Ford is the second automaker to have its dealer financing securitizations placed on a negative credit watch due to the impact of the COVID-19 outbreak.

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

The Small Business Administration said lenders approved $71 billion in loans from the Paycheck Protection Program in less than five days.

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

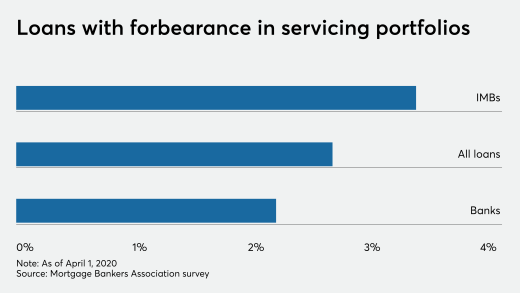

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

The Small Business Administration’s loan processing platform went down Monday for as long as four hours, temporarily halting the ability of lenders to process loans for small business owners seeking relief from the impact of the coronavirus.

The OCC and FDIC are holding off on easing debt limits in response to the coronavirus pandemic, leaving billions of dollars locked up at banking subsidiaries that could be used for lending amid the deepening economic crisis.

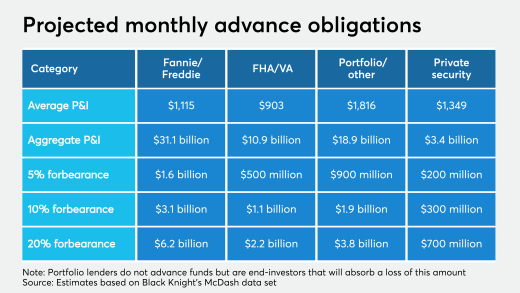

Servicers' obligations to advance or temporarily absorb unpaid funds could range from $3 billion to $13 billion per month, according to Black Knight.

- asr daily lead

Ford is the second automaker to have its dealer financing securitizations placed on a negative credit watch due to the impact of the COVID-19 outbreak.

April 8 -

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

April 7 -

The Small Business Administration said lenders approved $71 billion in loans from the Paycheck Protection Program in less than five days.

April 7 -

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

April 7 -

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

April 7 -

The Small Business Administration’s loan processing platform went down Monday for as long as four hours, temporarily halting the ability of lenders to process loans for small business owners seeking relief from the impact of the coronavirus.

April 7 -

The OCC and FDIC are holding off on easing debt limits in response to the coronavirus pandemic, leaving billions of dollars locked up at banking subsidiaries that could be used for lending amid the deepening economic crisis.

April 7