-

The decline in loan activity and softening prices also helped drive down builder sentiment for the 11th month in a row.

November 17 -

Quarterly numbers also show the smallest gain in appreciation since 2011, with values decreasing on an unadjusted basis, according to Fannie Mae.

October 17 -

Housing's unusually high appreciation rates have now slowed for three months straight, and the number of metropolitan areas that are considered overvalued keeps growing, according to CoreLogic.

September 6 -

Prices are starting to fall in one of the most expensive cities in the U.S. but they are still much higher than their pre-pandemic levels.

July 8 -

Several Sun Belt cities popular for relocation over the last two years were among markets with the most reduced listing prices in April.

May 27 -

A measure of home prices in 20 U.S. cities jumped 18.3%, down from 18.5% in October, the S&P CoreLogic Case-Shiller index showed Tuesday. It marked the fourth straight month that home-price appreciation has cooled off ever so slightly.

January 25 -

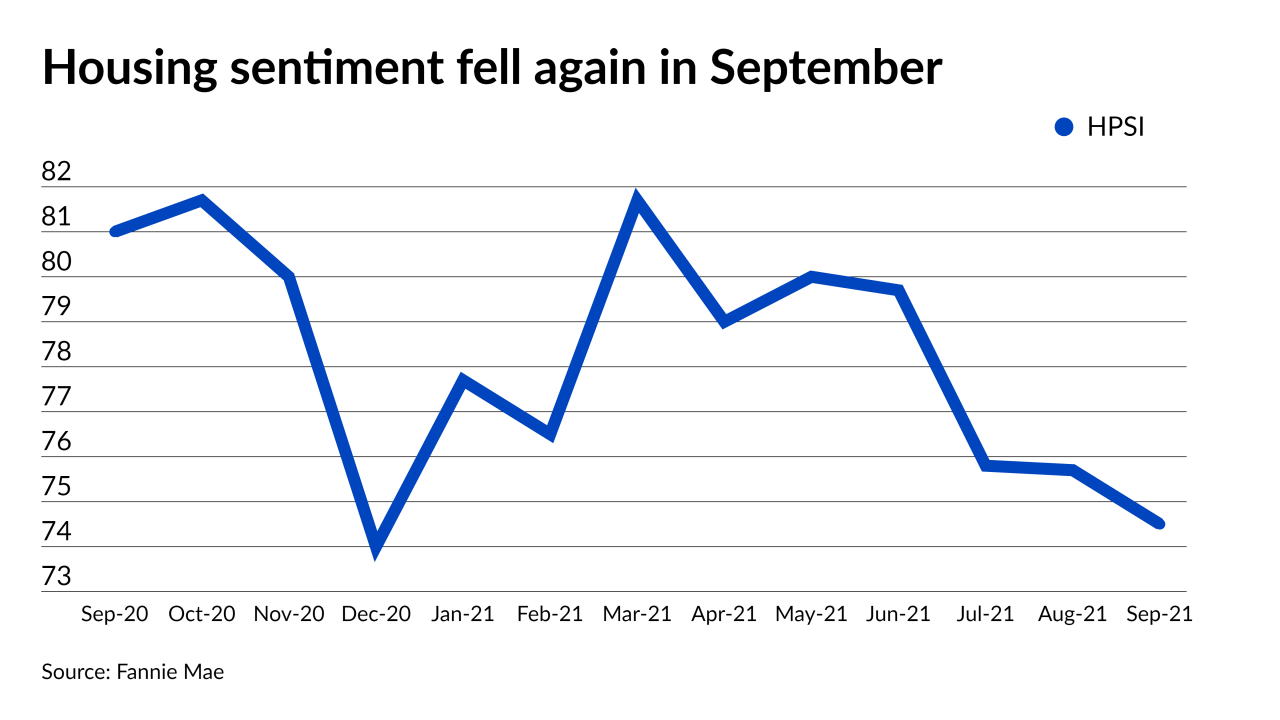

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

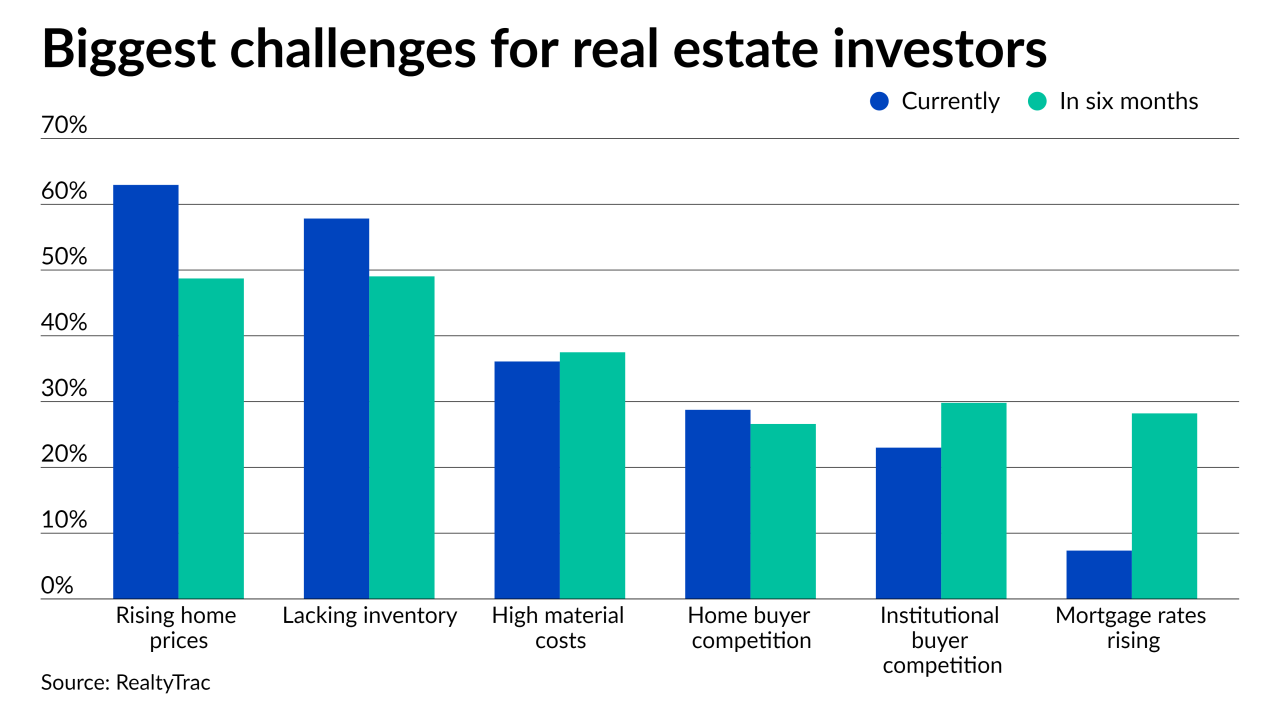

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

But average loan sizes remain near record highs, with summer purchases of new constructions continuing to drive up prices.

August 18 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

Concerns about foreclosure and a crowded market led to an increase in listings at lower price points in the second quarter.

July 30 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Federal Reserve Chair Jerome Powell is dismissing claims that loose monetary policy has led to rising home values and shrinking inventory and insists that the market is buoyed by creditworthy borrowers and investors.

April 28 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5