-

Leftover goals from the first administration of president-elect Donald J. Trump 1.0 could shake MBS and other ABS sectors.

January 17 -

The Consumer Financial Protection Bureau has long been a target for conservative ire, but dismantling it would require Congress' cooperation.

November 27 -

The Trump victory is considered a positive for changing the status of Fannie Mae and Freddie Mac, but what would that do to interest rates?

November 13 -

The Federal Reserve's top official was emphatic that he and other leaders on the Board of Governors cannot be dismissed or demoted at will by the president.

November 7 -

Traders are looking to central bankers for clues on how Trump's tax-cut and tariff policies could alter their outlook for global growth and inflation.

November 7 -

Trump has promised levies on US imports that would upend global trade, tax cuts that would further stretch the federal budget and deportations that could shrink the pool of cheap labor.

November 6 -

Mortgage professionals are focusing on housing policies and the Federal Reserve this November.

November 4 -

The Consumer Financial Protection Bureau may face an existential threat if former President Trump is reelected, while the agency could be emboldened if Vice President Harris wins.

October 28 -

The Federal Home Loans Bank System is under pressure to fund more affordable housing and has several proposals that may work in tandem with Vice President Kamala Harris' goal of building three million new units in her first term.

September 19 -

A former housing regulator confirmed that he anticipates a release from conservatorship would occur if Trump's elected, adding to other signs a plan is brewing.

September 16 -

In trading ahead of the debate, Treasuries rallied as oil tumbled and after U.S. bank regulators released revised details on proposed bank-capital rule changes.

September 10 -

Indexes from Goldman Sachs Group Inc. that track trading strategies for each party show the Democratic one started outperforming the Republican one right around the time Biden stepped down as candidate.

August 27 -

Vice President Kamala Harris' pledge to deliver 3 million homes has drawn applause from homebuilders, lenders and affordability advocates, but experts are uncertain how her administration would pull it off.

August 23 -

Mortgage professionals interviewed say there should be more focus on increasing housing supply.

August 21 -

Vice President Kamala Harris outlined a raft of populist economic proposals in her first major economic speech since securing the Democratic presidential nomination, including some aimed at lowering housing costs and boosting supply.

August 16 -

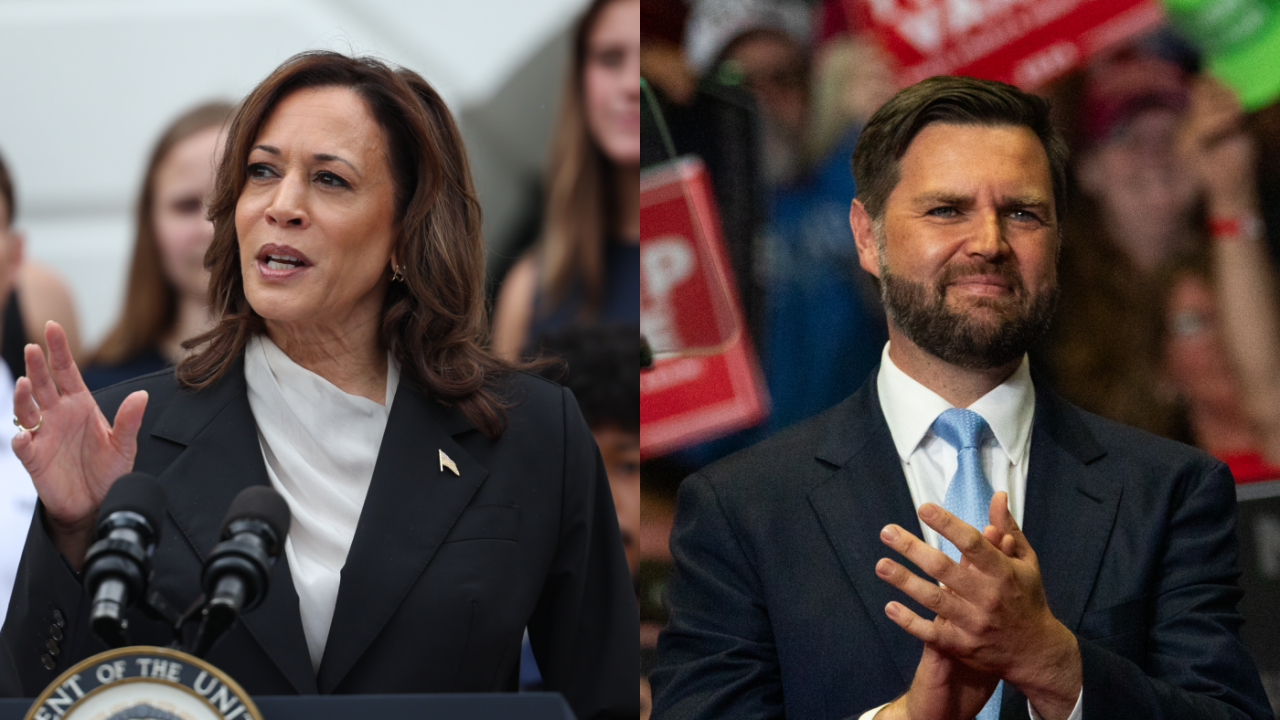

Vice President Harris' surprise elevation to the top of the Democratic ticket and the ascent of Ohio Sen. J.D. Vance to be the Republican vice presidential pick brings renewed vigor to each party's economic vision.

July 22 -

Investors are set to start the week scrambling to decide if President Joe Biden's decision to end his reelection campaign and endorse Vice President Kamala Harris increases or decreases Donald Trump's chances of regaining power.

July 21 -

The irony is, Trump's platform — including tax cuts, tariff increases and a crackdown on immigration — would, in the view of many economists and investors, stoke price pressures.

July 17 -

There's been no discussion among Cabinet members about invoking the 25th amendment of the US constitution, which covers the potential removal of a president due to disability.

July 9 -

The plan from the Heritage Foundation, a group the first Trump administration was largely in line with, would shutter CFPB, break up HUD and raise FHA premiums.

June 27