Fintech

Fintech

-

The card giant could pay $850 million in cash for the online small-business lender, according to a person familiar with the talks.

August 11 -

The agency sought feedback on potential changes to the Equal Credit Opportunity Act. But a coalition of industry and advocacy groups want a longer comment period to afford “a greater opportunity for thoughtful public participation.”

August 10 -

San Francisco-based Theorem is marketing its first-ever securitization of online, unsecured consumer loans culled from the LendingClub origination platform using machine-learning technology.

August 10 -

The Conference of State Bank Supervisors, banking law scholars and consumer advocacy organizations filed amicus briefs siding with the New York State Department of Financial Services in its court battle with the federal regulator.

July 31 -

The agency plans to issue an advance notice of proposed rulemaking dealing with efforts by fintechs and data aggregators to leverage a consumer's bank account information.

July 24 -

The court struck down a 2015 update to the Telephone Consumer Protection Act, which permitted robocalls to cellphones for government-related debt collection.

July 6 -

Jane Gladstone, new president of Promontory Interfinancial Network, says the recession will accelerate the shakeout among the nonbank disruptors and that small banks have an opportunity to forge new bonds with the survivors.

July 6 -

The race to provide coronavirus relief for small businesses is opening new routes to fund payments, including underused credit lines.

June 5 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

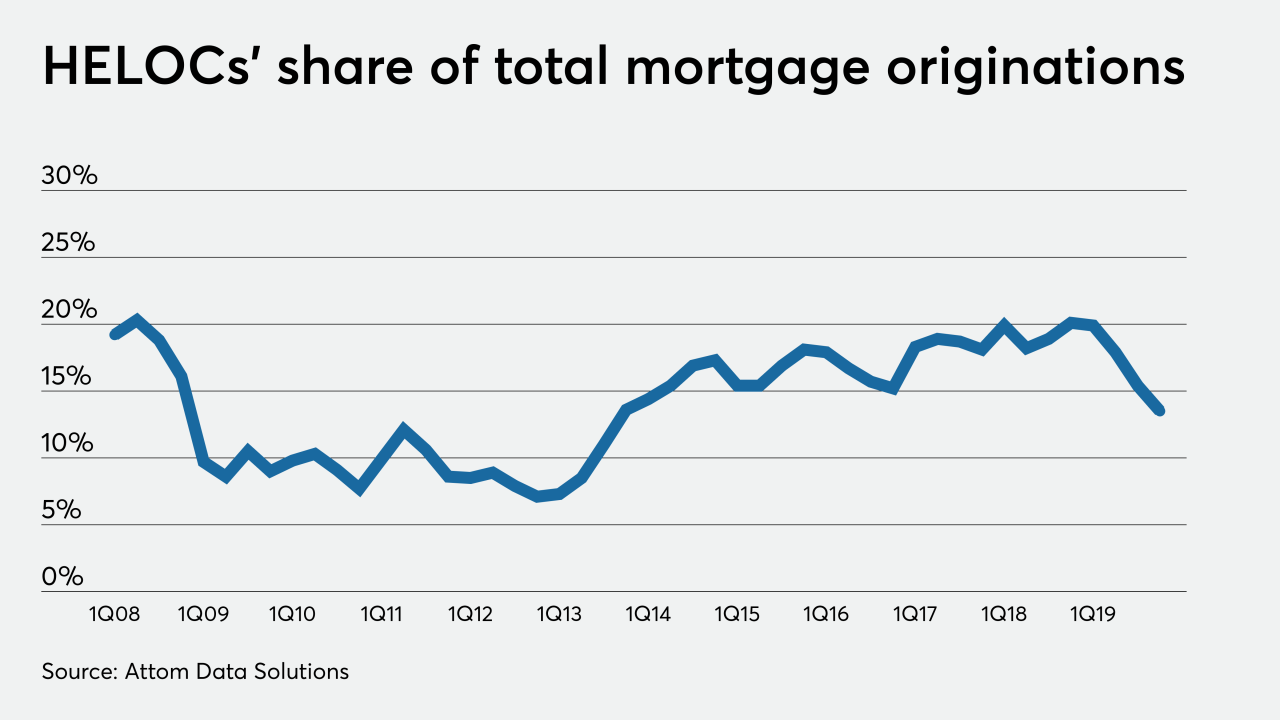

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

The online lender, reeling from the economic fallout of the coronavirus pandemic, also said it is cutting senior executives' salaries by 25%.

April 21 -

Compliance, risk management and staffing will likely come under added scrutiny as regulators lay out a framework for future fintech-bank mergers.

March 5 -

The heads of the two companies explain how the deal came about, what hurdles they face and how they plan to mash up their very different operations.

February 20 -

The deal for Boston-based Radius would be the first in history in which an online lender buys a mainstream bank.

February 18 -

Jason Gardner, founder and CEO of the card issuer Marqeta, discusses his experiences in starting up multiple fintechs and makes predictions for the new year.

December 30 -

PE firms have made investments in only seven banks in 2019, compared with 21 last year. Here's what's driving the slowdown.

December 22 -

The SoFi co-founder said Figure Technologies is working with national banks to employ its distributed ledger tech for loan originations.

December 13 -

Casting aside recession fears, the credit bureau predicts credit cards, mortgages, auto loans and unsecured personal loans should all perform well — including those extended by online lenders.

December 12 -

Federal and state policymakers wagged their fingers this week at high-cost lenders that might be looking to team with banks to evade a 36% ceiling on interest rates.

December 6 -

The online lender said it applied insights from its partnership with Fifth Third Bancorp in developing a new digital platform it’s marketing to other large financial services companies.

November 20