-

So-called transitional lending has traditionally been kept on balance sheet; but it’s become attractive to bundle the loans for transactions called (take a deep breath) commercial real estate collateralized loan obligations. Can investors stomach the features these deals sported before the crisis?

August 2 -

An affiliate managing the loan for the reinsurance giant's investment advisory arm will keep a horizontal equity strip of the deal for dual EU/US risk retention compliance.

August 1 -

While leveraged loans may use prime as a fallback, getting unanimous consent from collateralized loan obligation investors to use an alternative benchmark could be a challenge.

July 30 -

The alliance should help the asset registry and communications platform, accelerate its expansion beyond leveraged loans and structured finance and into more overseas markets.

July 20 -

Chinese banks and insurance companies represent a new and potentially large source of capital that could crowd out U.S. banks as investors in collateralized loan obligations.

July 11 -

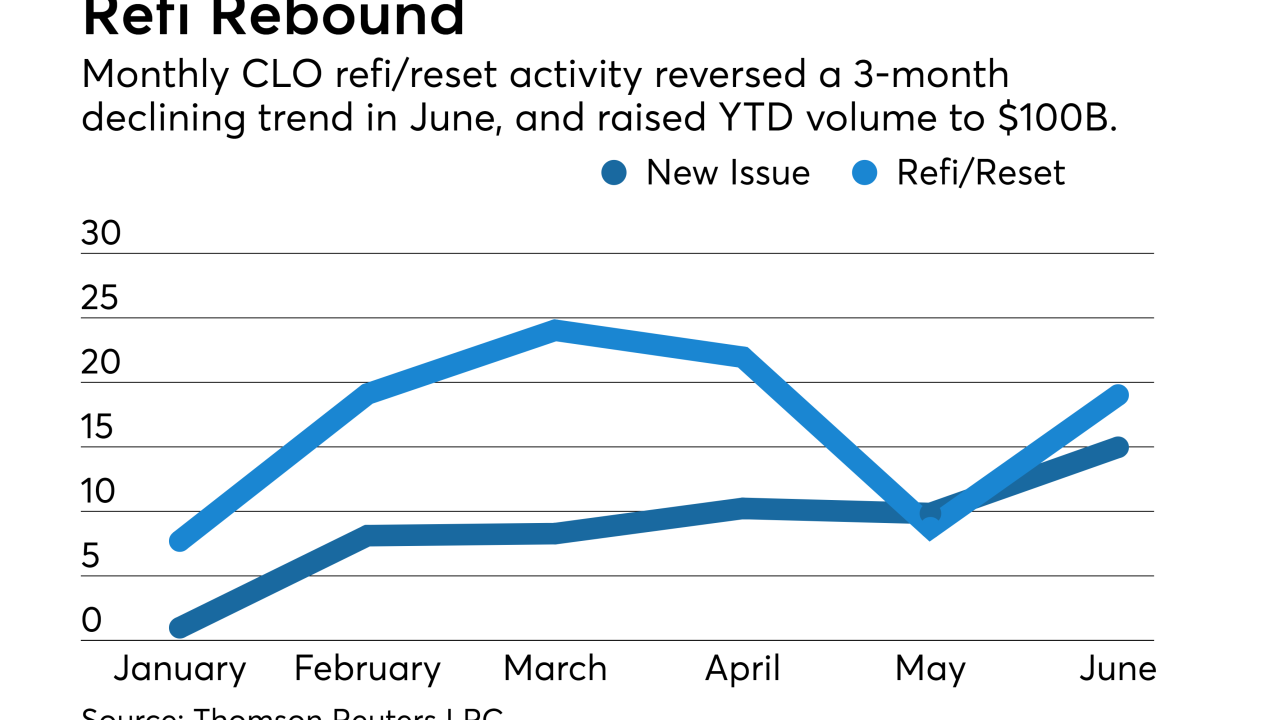

That was an increase of more than $5 billion, or 30%, from May's total, according to Thomson Reuters LPC, though it fell short of refinancing/reset activity, which rebounded to more than $19 billion.

