-

ECMC Group is marketing another $500 million of notes backed by federally guaranteed student loans that were once delinquent but are now making timely payments.

August 2 -

The delinquency rate for securitized commercial mortgages, which jumped in June, retreated just as quickly in July, falling 26 basis points to 5.49%. It's now only two basis points above its May level.

July 31 -

It's the second multifamily lender to debut in the CRE-CLO market this year, following Greystone, which completed its first deal in March. Like Greystone's deal, this one has a reinvestment period.

July 30 -

Moody's believes that rules grandfathering existing transactions increase the risk that these deals could be left unhedged; it may downgrades some European RMBS and U.S. student loan-backed securities.

July 27 -

The sponsors obtained a $500 million mortgage on the office building at the corner of Madison Avenue and 42 Street; proceeds were used to repay debt and fund a $330 million equity distribution.

July 25 -

Unlike the $15 billion-asset bank’s legacy mortgage bonds, the new offering is backed by loans to borrowers with strong credit and significant equity in their homes.

July 24 -

Unlike some other large loans obtained by affiliates of the private equity firm, this one is not being carved up into bits; rather, the entire $1.4 billion mortgage is securitized in a single transaction.

July 21 -

The alliance should help the asset registry and communications platform, accelerate its expansion beyond leveraged loans and structured finance and into more overseas markets.

July 20 -

U.S. District Judge André Birotte has dismissed all federal claims against Renovate America and its government bond-issuing partners in three lawsuits that had sought class-action status.

July 19 -

The credit characteristics of the collateral are broadly similar to the sponsor's inaugural deal, completed in February, but the capital structure has been tweaked.

July 19 -

Investors in hundreds of millions of dollars of bonds backed by private student debt could pay the price for shoddy paperwork and aggressive pursuit of troubled borrowers.

July 18 -

Citigroup and Deutsche Bank are marketing $931.6 million of commercial mortgage bonds with heavy exposure to three Manhattan skyscrapers.

July 18 -

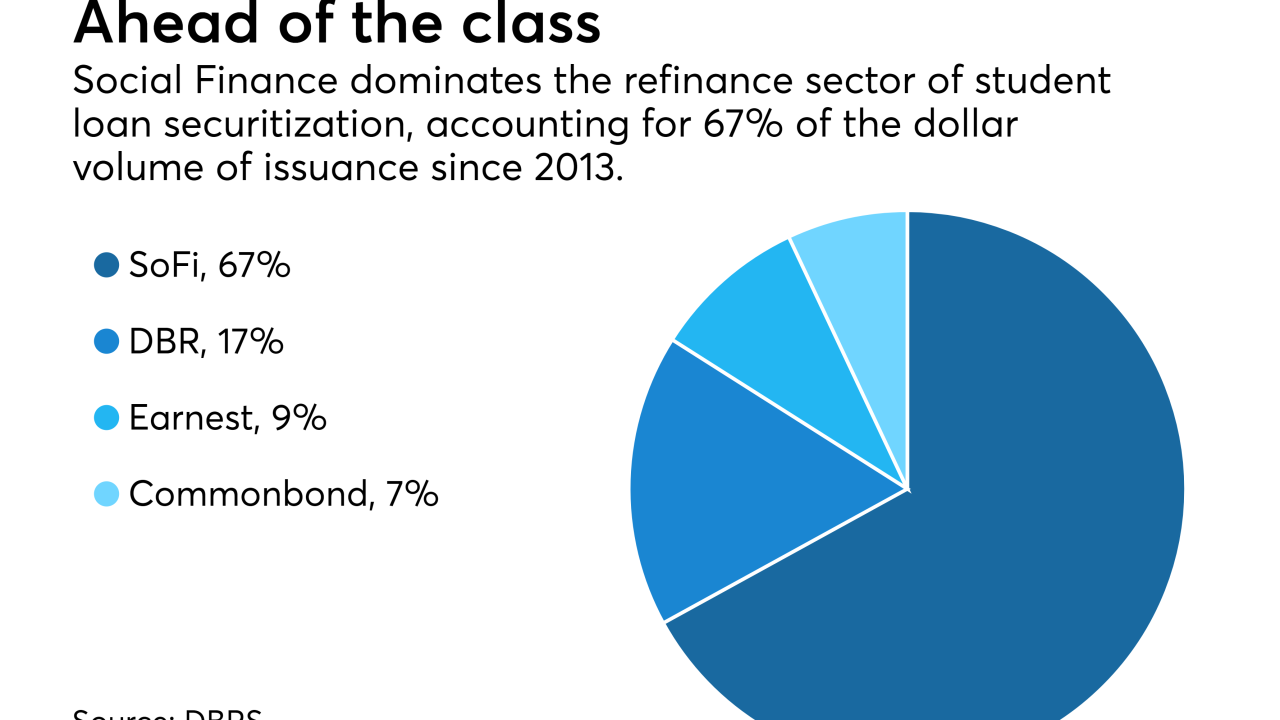

Navient and Social Finance are kicking off what’s expected to be a busy second half for student loan securitization with two deals totaling nearly $1.5 billion.

July 17 -

The collateral pool has a slightly higher percentage of new vehicles (24.53%) than the sponsor’s previous deal, and a shorter remaining weighted average term (62 months).

July 16 -

Property Assessed Clean Energy loans can no longer be offered in unincorporated areas of Kern County, Calif. The controversial loans, meant to promote energy efficiency, began in California and are now offered in a number of states.

July 12 -

A joint venture between Paramount Group and a wealthy New York family is tapping the commercial mortgage bond market to refinance a 52-story trophy office building in midtown Manhattan.

July 12 -

Chinese banks and insurance companies represent a new and potentially large source of capital that could crowd out U.S. banks as investors in collateralized loan obligations.

July 11 -

The two firms jointly obtained three separate loans totaling $706.7 million from Citigroup and Morgan Stanley on 52 retail properites with a combined 7 million square feet.

July 9 -

The collateral for the deal is heavily concentrated in the top three lessees, Quatar Airways, American Airlines, and Asiana; the deal permits the three to account for up to 65% of the portfolio.

July 6 -

The German automaker was compelled to shift funding to asset-backeds in the wak of an emissions cheating scandal; it has now resumed issuing unsecured debt

July 6