-

S&P Global Ratings forecasts lower losses in subprime lender American Credit Acceptance's next auto-loan securitization, citing the inclusion of performing loans transferred from a recently called deal.

By Glen FestMay 16 -

Social Finance is supplying lower levels of credit enhancement to its third consumer-loan securitization of 2019.

By Glen FestMay 16 -

The lender has not sponsored an asset-backed transaction since 2007, according to presale reports.

By Glen FestMay 15 -

Shawbrook's debut securitization of "buy-to-let" mortgages issued to UK landlords will pay coupons based on the sterling-based overnight index average benchmark, rather than Libor.

By Glen FestMay 14 -

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

By Glen FestMay 14 -

The 240 note classes under review from 24 issuers include several already holding high-risk triple-C ratings.

By Glen FestMay 14 -

After a slow takeoff in the first quarter, a third aircraft lease securitization has launched since April through a debut offering from six-year-old fleet management firm Goshawk Management.

By Glen FestMay 13 -

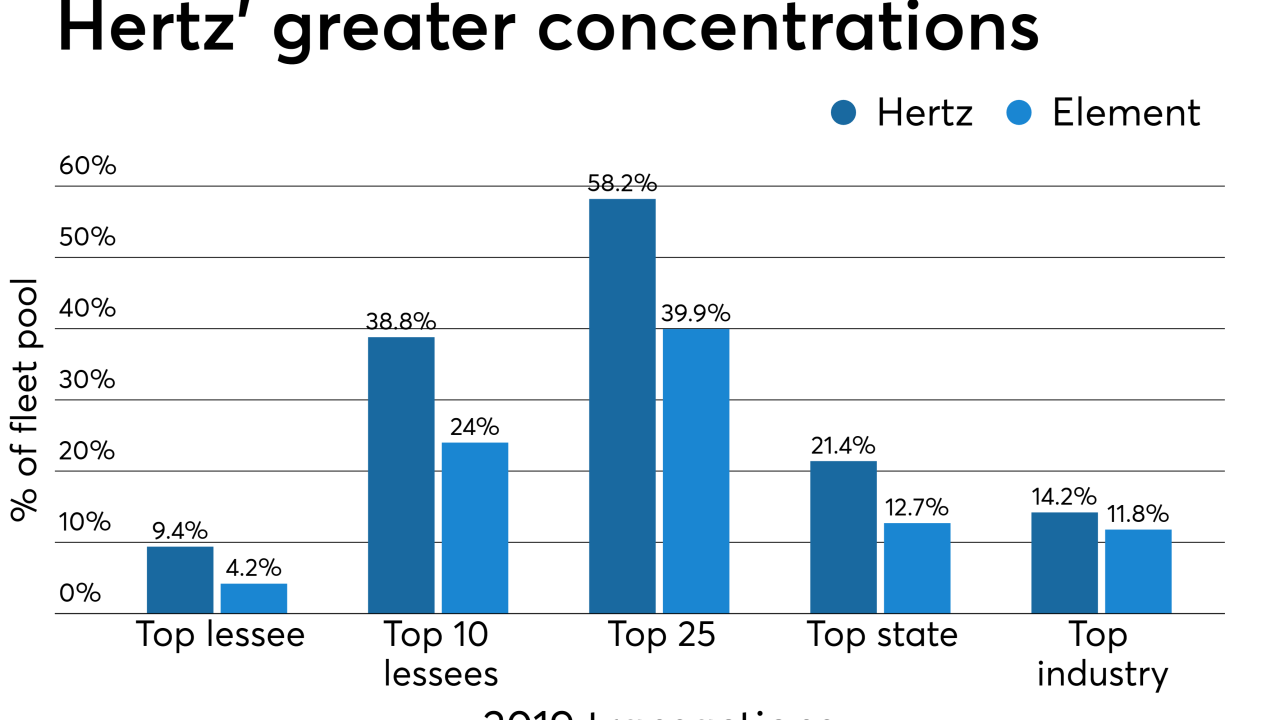

Energy industry clients make up 8.8% of the value of the latest pool from the master trust of Donlen Corp., a fleet management subsidiary of Hertz.

By Glen FestMay 10 -

GM Financial is sponsoring two series of notes totaling $1.2 billion with staggered revolving periods; Hyundai Capital America's deal is its first floorplan offering in three years.

By Glen FestMay 9 -

The loan pool includes a 9% share of Sheraton properties and 10% of Westin. MVW acquired both last September.

By Glen FestMay 8 -

The transaction represents one of the biggest mortgage-backed bond offerings of large-balance home loans this year — behind only Wells first prime jumbo RMBS in January.

By Glen FestMay 8 -

Santander Drive Auto Receivables Trust 2019-2 has a lower average FICO (600) and lighter seasoning (two months) compared to SDART 2019-1.

By Glen FestMay 8 -

CLO managers are again turning to an old tool, the combo note, to attract more investors for deals’ higher-risk equity stakes.

By Glen FestMay 7 -

The carrier, through CLO management affiliate Park Avenue Institutional Investors, is bringing total AUM in senior loans to $1.65 billion.

By Glen FestMay 6 -

After a decade of investing in distressed trust-preferred securities CDOs of small and regional banks, Hildene now sees non-distressed CLO equity as an inviting target.

By Glen FestMay 6 -

DT Auto Owner Trust 2019-2 will issue five classes of notes, collateralized by $550 million in auto loans issued through company-owned "buy here-pay here" dealerships.

By Glen FestMay 2 -

After a six-month dry spell, securitization activity for marine cargo shipping container leases is starting to thaw out with a second deal this spring.

By Glen FestMay 2 -

Navient Corp. is returning to all fixed-rate collateral for its next securitization of refinanced private student loans issued via its Earnest affiliate to high-earning college graduate professionals.

By Glen FestMay 1 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

By Glen FestApril 30 -

Kroll has again downgraded the subordinate note classes for Honor Automobile Trust Securitization 2016-1, with total losses expected to build to $7 million to $8 million.

By Glen FestApril 29