-

Denmark has offered additional checks and balances by the European Systemic Risk Board as a way to address concerns that insurers' investment in synthetic risk transfers could threaten financial stability.

November 25 -

The prepayment rate grew by 37% over September as mortgage rates fell leading to higher refinancing volume in October, ICE Mortgage Technology said.

November 25 -

There is also a class N tranche of notes that make payment to those noteholders if funds are available after the overcollateralization.

November 24 -

Heading into the Thanksgiving holiday-shortened week, the benchmark Bloomberg Treasuries index is on track for a small gain in November after rising in eight of the prior 10 months.

November 24 -

The transaction uses a shifting interest repayment structure, and its lockout that is subject to performance triggers.

November 24 -

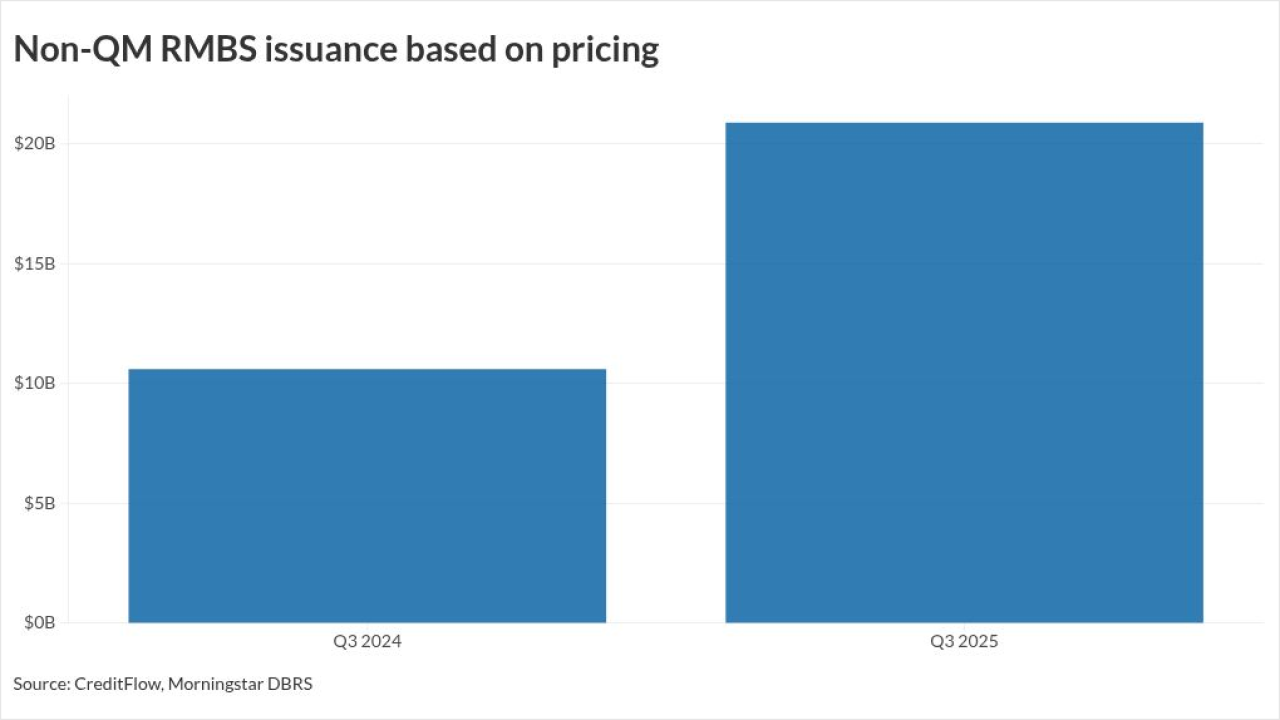

New private-label bonds collateralized by loans made outside the qualified mortgage definition hit highs for the month, quarter and year, CreditFlow data shows.

November 24 -

On a weighted average (WA) basis, the collateral mortgages have a slightly higher leverage level than previous transactions, although moderate, with an original loan-to-value (LTV) ratio of 71.9%.

November 21 -

Private-label CMBS loan delinquencies are rising, but ample liquidity is making 2025 issuance volume the highest since 2007.

November 21 -

The moves come despite Fed officials including Michael Barr voicing caution on lowering borrowing costs again in December given inflation is still above target.

November 21 -

Federal Reserve Gov. Stephen Miran reiterated his view that monetary policy has become more restrictive than economists think, but expressed increased urgency that the central bank take strong corrective action.

November 20