-

AXA Investment Advisors' two primary-issue CLOs in 2017 were each priced within the past month.

By Glen FestDecember 29 -

Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

By Glen FestDecember 28 -

Many raised large amounts of capital to put to work in the equity, or riskiest slices of their deals, allowing them to resume issuing new deals just as new loan issuance was taking off.

By Glen FestDecember 22 -

Exposure to PetSmart's now triple-C rated loan will strain the distressed debt limits of 24 collateralized loan obligations, while two other deals face potential interest-diversion test failures.

By Glen FestDecember 21 -

Only 2.6% of speculative-grade rated firms with public financials carry Moody's weakest liquidity rating, a drastic reduction since March 2016, helped by a recovery in the oil and gas sector.

By Glen FestDecember 20 -

The collateralized loan obligation market is ending the year at nearly full throttle with nearly $18 billion in new deal/refi volume month-to-date, with more on the way.

By Glen FestDecember 20 -

A £366.2 million mortgage on 127 industrial properties is being used as collateral for a transaction called Taurus 2017-2 UK DAC.

By Glen FestDecember 19 -

The first refinancing, in January, was primarily intended to extend the life of the post-reinvestment period deal; this time, the manager is also lowering the interest paid.

By Glen FestDecember 18 -

The Alpharetta, Ga.-based manager of Hilton, InterContinental, Marriott and other branded hotels recently obtained a $600 million mortgage from three banks: Goldman Sachs, Citigroup and JPMorgan Chase.

By Glen FestDecember 15 -

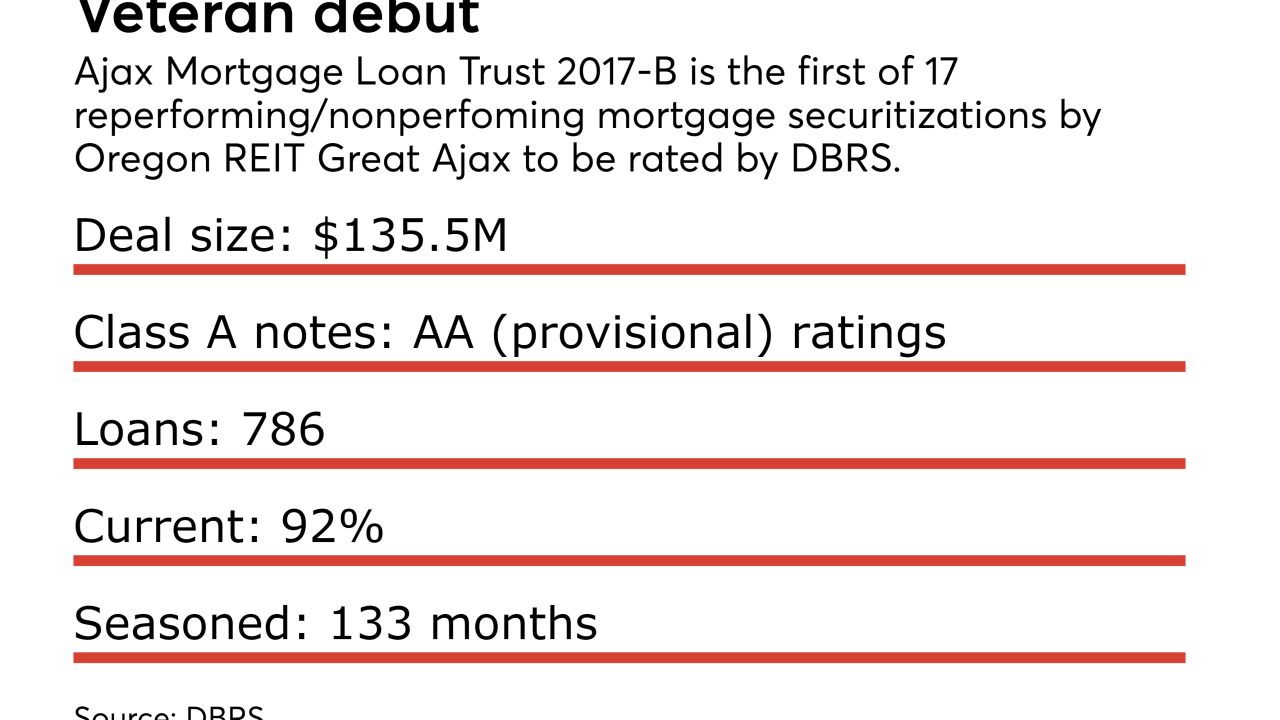

The real estate investment trust has already completed 16 unrated offerings of bonds backed by legacy loans that were once delinquent; those prior deals were backed by more deeply distressed loans.

