Speculators who bet on declines in commercial mortgage bond indexes as a way to profit from the expected demise of regional shopping malls may still be waiting for a big payout, according to Trepp.

Sure, yield spreads on subordinate bonds of some CMBX indexes widened significantly over the course of the year — until very recently. So anyone who timed the trade right could certainly have come out ahead.

But, as Trepp noted in a report published this week, few mortgage bonds referenced in these mall-heavy indexes realized actual losses. So buyers of credit protection may not have profited as much as they had hoped.

Here’s how the trade, which gained notoriety in February, was supposed to work:

CMBX consists of a group of indices operated by Markit that are each linked to a group of 25 CMBS conduit deals issued during a particular year. These indices are used as an indicator of the overall performance of the commercial real estate market. Participants who expect (or fear) that bonds will incur losses can buy insurance in the form of credit default swaps. If the bonds realize losses, they get a payout. In the meantime, the buyers pay monthly premiums to the seller (usually a bank) as long as they hold the position.

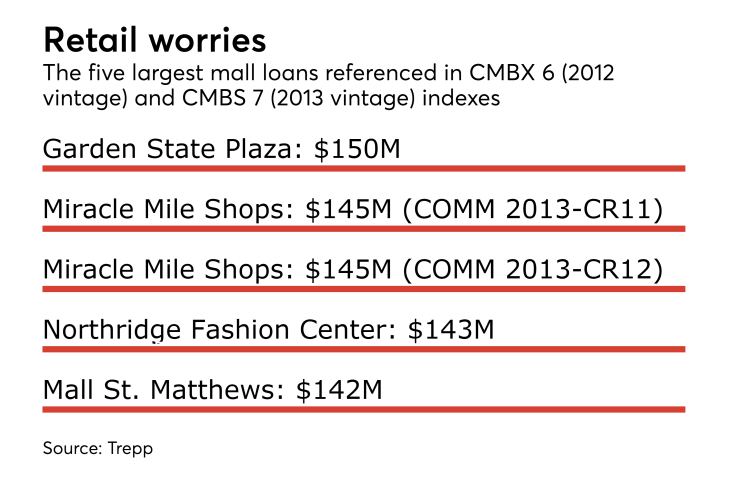

Speculators concentrated their bets CMBX Series 6 (linked to 2012 vintage CMBS) and Series 7 (linked to 2013 CMBS), which have the most exposure to retail center and shopping mall loans (38.2% for the Series 6 index and 32.4% for the Series 7). In particular, the weak performance of JCPenney, Sears and Macy’s could impact loans the properties they occupy, which are referenced in these indexes. The three department store chains often anchor class-B and -C malls and have been shuttering stores by the dozens.

“Such closures often trigger co-tenancy clauses for other in-line mall tenants, prompting them to downsize or vacate altogether,” Trepp stated in the report. “The thinking has been that properties, particularly those in secondary or tertiary markets, exposed to the three firms are at greater risk of default and losses. As such, those holding short positions in certain CMBX indices would receive a payout.”

So far, however, only 40 retail loans in deals tied to the CMBX 6 and 7 series have paid off, and four incurred losses totaling $4.3 million. Each of those notes disposed was in a 6 series deal. No losses have been attributed to deals tied to CMBX 7.

Trepp does think that the number of distressed retail mortgages will likely increase as they inch closer to their scheduled maturity dates and collateral performance continues to deteriorate.

And broader retail worries continue to weigh on CMBX. At the end of November, spreads for the BBB- tranches of CMBX 6 and 7 reached their widest levels of the year, at 358 and 202 basis points wider, respectively, than their lows in January. Spreads for the lower credit BB bonds in those same indices reached highs that were a staggering 499 and 254 basis points wider than their narrowest points roughly 10 months ago.