There isn’t a better time than now to review your employee healthcare and wellness benefits.

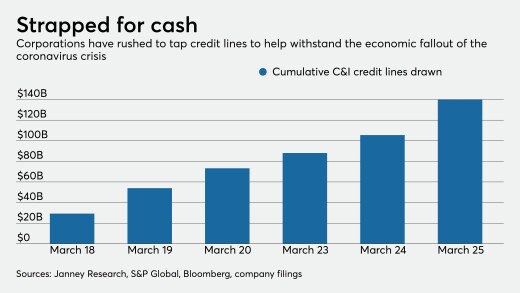

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

The reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

While LendingClub, Prosper, Avant and SoFi are giving existing borrowers breaks in the short term, they're considering tightening credit as the coronavirus outbreak threatens to drag the economy into a recession.

Federal Reserve Chairman Jerome Powell said the central bank will maintain its muscular efforts to support the flow of credit in the U.S. economy as Americans hunker down from the coronavirus pandemic.

While analysts agree banks are in better shape than in 2008, lawmakers are dusting off a crisis-era tool used by the Federal Deposit Insurance Corp. to soothe potential liquidity fears during the coronavirus pandemic.

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

The $2 trillion deal passed by the Senate late Wednesday would aim to put banks and consumers alike on stronger financial footing as they weather the coronavirus pandemic.

-

There isn’t a better time than now to review your employee healthcare and wellness benefits.

March 27 FinFit

FinFit -

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

March 26 -

The reprieve from mortgage data collection was among several changes to the agency’s supervisory and enforcement procedures to help firms responding to the COVID-19 pandemic.

March 26 -

While LendingClub, Prosper, Avant and SoFi are giving existing borrowers breaks in the short term, they're considering tightening credit as the coronavirus outbreak threatens to drag the economy into a recession.

March 26 -

Federal Reserve Chairman Jerome Powell said the central bank will maintain its muscular efforts to support the flow of credit in the U.S. economy as Americans hunker down from the coronavirus pandemic.

March 26 -

While analysts agree banks are in better shape than in 2008, lawmakers are dusting off a crisis-era tool used by the Federal Deposit Insurance Corp. to soothe potential liquidity fears during the coronavirus pandemic.

March 25 -

With seven in 10 rooms sitting empty amid the coronavirus outbreak, hotel and banking groups are urging policymakers to open up the Term Asset-Backed Securities Loan Facility.

March 25