Earnings

Earnings

-

The Silicon Valley fintech expects to make $1.5 billion in auto loans this year after implementing key elements needed to achieve scale, said CEO David Girouard. The expansion comes as the automotive market continues to boom.

February 16 -

"The quality of our new business is high. The pricing of that business does not reflect the capital requirements of our regulatory rule," CEO Hugh Frater said.

February 15 -

However, leadership noted that 2021 was the second record year for new single-family mortgages and also discussed how the government sponsored-enterprise plans to further rebuild its capital.

February 10 -

The credit card issuer fielded questions about its fees two days after the Consumer Financial Protection Bureau announced a wide-ranging review of consumer charges. Executives said they would not take a big revenue hit even in the face of new limits.

January 28 -

The largest bank based in oil-rich Texas is building a framework for gauging the threat that climate change poses to its business and plans to disclose more information on the subject this summer. Meanwhile, its energy loan portfolio shrank 24% year over year.

January 19 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

Roger Hochschild predicts consumers will keep using their Discover cards in the months ahead, particularly when shopping online.

October 21 -

Goldman Sachs Group posted a surprise jump in its trading business, rounding out a stellar quarter for Wall Street’s biggest banks.

October 15 -

The San Francisco bank reported a 26% increase in its third-quarter earnings, thanks to robust single-family, multifamily and commercial real estate loan activity in New York, Boston and its home city.

October 13 -

The wholesale lender has a cost structure aimed at beating the competition in a rising rate environment, Chairman and CEO Mat Ishbia said on the second quarter earnings call.

August 17 -

While the company's mortgage originations saw a 46% annual drop in gain on sale margin, it anticipates that annual volumes will exceed 2020 levels.

August 13 -

The company attributed its second quarter loss to competitive pricing pressures and GSE-imposed charges.

August 10 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The digital lender, which bought Radius Bancorp in February, still expects to record a full-year loss partly because of merger-related costs. But its stock price soared Thursday after it reported second-quarter net income of $9.37 million.

July 29 -

States in its footprint have some of the lowest vaccination rates in the country. Another round of shutdowns could further damage industries like hospitality that have already been hit hard by the pandemic, executives said.

July 23 -

Small Business Administration lenders have reported strong quarterly results, but those gains could evaporate later this year. Here’s why.

July 23 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

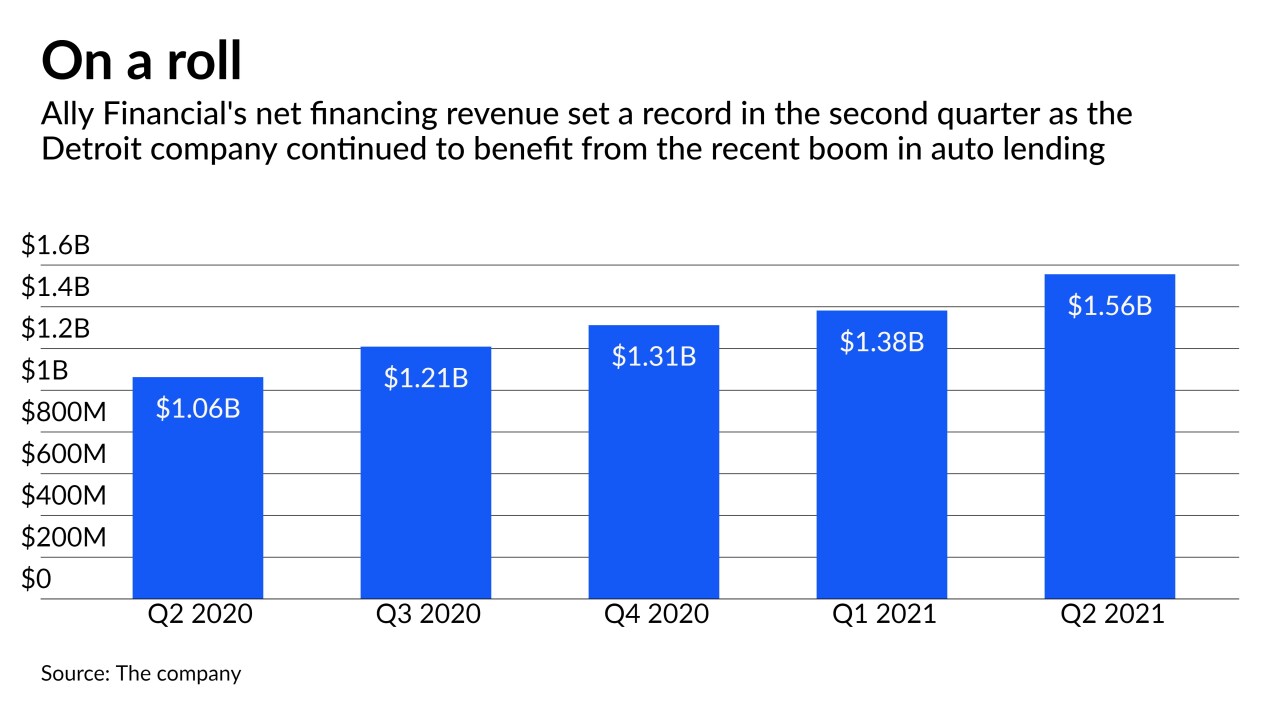

The Detroit company, one of the nation's largest car lenders, enjoyed a surge in profits during the second quarter, largely due to strong consumer demand for vehicles. But how long will the good times last?

July 20 -

Even though the channel helped the bank do over $2 billion in business last year, going forward it will produce loans through the traditional retail business.

July 2 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10