-

For the first time, the collateral includes lease contracts from its standalone Genesis luxury sedan line; two models, the G80 (base price $41,000) and G90 (base price $68,000) account for 4% of the total pool balance.

By Glen FestJune 4 -

The $900 million transaction consists of a mix of fixed- and floating-rate bonds backed by receivables from inventory financing payments of primarily BMW, MINI and Rolls-Royce dealers.

By Glen FestJune 1 -

Despite a steep drop in average FICO and increase in extended-term loans, DriveTime is shaving overcollateralization levels thanks in part to improved performance from its outstanding securitization portfolios.

By Glen FestJune 1 -

Blackstone originally included 21 of the 23 properties as collateral for a $2 billion loan issuance and securitization in 2016 to partially fund its $8.8B BioMed Realty buyout.

By Glen FestMay 31 -

The ratings agency cautions that marketplace lenders' efforts to tighten credit standards during a "solid" macroeconomic environment underscore the volatility their portfolios might face in a downturn.

By Glen FestMay 30 -

The investment firm obtained $430 million of financing on its leasehold interests in 355,000 square feet of retail and office space, but it just lost its one office tenant, Amtrak.

By Glen FestMay 29 -

Noria 2018-1 is a €1.6 billion securitization of unsecured personal loans, of which 30% are debt consolidation accounts.

By Glen FestMay 28 -

Default risks in retail and media leveraged loans have also risen to the forefront of CLO manager concerns, which a few years ago were centered on oil and gas exposure.

By Glen FestMay 24 -

Despite concerns about credit quality, the only constraints on new issuance appear to be the supply of loan collateral and the capacity of warehouse facilities and rating agencies.

By Glen FestMay 24 -

Issuance is strong and defaults remain low; yet CLO market participants are concerned about heavy debt loads of the companies they invest in, as well as the lack of investor protections.

By Glen FestMay 23 -

Home Partners of America distinguishes itself from other single-family home lessors by offering right-to-purchase options. But for the majority of properties in its new asset-backed deal – a recycling of homes pooled in its first securitization – the purchase option has been bypassed or expired.

By Glen FestMay 22 -

Sean Solis has been a partner at Dechert since 2014, advising collateralized loan obligation managers and arrangers through the hoops on U.S. and European risk-retention regulations.

By Glen FestMay 21 -

A continued "oversupply" of CLO deals, along with expectations for new debut or returning managers in the absence of risk-retention requirements, is expected to keep activity flowing.

By Glen FestMay 21 -

Monthly repayment rates, a key credit metric, are improving, but Ally Financial's second dealer inventory financing transaction of the year includes fewer dealers from its highest-ranked internal credit tier.

