The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

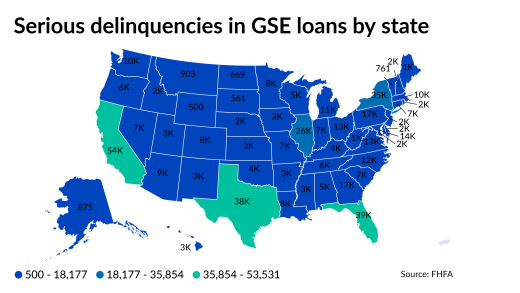

However, the serious delinquency rate dropped to a point significantly below the market-wide average, and much of the foreclosure activity allowed to proceed did so with new consumer protections in place.

With resources provided through the Homeowner Assistance Fund, the $1 billion plan will help cover homeowners’ past-due payments and comes after New York unveiled a similar assistance package earlier this month.

-

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

April 6 -

The two states' combined plans amount to over $1.5 billion of the Homeowner Assistance Fund included within the American Rescue Plan Act , which was passed a year ago.

March 4 -

-

An uptick in pandemic-related payment suspensions reflecting new or restarted plan activity previously occurred as the omicron variant spread, but activity has since subsided.

February 7 -

Despite the rising number of COVID infections, investors made no moves that would apply downward pressure.

January 6 -

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

However, the serious delinquency rate dropped to a point significantly below the market-wide average, and much of the foreclosure activity allowed to proceed did so with new consumer protections in place.

December 22