July 10 -

Triumph Capital Advisors doubled its business with a risk-retention driven acquisition of Doral Bank's CLO assets in 2015; the same regs spurred its spin-off as a separately capitalized vehicle to Pine Brook under CEO Gibran Mahmud.

July 10 -

With risk premiums on collateralized loan obligations at or near their tightest levels since the financial crisis, there may be nowhere to go but out, according to Wells Fargo Securities.

July 3 -

The liquidation of Veneto Banca and Banca Popolare puts increasing pressure on other banks in the Eurozone to reduce their holdings of bad loans, according to Fitch Ratings; it remains to be seen whether securitization will play a significant role.

July 2 -

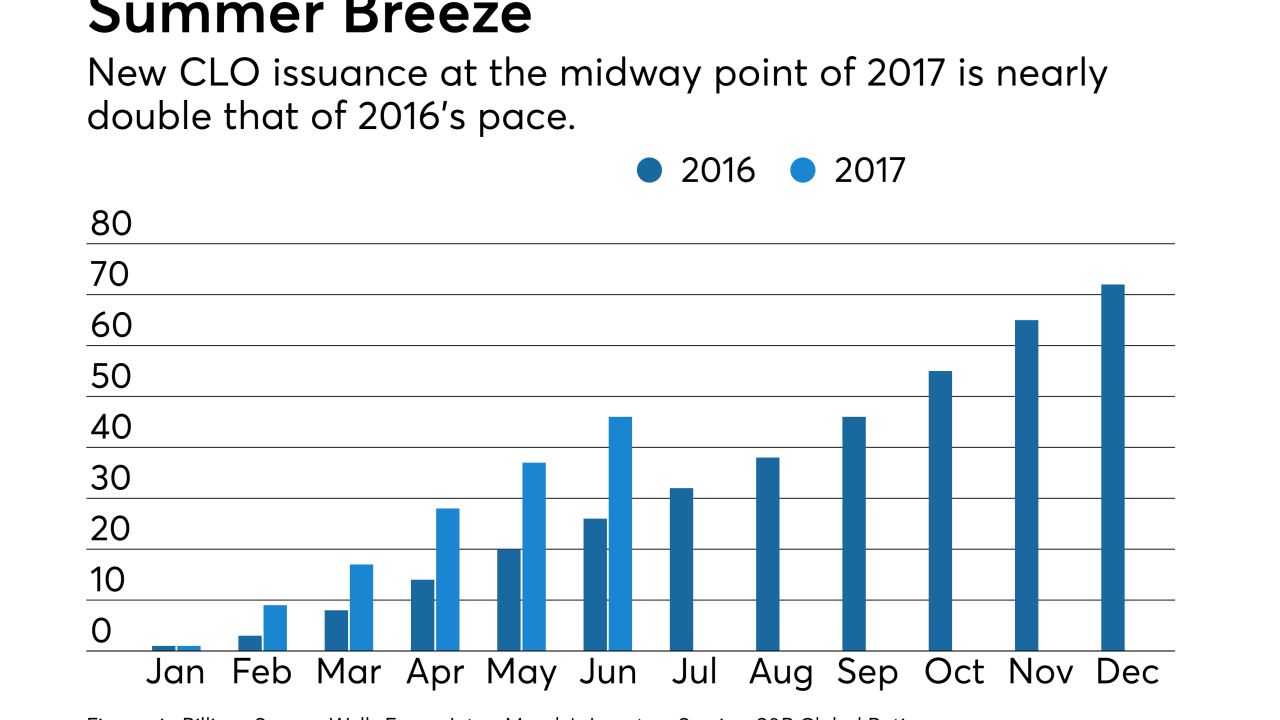

The $15 billion upward revision puts the bank's projection in line with that of JPMorgan; four new CLOs were printed last week, and another six were refinanced or repriced.

June 25