Oil and gas industry exposure is growing again in Hertz-owned Donlen Corp.’s next securitization of corporate vehicle fleet leases.

The $400 million Hertz Fleet Lease Funding LP, Series 2019-1 has a greater concentration of corporate clients leasing cars and light-duty trucks for use in oilfield and upstream services, according to presale reports from Moody’s Investors Service and DBRS.

Oil and gas makes up 8.8% of the securitization value of the Series 2019-1 pool. That is up from 7.42% from the

Energy services was once the primary industry sector served by Donlen, which had a 13.63% concentration in the trust’s Series 2015-1 securitization. That fell to a 4.26% concentration in 2017 in the wake of the 2014-2016 industry slump in oilfield services and petroleum exploration.

“The majority of the oil and gas lessees currently in the pool are oilfield services companies,” Moody’s report stated. “Upstream companies were in much stronger financial shape in 2018, compared with 2016-17, and producers have more discretionary cash flow for reinvestment through 2019, because of growing production and higher oil prices.”

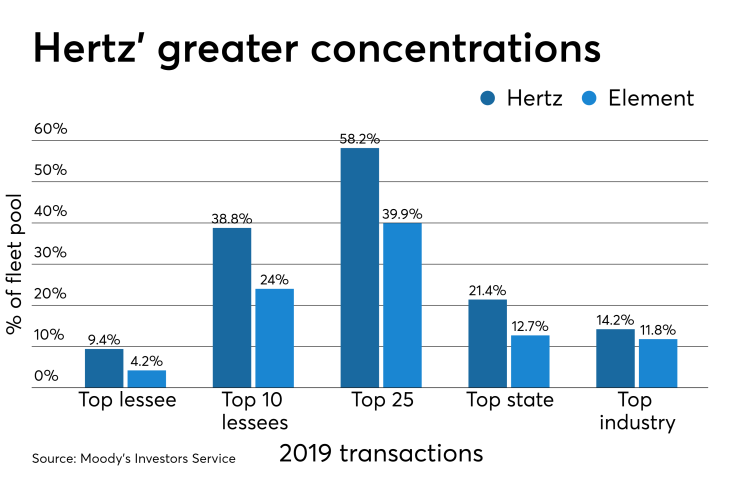

The growth in energy services is impacting state concentration levels, with Texas-based lease exposure increasing to 21.4% of the pool’s securitization value to make it the state with the most exposure for Donlen. The concentration of Texas leases is up from 19.0% last year and at its highest mark for the trust since 2015.

Geographic and industry exposure are among other higher-than-average pool concentrations for Hertz/Donlen, compared with ABS issuers from peer fleet leasing competitors like Element Fleet Corp., which sponsored the $400 million Chesapeake Funding II LP Series 2019-1 transaction in March. Donlen also has higher concentrations in top lessees. (See chart.)

The 2019-1 Series is the seventh corporate-vehicle fleet lease ABS issuance through the Hertz Fleet Lease Funding master trust in the years since Hertz Corp.’s 2011 buyout of Northbrook, Ill.-based Donlen. (The trust has historically issued one series a year.)

The capital stack for Series 2019-1 include Class A-1 and A-2 notes with a combined notional value of $355.6 million, split between fixed- and floating-rate classes. Both are triple-A rated by DBRS and Moody’s.

Hertz is also issuing four subordinate note classes in the deal: a $10.3 million Class B fixed-rate tranche rated Aa2 by Moody’s and AA (high) by DBRS; $9.9 million in Class C notes with ratings of A2/A (high); a $9.7 million Class D tranche rated Baa2/BBB (high); and a Class E tranche that only DBRS is rating, at BBB.

The Class A notes have credit enhancement of 14.1%, unchanged from Series 2018-1.

The bonds are backed by receivables from a pool of entirely open-end leases, in which lessees bear the resale value risk of the vehicle after lease maturity. However, up to 3% of the pool can include closed-end leases that would shift residual value risk to Donlen, during the transaction’s eight-month revolving period.

The pool consists of lease agreements for 395 medium- and large-size corporates, which have an average speculative-grade rating of Ba2 (30% of the lessees are investment grade, however). Moody’s says the top 200 lessees have become more diversified since the 2017-1 series. The 106,272 leases in the securitization have a value of $1.57 billion, or $18,011 per lease. The leases have a weighted average remaining maturity of 38 months.

Approximately 19.6% of the securitization value is in fixed-rate leases (with an average rate of 3.9%), with the remaining 80.4% on floating rates indexed to either Libor or dealer commercial paper rates.

Nearly 94% of the fleet value is in passenger car and light-duty truck collateral.

Donlen’s managed portfolio performance has been strong, with 60-day-plus delinquencies of 0.04% to 1.25% over the last decade, but the year-to-date 2019 figure has grown to 1.98%. All delinquencies over 30 days were up to 3.59% through the first quarter, compared with 2.9% at the end of 2018.