Lenders have joined a lobbying push to expand a crisis-era program to provide more financing for struggling hotels as new data issued Wednesday showed the increasing toll that the novel coronavirus is taking on the hospitality industry.

The hotel industry’s main trade group, the American Hotel & Lodging Association, and some finance groups, including the Mortgage Bankers Association and the CRE Finance Council, wrote a letter to federal regulators on Tuesday asking that the Term Asset-Backed Securities Loan Facility be broadened to provide financing to commercial mortgage-backed securities.

Loans to hoteliers that cover their operations and renovations are often bundled into CMBS. Lending

“We’ve had several positive conversations with members of Congress who have expressed interest in advocating liquidity to commercial real estate,” Justin Ailes, managing director, government relations for the CRE Finance Council said Wednesday about the push to expand TALF.

The hotel group and other trade associations said in the March 24 letter that the decision to exclude CMBS from the program “caused significant harm to that market” and that “a significant contraction in available liquidity” was threatening the economy.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

“Many small and medium-sized hoteliers will be unable to meet their CMBS debt service requirements during the COVID-19 crisis,” an AHLA spokesman said in an email. “This will lead to mass foreclosures and will snowball into mass-disruption and a lack of liquidity in the asset-backed securities marketplace.”

The Senate was poised to vote as early as Wednesday on a $2 trillion stimulus package to provide assistance to businesses and consumers, but it is unclear how much more will be needed to keep hotels from mass closures and if the legislation would expand TALF to finance CMBS debt.

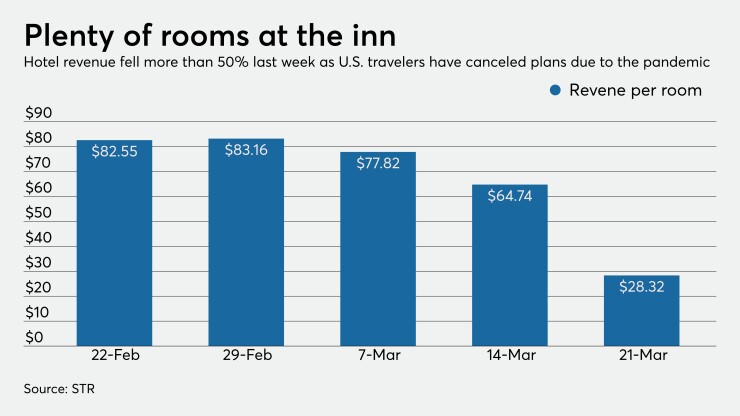

Meanwhile, hotels saw an “unprecedented” drop in revenues and occupancy for the week ending March 21 as travel and the broader economy shut down to slow the spread of the new coronavirus, according to a report released Wednesday by data firm STR.

Revenue per available room, a key metric watched by the hospitality industry, fell to an average of $28.32, down 69.5% from the same week one year ago, STR said. The average occupancy of 30.3% is down 56.4% year over year.

Jan Freitag, STR’s senior vice president of lodging insights, said the decline is worse than the aftermath of the 9/11 terrorism attacks and the financial crisis of 2008 as seven in 10 rooms are now empty.

“That average is staggering on its own, but it’s tougher to process when you consider that occupancy will likely fall further,” Freitag said in a release Wednesday.

The outlook for hotels is even more dire when looking at blocks of rooms booked 10 at a time or more — a key statistic to gauge demand from conferences or other events that have been canceled en masse amid the outbreak.

Freitag said in the release that this “group occupancy” was down to 1% on average and that revenue per available room in this category had declined 96.6% year over year.

“The industry is no doubt facing a situation that will take a concerted effort by brands, owners and the government to overcome,” Freitag said.