Home Partners of America is marketing its fourth securitization of single-family rentals, albeit this time with far fewer of its signature lease-purchase option contracts.

Home Partners of America 2018-1 will issue $460.1 million bonds backed by a single mortgage for 1,793 properties owned and managed by Chicago-based HPA or its affiliates.

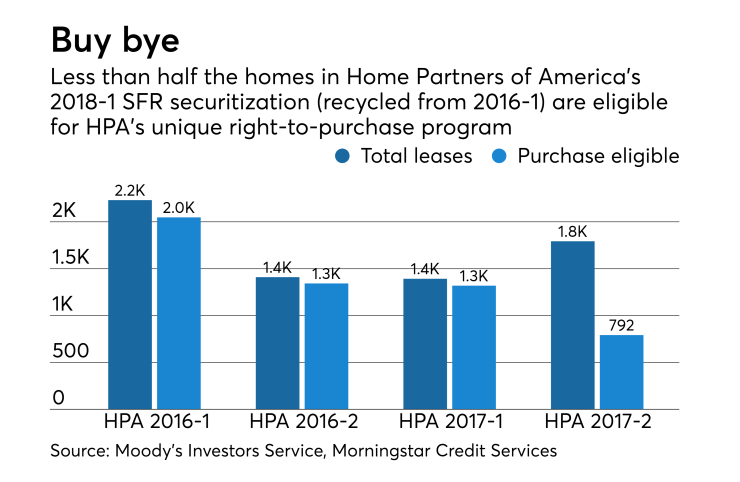

Only 792 of the properties – or 44.7% of the pool – are eligible for HPA’s “right to purchase” agreement in which homeowners can lease a home from HPA for a period up to five years before deciding whether to take out a mortgage to buy the home.

In three prior deals that HPA has sponsored, between 95% and 98% of the contracts were eligible for the right-to-purchase program, something that Moody’s Investors Service touted as a strength.

The drop-off in purchase-option homes is due to the fact the HPA 2018-1 pool is recycled collateral from HPA’s

Right-to-purchase agreements end when tenants either renew leases under cheaper market-rate rents compared to their contract rent rates, or a home is leased to new tenants ineligible for the right-to-purchase program.

Homes from the debut deal that were eventually purchased by tenants were previously released from the 2016-1 pool.

The notes being offered in the new transaction include tranches of Class A notes ($207.2 million) and Class B notes ($44 million), each with preliminary triple-A ratings from Morningstar Credit Ratings. Moody's Investors Service assigned an its Aaa rating to the Class A notes and Aa2 rating to the B notes.

The trust’s credit support level is 54.97%, a rise from the 50% support level in

Three other note classes (C,D, and E) totaling nearly $100 million are being issued with ratings between AA+ and BBB- from Morningstar, as well as a $72.8 million unrated Class F tranche. Moody’s rates only the C notes (A2) and the D notes (Baa2).

A $36.8 million Class G tranche is being retained for the trust.

The deal was underwritten by Citigroup, Deutsche Bank and Morgan Stanley.

The five-year loan backing the notes is secured by the portfolio of homes in 17 states. The leases in the 2018-1 pool have up to 36-month terms, with an average of 12.7 months remaining. The monthly rents range from $1,160 to $4,760, and the average valuation (through broker-price opinion, or BPO) is $316,598.

Both purchase-contract and market-rate lease types are expected to provide over $47 million in cash flow over the life of the transaction that will be used to pay down the notes being issued with the HPA 2018-1 transaction. Moody’s expects losses of approximately $2.7 million, or 5.6% of expected gross income.

The right-to-purchase option distinguishes HPA from other single-family rental firms, such as Invitation Homes, that also market portfolios of rental homes to asset-backed investors.

Under HPA’s program, households choose a home listed for sale that HPA will acquire (based on minimum requirements) and lease back to the tenant who will have an option to buy back the house (at a premium) during the next three to five years.

So even though these tenants take out leases at above-market rates on homes averaging 27 years of age, Moody’s considers the HPA pools lower-risk collateral than standard SFR collateral since the deals involve better-quality homes handpicked by potential homebuyers. The buyers in turn have a stronger incentive to maintain properties and stay current on leases.

A plus for investors is that although the deal does not amortize from the monthly lease cash flow, homes that are mortgaged to tenants are released from the pool with advanced payments, accelerating deleveraging on the transaction.

But for tenants to gain the most benefits from the lease-purchase agreements, they must act sooner than later. None of the tenant’s escalating rent costs (up to 3.75% a year) during the lease period apply toward the purchase of the home. And the longer a tenant waits to buy a home, the purchase price and annual maintenance costs grow 3.5% to 5% a year based on the annual compounded increases in HPA’s initial outlay in purchasing and upgrading the house.

In an example on HPA’s website, a home purchased by HPA at $200,000 is leased to the tenant at $1,400 a month. The tenant’s first-year purchase option price is $220,500 – a figure that rises to $243,100 by year three and $268,000 by year five if the tenant doesn’t choose to buy. By that time, the rent has risen to $1,650. (In Texas, the maximum period for a purchase right is three years.)