CLO managers have broken through a new floor for spreads in senior, triple-A-rated tranches.

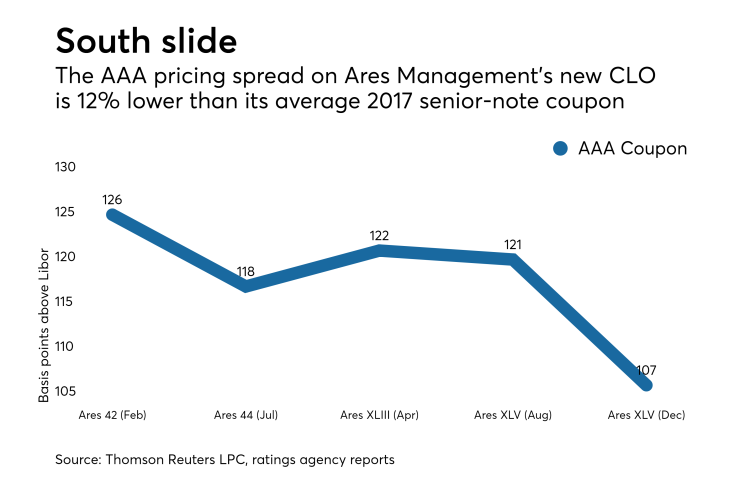

On Monday, Moody’s Investors Service issued a report noting that Ares Management is pricing its fifth new-issue collateralized loan obligation of the year with a triple-A spread of only 107 basis points above three-month Libor for its $608 million Ares XLVI.

That matches the 107 basis point coupon spread also negotiated by Blue Mountain Partners for the senior notes in that shop’s third deal of 2017 (the $407.8 million BlueMountain Fuji U.S. CLO III), according to an S&P Global Ratings presale report also issued Monday.

Both followed the lead of GSO/Blackstone Debt Funds Management’s $413.8 million Long Point Park CLO, which is pricing at 107 basis points, according to a presale report last week from Moody’s.

In October, spreads began falling inside of 120 basis points at levels analysts described as post-crisis tights. Those spreads continued to tighten in early November with coupons falling to an average of 115 basis points, according to Wells Fargo Securities.

Now with multiple deals pricing at spreads at or below 110 basis points, CLO senior note spreads have fallen at least 24.1% from the peak spread average of 145 basis points in January, and 33% from the 165 basis point level that was the highest in the last two years, according to Thomson Reuters data.

Pricings on CLOs have fallen to the lowest levels since at least 2013 as managers have squeezed investors in order to maintain the gap between liability spreads on note tranches and the declining leveraged loan interest rates they are receiving from their purchased assets.

Loan spreads have declined due due to the massive $700 billion loan refinancing wave this year (through Oct. 31). Lower rates on refinanced loans impact CLOs by reducing the interest receivables CLOs can pass on to equity investors at the bottom of a deal's payment waterfall.

Average CLO spreads declined for five consecutive months heading into November. In October, Oak Hill Advisors, Carlyle Investment Management and CIFC each were among the first to price a new broadly syndicated CLO inside of 120 basis points since June.

Voya Alternative Asset Management gained the tightest spread that month at 113 basis points in an Oct. 30 pricing for ts Voya CLO 2017-4 deal, according to Thomson Reuters. That benchmark was equaled or bested with new deals issued by Invesco, Octagon Credit Investors, CVC Credit Partners, Onex Credit Partners, and Teachers Advisors Inc.

The tight spreads so far in December are not relegated to regular issuers. On Monday, S&P issued a report on the debut $339 million CLO for Middle Market Credit Fund LLC, which is marketing its AAA notes at 117 basis points.