Castlelake, a lessor that specializes in acquiring aircraft midway through their useful life, is making its annual trip to the securitization market.

There are a number of risks associated with older aircraft, including limited re-leasing prospects, technological obsolescence and higher maintenance costs.

However, one of the biggest concerns Kroll Bond Rating Agency has with the latest deal, Castlelake Aircraft Structured Trust 2017-1, is the concentration of the portfolio in the three top lessees, Quatar Airways (19% of the portfolio), American Airlines (14.5%), and Asiana (13%). Together, they represent nearly half (46.5%) of the portfolio.

While that’s similar to the initial percentage of Castlelake’s previous securitization, completed in 2016, it’s possible the concentration of the top three lessees in the latest deal could reach 65%. That’s higher than a majority of recent aircraft securitizations.

In its presale report, Kroll said that this risk is “somewhat mitigated” by the credit worthiness of the initial lessees, though it’s difficult to predict the migration of the portfolio’s three largest lessees over time.

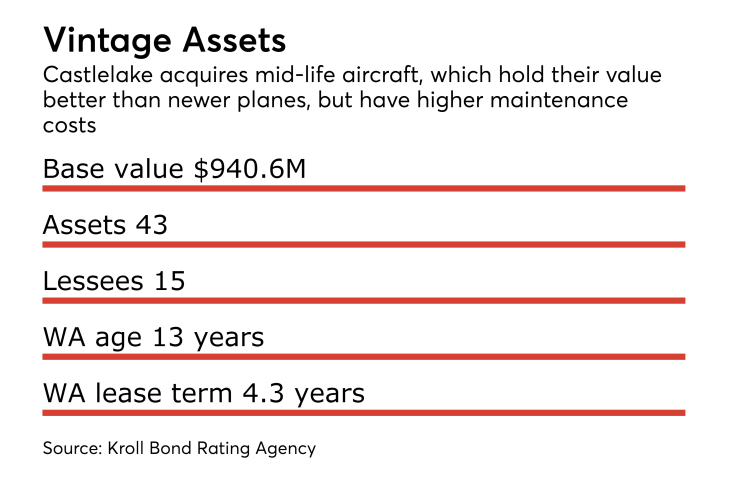

Castlelake typically acquires aircraft only after their initial values have depreciated significantly, thereby providing an attractive entry point for its investments. With an initial weighted average age of 13 years, and a remaining lease term of approximately 4.3 years, the portfolio is similar to the portfolios of other recent mid-life aircraft securitizations.

The transaction has a number of features designed to address risks associated with older aircraft Castlelake is borrowing less against the value of the planes than do lessors of newer aircraft. The portfolio being securitized has an initial value of approximately $940.7 million (based on the average of the half-life base values provided by three appraisers and adjusted for maintenance conditions) they will secure three tranches of fixed-rate loans totaling $785.5 million.

A senior, $616 million tranche with an expected life of 12 years is provisionally rated A by Kroll, on par with the senior tranche of Castlelake's 2016 deal. Likewise, a subordinate, 12-year tranche carries the same BBB rating as the comparable tranche of the previous deal. However, the seven-year tranche is rated B-, one notch lower than the comparable tranche of the 2016 transaction.

These loans amortize faster than loans backed by newer planes, providing additional protection to investors from technological obsolescence and limited re-leasing prospects. In addition, the transaction also contains cash sweep mechanisms and performance triggers.

Deutsche Bank and Citigroup are the joint structuring agents.

The aircraft being securitized represent approximately 16.8% (by number of aircraft) of Castlelake’s managed leased fleet, including aircraft committed to be purchased.