-

Investors in hundreds of millions of dollars of bonds backed by private student debt could pay the price for shoddy paperwork and aggressive pursuit of troubled borrowers.

July 18 -

Citigroup and Deutsche Bank are marketing $931.6 million of commercial mortgage bonds with heavy exposure to three Manhattan skyscrapers.

July 18 -

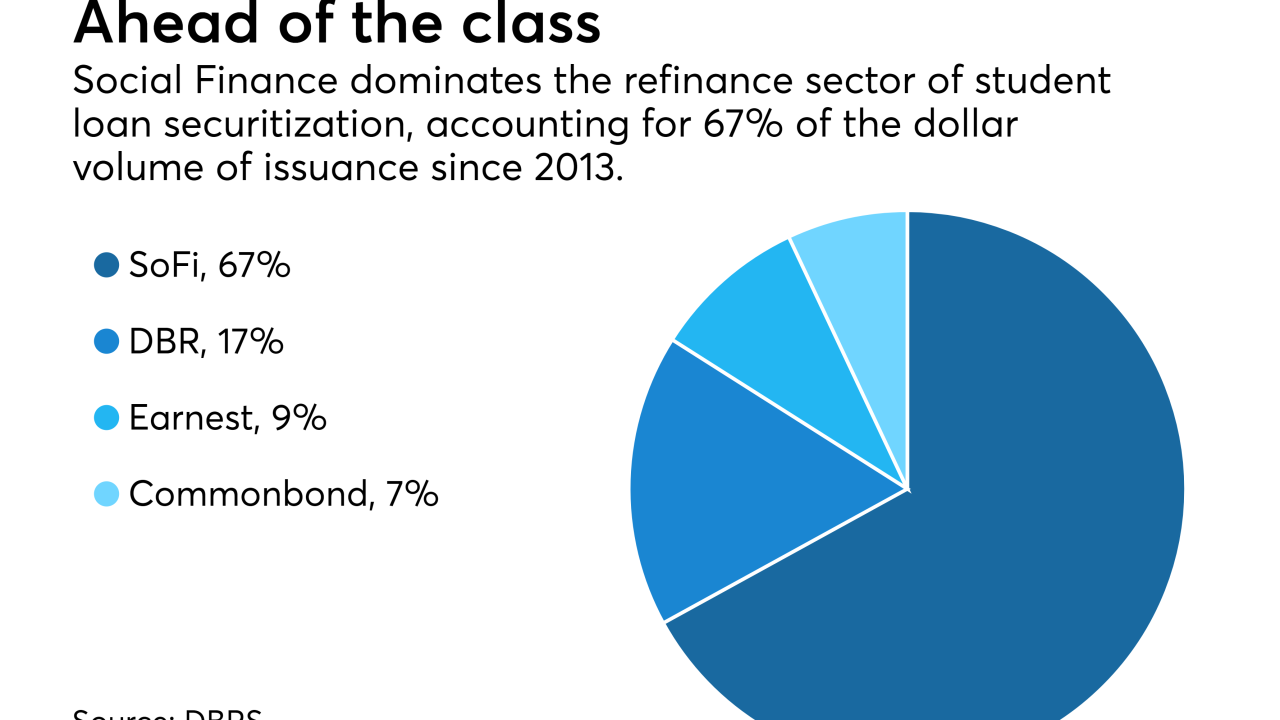

Navient and Social Finance are kicking off what’s expected to be a busy second half for student loan securitization with two deals totaling nearly $1.5 billion.

July 17 -

The collateral pool has a slightly higher percentage of new vehicles (24.53%) than the sponsor’s previous deal, and a shorter remaining weighted average term (62 months).

July 16 -

Property Assessed Clean Energy loans can no longer be offered in unincorporated areas of Kern County, Calif. The controversial loans, meant to promote energy efficiency, began in California and are now offered in a number of states.

July 12 -

A joint venture between Paramount Group and a wealthy New York family is tapping the commercial mortgage bond market to refinance a 52-story trophy office building in midtown Manhattan.

July 12 -

Chinese banks and insurance companies represent a new and potentially large source of capital that could crowd out U.S. banks as investors in collateralized loan obligations.

July 11 -

The two firms jointly obtained three separate loans totaling $706.7 million from Citigroup and Morgan Stanley on 52 retail properites with a combined 7 million square feet.

July 9 -

The collateral for the deal is heavily concentrated in the top three lessees, Quatar Airways, American Airlines, and Asiana; the deal permits the three to account for up to 65% of the portfolio.

July 6 -

The German automaker was compelled to shift funding to asset-backeds in the wak of an emissions cheating scandal; it has now resumed issuing unsecured debt

July 6 -

Towd Point Mortgage Trust 2017-3 is smaller the the sponsor's two previous deals of the year, but the credit quality of the collateral is remarkably similar.

July 4 -

It's the largest increase in five years; the percentage of securitized commercial mortgages behind on payments is now 5.75%, according to Trepp.

June 29 -

Angel Oak was able to secure triple-A credit ratings for its next offering of nonprime residential mortgage bonds, despite offering considerably less credit enhancement.

June 28 -

The Blackstone Group is tapping the commercial mortgage bond market to help finance the purchase of 11 multifamily properties from IMT Capital, according to Kroll Bond Rating Agency.

June 28 -

Lea Overby was formerly managing director, research; she replaces Charles Citro, who left the credit rating agency to pursue other opportunities.

June 28 -

Sponsoring securitizations of the loans funded on its platform will give LendingClub more control over its reputation in the market and make it less beholden to direct loan buyers.

June 26 -

The transaction is backed by apartment properties, hotels and office buildings in a state of transition.

June 26 -

Investors had better hope it does; the spectrum rights backing the notes would be less valuable to a combined Sprint and T-Mobile, decreasing recovery in the event of default.

June 21 -

The marketplace lender had to offer higher investor protections on a consumer loan securitization than rival Upstart, but it also achieved a lower funding cost

June 20 -

The office market in Arlington, Virginia has taken a big hit from cutbacks at the Department of Defense, but Goldman Sachs is making a sizable bet on a comeback.

June 19