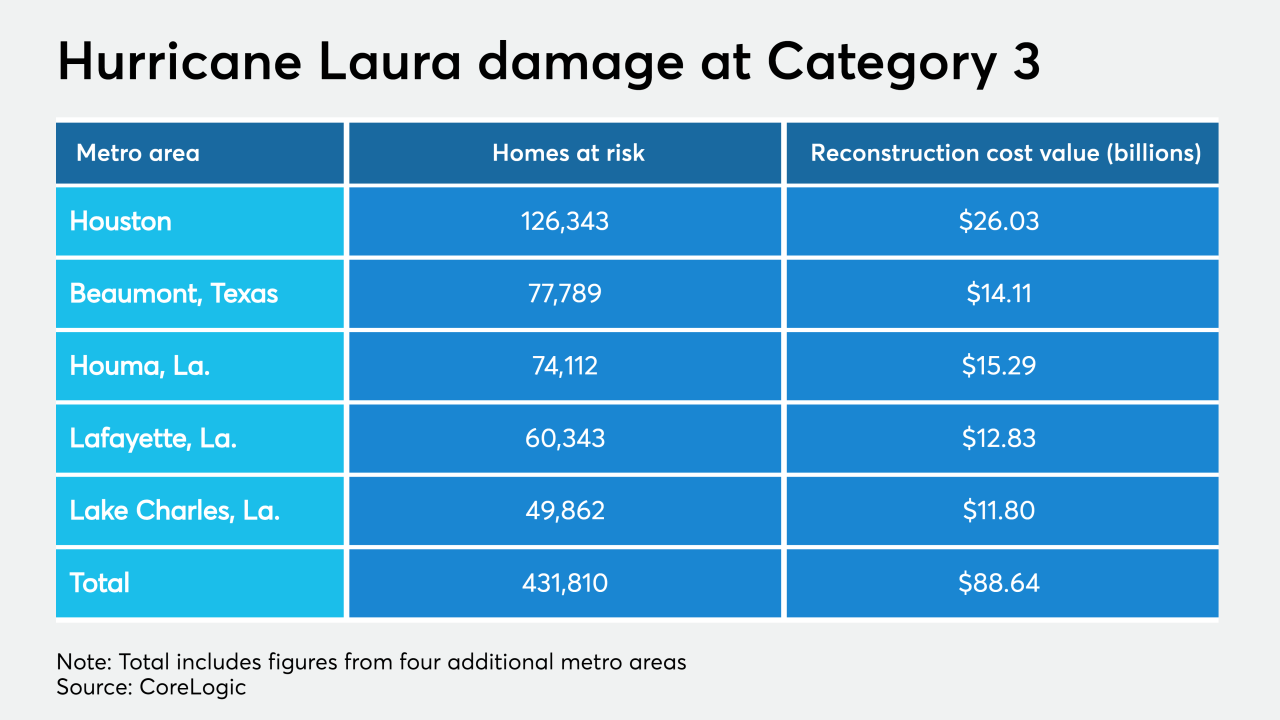

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

Brookfield Property Partners, in a JV with Qatar's sovereign wealth fund, is securitizing a commercial mortgage for the newly constructed, 70-story tower near New York's revitalized Hudson Yards district.

August 17 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14 -

he report concluded that the industry should fare well compared with its peers, but that loans to mid-sized European companies remained vulnerable to fall-out from Covid-19.

July 15 -

Bankers had asserted in April that they could handle a slump in oil prices tied to the coronavirus pandemic. Continued volatility, combined with declining collateral values and a rise in bankruptcies for exploration companies, is denting their confidence.

July 13 -

King Street's new CLO is the first European deal rated by Moody’s to fail to meet all the portfolio requirements at this milestone.

July 2 -

As COVID-19 infections increase across the country, including in California, Citigroup has structured a residential mortgage-backed securities offering fit for the times, providing investors with a strong deal structure and robust collateral.

June 25 -

Four transactions from three managers, Alcentra, Barings and Bardin Hill, showed a breach of one or more of their so-called over-collateralization tests based on May filings.

June 18 -

A budget item establishing a new agency to protect consumers from predatory lenders has been put on hold as state officials deal with the coronavirus response and other priorities. But it could be revived in legislative talks later this summer.

June 11 -

One criticism of the CARES Act is that it provides relief only to borrowers with government-backed loans. Bills in New York and California would cover the remaining 30% of homeowners.

June 4 -

A Democratic measure to freeze foreclosures and auto repossessions through the coronavirus crisis while expanding eligibility for loan forbearance is getting strong pushback from banks and credit unions, which complain it would constrain credit.

May 21 -

An indefinite closure of New York retail businesses during the COVID-19 pandemic added credit pressure on revenue bonds issued for the state’s largest mall.

May 11 -

More than a dozen firms have struck agreements with nine states to provide forbearance to customers struggling to make payments in the midst of the coronavirus pandemic.

April 22 -

In the last two quarters of 2019, according to Fitch Ratings, more U.S. managers of collateralized loan obligations (CLOs) had been structuring some of their transactions to comply with risk-retention rules.

April 6 -

Royal Bank of Scotland Group Plc is pressing ahead with its restructuring plan, trimming its securitized credit team in London even as many of its peers halt job cuts amid the chaos caused by the coronavirus outbreak.

April 2