By Glen FestMay 18 -

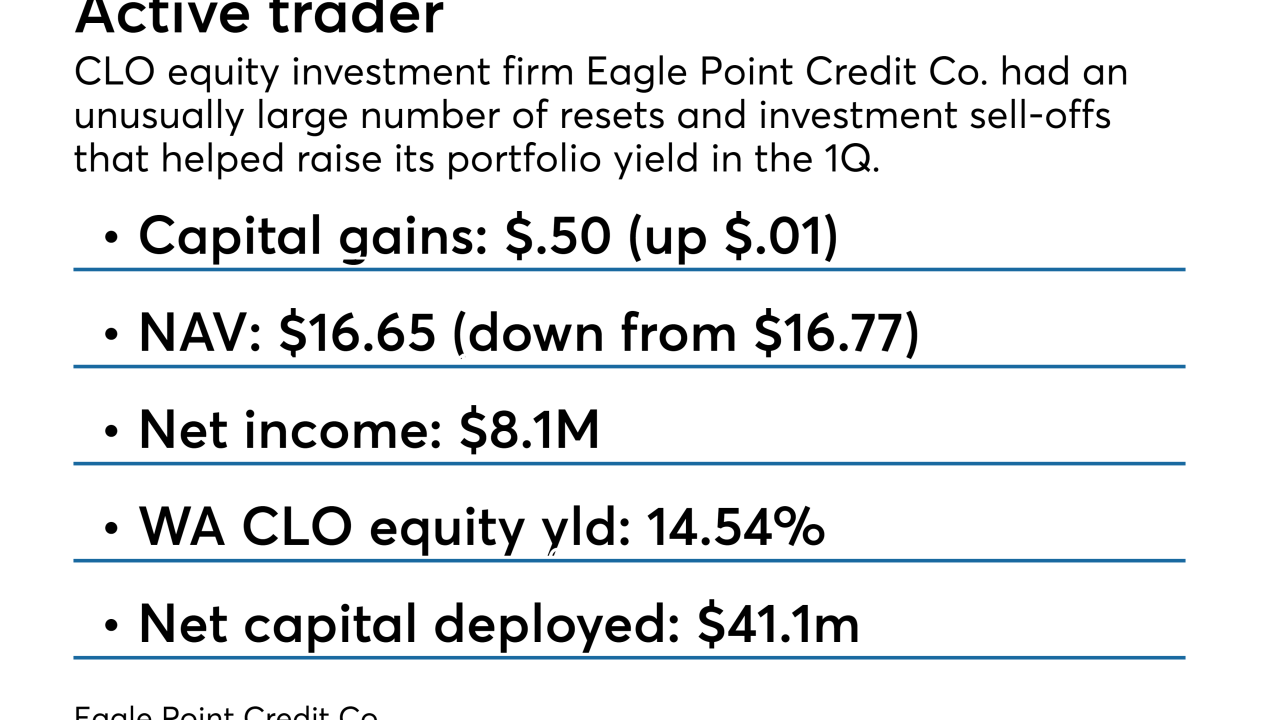

The closed-end fund, a major investor in CLO equity. directed resets of four deals that it controls in the first quarter; this helped end a yearlong slide in its weighted average portfolio yield.

By Glen FestMay 18 -

Industrywide, car sales were down last year, but there were record purchases of Civics and brisk second-half sales of the redesigned Accord; this is reflected in the model concentrations of HAROT 2018-2.

By Glen FestMay 17 -

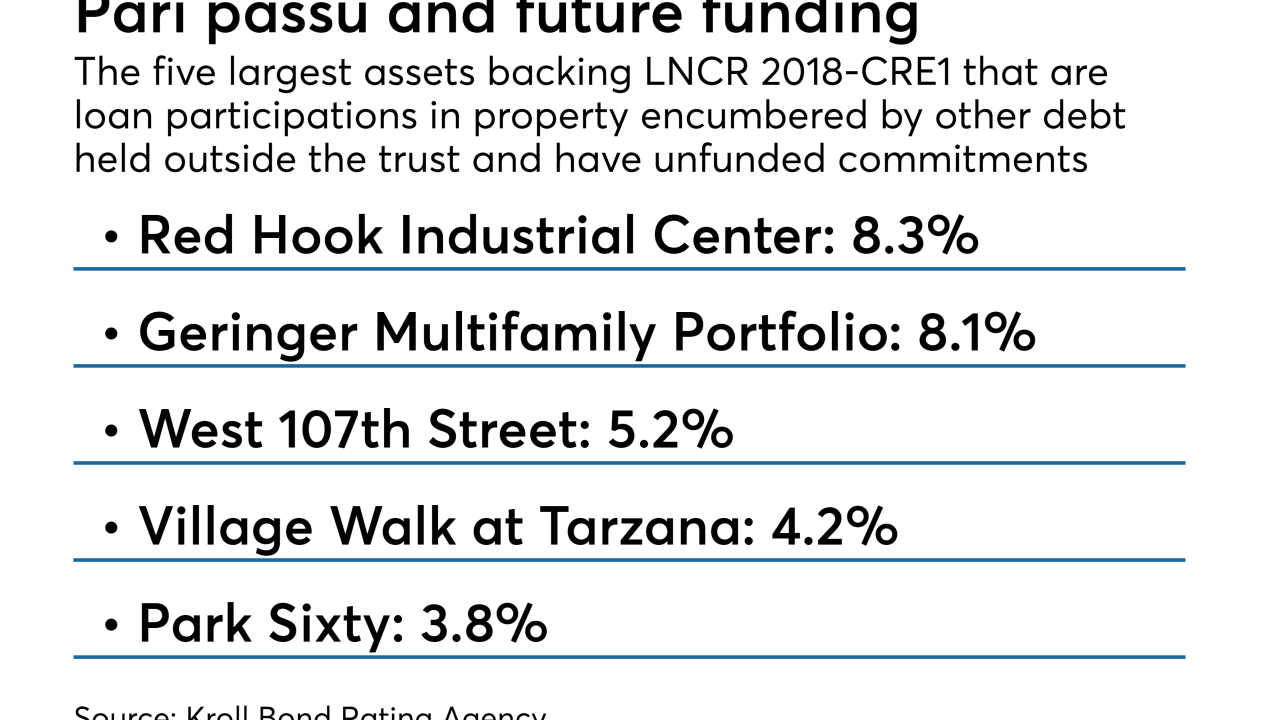

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

By Glen FestMay 17 -

According to Morgan Stanley, seven of 15 new European CLOs in the pipeline are debut or re-entry deals involving U.S. asset managers.

By Glen FestMay 16 -

Stabilizing farm incomes are expected to help boost the performance of the sponsor's managed portfolio, which experienced a rise in 2015-2017 delinquencies, as well, according to ratings agency reports.

By Glen FestMay 15 -

CKE Restaurant Holdings is tapping the securitization market to refinance its existing debt and potentially fund a dividend payout to its private equity sponsor Roark Capital.

By Glen FestMay 14