Pending any last-minute holiday shopping, The Carlyle Group is wrapping up its final new-issue collateralized loan obligations in what has been a busy year.

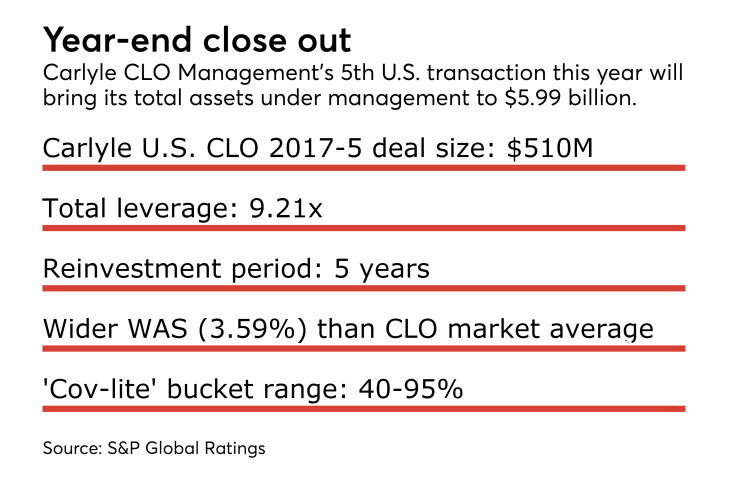

Through its Washington, D.C.-based Carlyle Investment Management indirect subsidiary, the private equity firm is launching its fifth U.S. CLO sized at $510 million, and a fourth European CLO totaling €400 million, according to presale reports from S&P Global Ratings.

Carlyle U.S. CLO 2017-5 will issue two tranches of senior, Class A notes including $287 million of AAA-rated, Class A-1A notes paying Libor plus 107 basis points – which matches the lowest spreads on recent deals

Three mezzanine tranches are being issued as deferrable notes, totaling over $76 million. Collateral manager Carlyle CLO Management (part of Carlyle Investment Management) is retaining $50 million in equity.

The deal carries a higher-than-average leverage of 9.21x, compared to the three-month average of S&P-rated deals. The weighted-average spread (WAS) is slightly higher than peer deals at 3.59%, but comes with an excess spread of 2.13% measured by the weighted average cost of debt from WAS.

S&P noted an unusual feature: a moving cap on cov-lite loans. The maximum percentage of non-covenanted loans (usually those lacking maintenance requirements on the borrower) can range between 40% and 95%. That factor will vary based on the aggregate ratings mix of the entire pool of loans as well as the percentage of loans that are not senior-secured (which can be no more than 4%).

The U.S. deal, which adds to Carlyle's issuance of $2.43 billion in primary CLO notes this year, is slated to close in January.

The Carlyle Euro CLO 2017-3 DAC is expected to close next week however. The €234 million senior tranche of AAA-rated notes pays Euribor plus 75 basis points. (The three- and six-month Euribor are each currently negative rates at -0.326% and -0.271%, respectively – an effective spread of 108 and 102 basis points).

The European CLO is managed by CELF Advisors, a subsidiary of the firm’s Carlyle Investment Management LLC unit.

The three previous Euro deals from Carlyle in 2017 total €1.3 billion, contributing to a surge year in CLO issuance overseas of more than €18 billion through the end of November to surpass 2016’s full-year total of $16.8 billion.

The growth in CLO issuance was spurred by the increased supply of European loans and high-yield bonds from the European Central Bank’s corporate bond-buying program, as well as investors buying more corporate credit in a negative government-bond yield environment, according to Morgan Stanley.

Carlyle Group has also refinanced or reset eight U.S. and European deals this year, according to Thomson Reuters LPC data.