-

With an expected March 20 closing, BMW's next lease securitization brings first-quarter deal volume to $6.5 billion, the highest three-month total in four years.

By Glen FestMarch 11 -

While S&P expects higher net losses to over a five-year span, Kroll believes stricter reinvestment criteria for the extended revolving period can reduce them.

By Glen FestMarch 11 -

The $1 billion DRIVE 2019-2 is backed by loans with slightly weaker credit metrics than the lender's prior deal, forcing it to increase credit enhancement.

By Glen FestMarch 7 -

Oil and gas firms have represented the largest sector concentration for Enterprise Fleet Management since 2012, but had declined slightly in the sponsor's previous transaction.

By Glen FestMarch 7 -

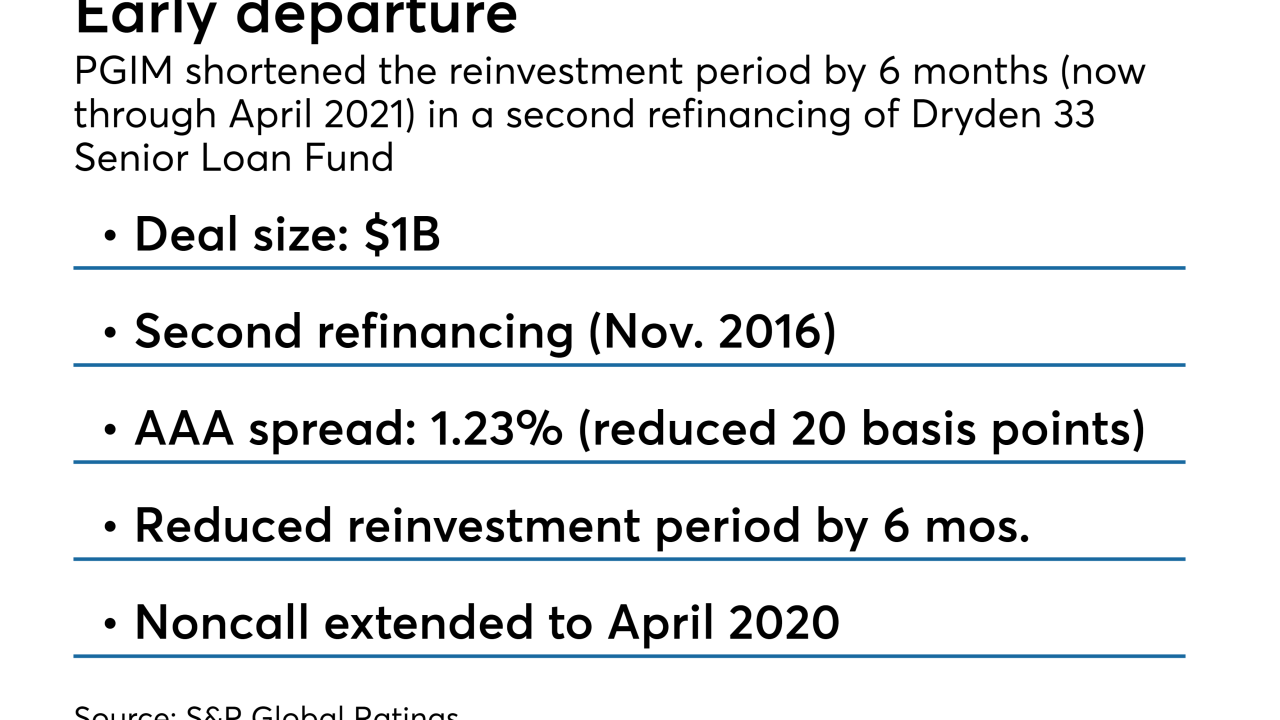

PGIM gains a 20 basis-point reduction in the AAA note coupon as it reduces the reinvestment period by six months

By Glen FestMarch 6 -

Investors appear to be willing to accept lower spreads in exchange for tying their money up for less time; CLO managers may be hoping to refinance when market conditions improve.

By Glen FestMarch 6 -

The majority of the collateral for Finsbury 2019-1 was originated over the past year, but it includes some loans from a 2016 deal that has been called; some of these older loans are delinquent.

By Glen FestMarch 6 -

After waiting a decade to return to the CLO market, AIG now has taken less than three months to issue a second deal through its new "CLO 2.0" platform.

By Glen FestMarch 5 -

Of the $300 million in proceeds, $90 million will be set aside to fund future acquisitions; the rest will repay an outstanding tranche of variable funding notes and pay a dividend to Roark Capital.

By Glen FestMarch 5 -

The $500.25 million Magnetite XXI has a three-year reinvestment period and can be called after just one year; it also priced inside most other deals that came to market in February.

By Glen FestMarch 4 -

Kroll Bond Rating Agency is maintaining its BBB rating, despite the fact that the restaurant chain has experienced nine consecutive quarters of declining same-store sales.

By Glen FestMarch 4 -

Tobacco-industry loans are rare assets for CLOs, but Sound Point is ensuring none will go into its CLO XII portfolio for the remaining 20-month reinvestment period.

By Glen FestMarch 1 -

Concerns about risks in the leveraged loan market, as well as the potential impact of new capital rules for Japanese banks, continue to weigh on collateralized loan obligations.

By Glen FestFebruary 27 -

The first step toward getting a handle on blockchain technology is to avoid getting bogged down in how it works. Think instead of what it can do, experts say.

By Glen FestFebruary 27 -

Three years after Verizon issued its first term securitization of device payment plans, it remains the sole issuer; Sprint, T-Mobile and AT&T appear to have other priorities.

By Glen FestFebruary 27 -

Allowing borrowers to defer payments can be an effective way to mitigate losses, but only when used judiciously, according to S&P.

By Glen FestFebruary 26 -

Not every tranche of notes originally issued by ALM XIX has been upsized by the same amount; in fact, some of the lower-rated tranches have been cut in size.

By Glen FestFebruary 26 -

Market participants seem to view S&P's downgrade of TGI Friday's 2017 transaction this month as an outlier event in a sector that continues to gain in popularity with investors.

By Glen FestFebruary 26 -

The captive lender is already underwriting and managing leases for GM electric cars in China; it is also buying and managing fleets for GM’s Maven ride-sharing program launched in the U.S. in 2016.

By Glen FestFebruary 25 -

The €400 million RRE 1 Loan Management DAC has a 4.5-year reinvestment period and two-year non-callable period, according to presale reports.

By Glen FestFebruary 22