-

Efforts to calm lenders’ fears about coronavirus-related forbearance may not offset tightening standards, and the FHA is less likely to boost volume than it was during the financial crisis.

April 21 -

The agency said it is aligning policies for Fannie Mae- and Freddie Mac-backed loans in forbearance so that servicers are only responsible for advancing four months of missed payments.

April 21 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

The Borrower Protection Program enables the two agencies to exchange information about loss mitigation efforts and consumer complaints regarding specific servicers.

April 15 -

The volume of COVID-19 forbearance requests has risen rapidly as operational processing has improved and hold times have contracted, according to the Mortgage Bankers Association.

April 14 -

Lenders that split their sales of loans and servicing between two different investors may be facing yet another challenge due to the coronavirus outbreak.

April 13 -

A bipartisan group of lawmakers wrote in a letter to the Treasury secretary that the Financial Stability Oversight Council should create a liquidity facility to deal with a flood of forbearance requests brought on by the coronavirus pandemic.

April 8 -

Mark Calabria needs to be working to secure a Fed facility for servicer advances and to support, not denigrate, smaller servicers, the Mortgage Bankers Association said.

April 8 -

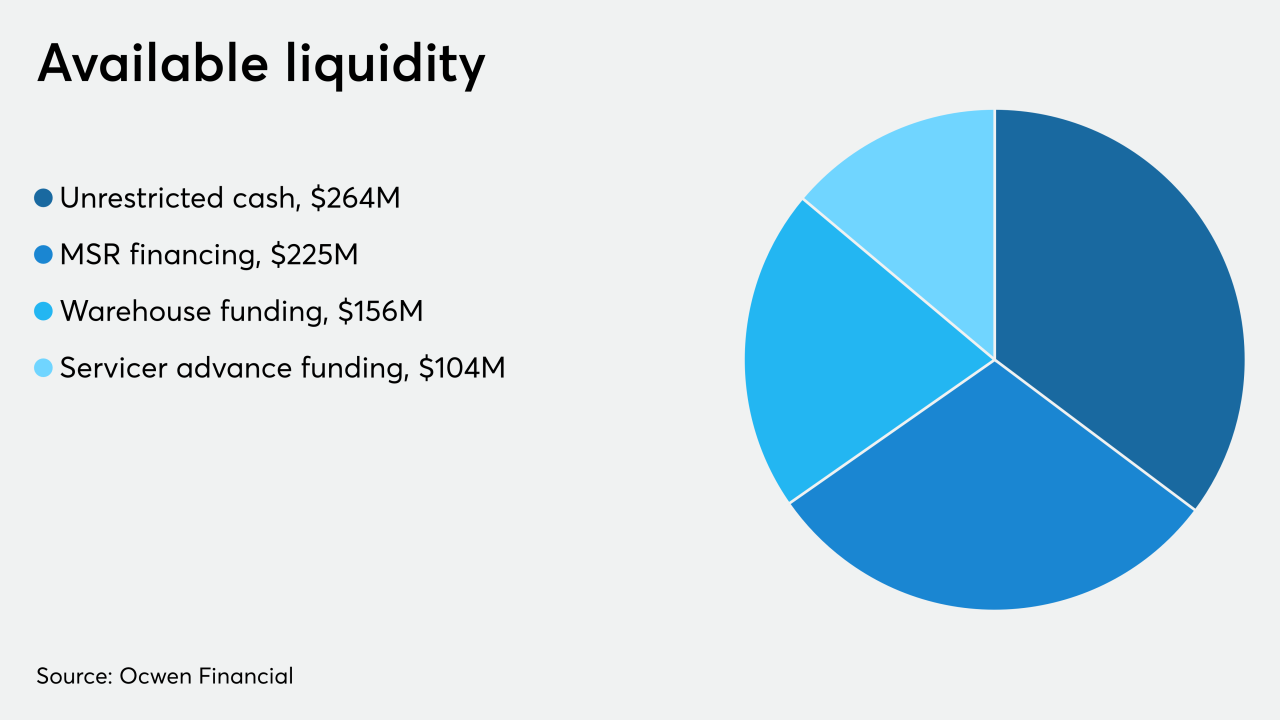

Ocwen Financial has approximately $749 million of liquidity from various sources to deal with servicing issues arising from the coronavirus, a company press release said.

April 3 -

Mortgage servicers need direction from federal agencies on how to implement the forbearance plans called for in the CARES Act, according to the Community Home Lenders Association.

March 31 -

Mortgage bankers are sounding alarms that the Federal Reserve's emergency purchases of bonds tied to home loans are unintentionally putting their industry at risk by triggering a flood of margin calls on hedges lenders have entered into to protect themselves from losses.

March 30 -

The impending wave of loan delinquencies because of the coronavirus hurt private mortgage insurer earnings, but the companies will still have sufficient capital, a Keefe, Bruyette & Woods report said.

March 27 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to lend additional support to the mortgage-backed securities market and temporarily allow some flexibility in lending requirements to address coronavirus-related concerns.

March 23 -

Mark Calabria said Fannie Mae and Freddie Mac are currently equipped to handle elevated delinquencies, but they might need congressional or Federal Reserve help if fallout from the coronavirus persists.

March 19 -

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

Fannie Mae and Freddie Mac coming out of conservatorship and transitioning into public utilities would be the ideal for small mortgage lenders, according to trade-organization representative Robert Zimmer.

March 10 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

An effort by the Federal Housing Finance Agency to examine membership rules for the Federal Home Loan Bank System is reigniting an argument over whether to allow more nonbanks in or impose tougher barriers.

March 1 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13