A debt refinancing wave, coupled with vastly improved cash flow for the oil and gas sector has greatly eased the stress on corporate liquidity heading into the new year.

But the relief may not last long, according to Moody’s Investors Service.

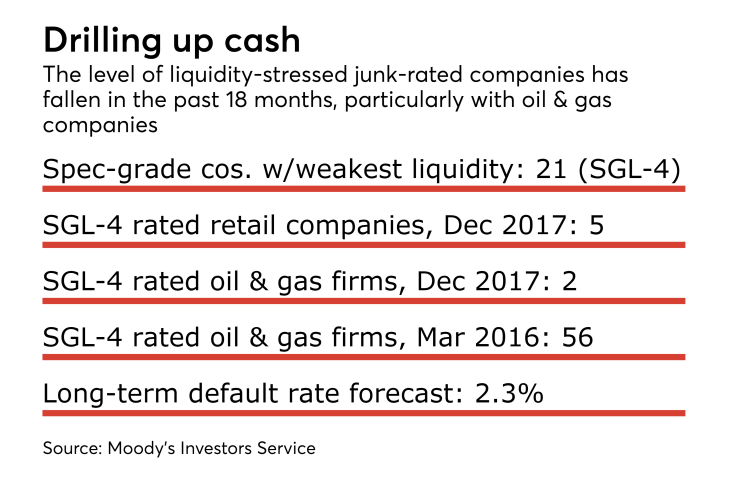

In a report issued Wednesday, Moody’s stated that of 773 speculative-grade rated companies with public financials, only 21 carried the weakest liquidity rating at mid-December, or about 2.6%. That figure, which is measured by Moody's liquidity stress indicator (LSI), is down sharply from a recent peak of 10.3% in the spring of 2016.

"The backdrop for U.S. speculative-grade liquidity in 2018 is favorable, with a modest projected pick-up in U.S. economic growth and accommodative credit markets," Moody’s Senior Vice President John Puchalla said in the report.

The LSI is a measure of the corporate liquidity health, based on a four-point speculative-grade liquidity scale (from SGL-1 through SGL-4, ranging from strongest to weakest liquidity) that Moody's assigns to about half of its universe of speculative-grade rated companies. Moody's does not maintain public SGL ratings on companies with private financials, so Moody's estimates the percentage of companies with weak ratings across all issuers, public and private, is in the 5% range, the report said.

Since the LSI is an indicator of future default activity in the junk-rated universe, Moody’s has adjusted its long-term spec-grade default forecast to just 2.3% for November 2018, down from the current mark of 3.4% (and well below the historical long-term average of 4.7%).

That's good news for collateralized loan obligations, since lower default levels can improve the credit-quality metrics of CLOs. These transaction must limit their exposure to assets that are C-rated or in default in order to maintain minimum average rating levels in their portfolios.

Despite the low-default forecast, there are some headwinds for speculative-grade companies. Interest rates are expect to keep rising and tax reform legislation could reduce the amount of interest that companies can deduct, both of which will increase borrowing costs.

“We expect the Fed's tightening cycle, the hit to low-rated borrowers from the likely curtailment of interest deductibility as part of the tax overhaul, and less dramatic gains in commodity sector liquidity to level off and potentially raise the LSI slightly in 2018,” the report stated.

The improvement in the oil and gas sector has been dramatic: The 54 oil and gas companies saddled with Moody’s weakest liquidity rating of “SGL-4” in March 2016 has been reduced to just two, which has shrunk the universe of SGL-4 rated companies to just 21 across all sectors.

While the improvement in oil and gas “largely run its course,” retail sector woes persist in terms of defaults and downgrades, the report stated. The list of SGL-4 rated retail firms has grown to five (the most of any sector), after the addition of Sears Holding Co. and Bon-Ton Stores Inc. had their liquidity ratings downgraded in November due to “weak” operating trends, according to Moody’s.

"Factoring in our liquidity assessments for retails that do not have public SGL ratings, 10.3% of spec-grade retailers have weak liquidity," the report stated.