By Glen FestDecember 15 -

Lee Shaiman, who oversaw $20 billion in leveraged finance and other fixed-income investments at Blackstone, will succeed Bram Smith. who announced his retirement in early 2017.

By Glen FestDecember 13 -

The collateralized loan obligation manager launched a fifth 2017 U.S. deal totaling $510 million, while its European subsidiary is preparing a third transaction totaling €400 million.

By Glen FestDecember 13 -

The $1.5 billion FREMF 2017-K1 has a in-trust stressed loan-to-value ratio of 120%, as measured by Kroll; that's projected to fall to 108.7% when the deal matures.

By Glen FestDecember 12 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

By Glen FestDecember 11 -

The $12.9 billion in collateralized loan obligations issued last month brings the 11-month total to $108 billion, just shy of the 2014 record of $124 billion.

By Glen FestDecember 8 -

Despite a large overcollateralization target and the elimination of no-interest loan programs, Conn's securitizations suffer high default levels that keep its Class A notes at a triple-B ratings cap.

By Glen FestDecember 8 -

A $92 million portion of $194.4 million mortgage on a portfolio of 36 ExtraSpace Self Storage locations is the largest of 42 loans backed backing MSC 2017-HR2.

By Glen FestDecember 7 -

The Dan Gilbert-controlled skyscraper has apportioned $70M of a $102M whole-loan refinancing to the Wells conduit.

By Glen FestDecember 6 -

The €173.3 million deal is backed by loans originated by the former Catalunya Banc, which were purchased at discount by the Blackstone Group in 2014.

By Glen FestDecember 6 -

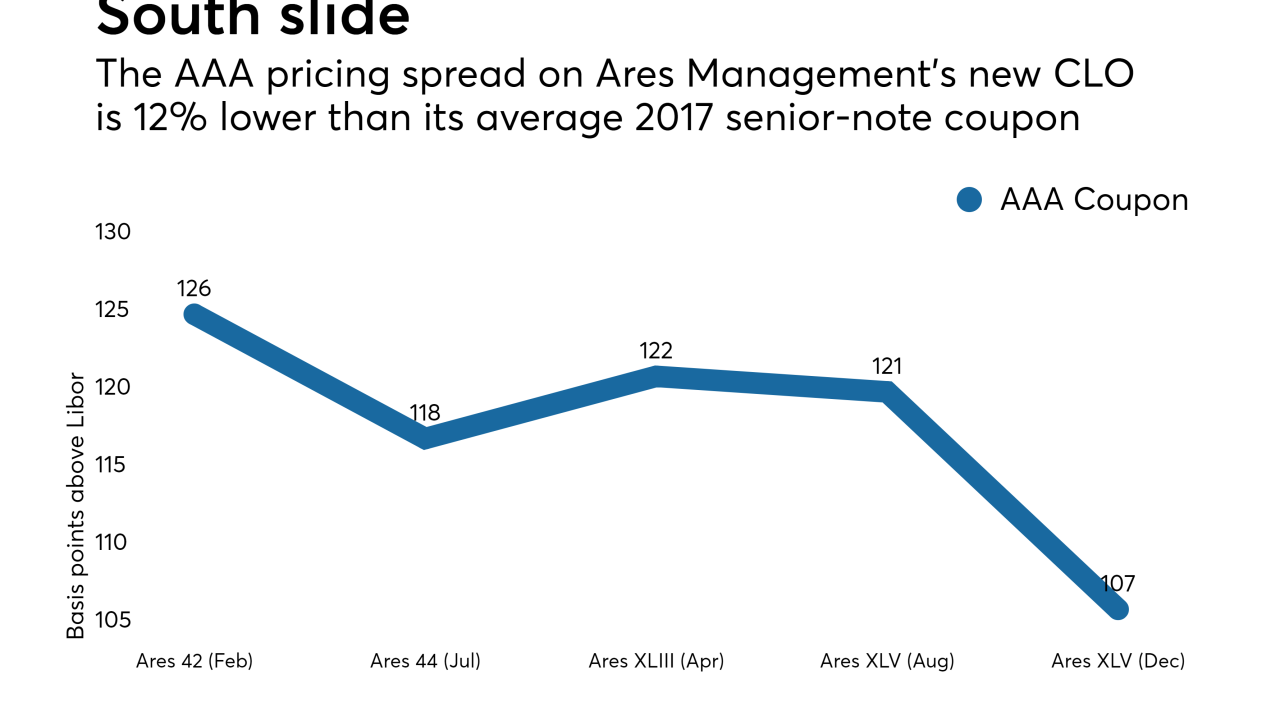

Three broadly syndicated deals printed in December have senior, AAA-rated tranches that pay just 107 basis points over Libor - the lowest coupon of the year.

By Glen FestDecember 6