-

The residential mortgages being reinsured are less risky, by several measures, than its previous deal; none of the borrowers have ever missed a payment.

April 11 -

Losses on Conn’s consumer loans are stabilizing, and the electronics and appliance store chain sees an opportunity to reduce the level of credit enhancement for its latest securitization.

April 11 -

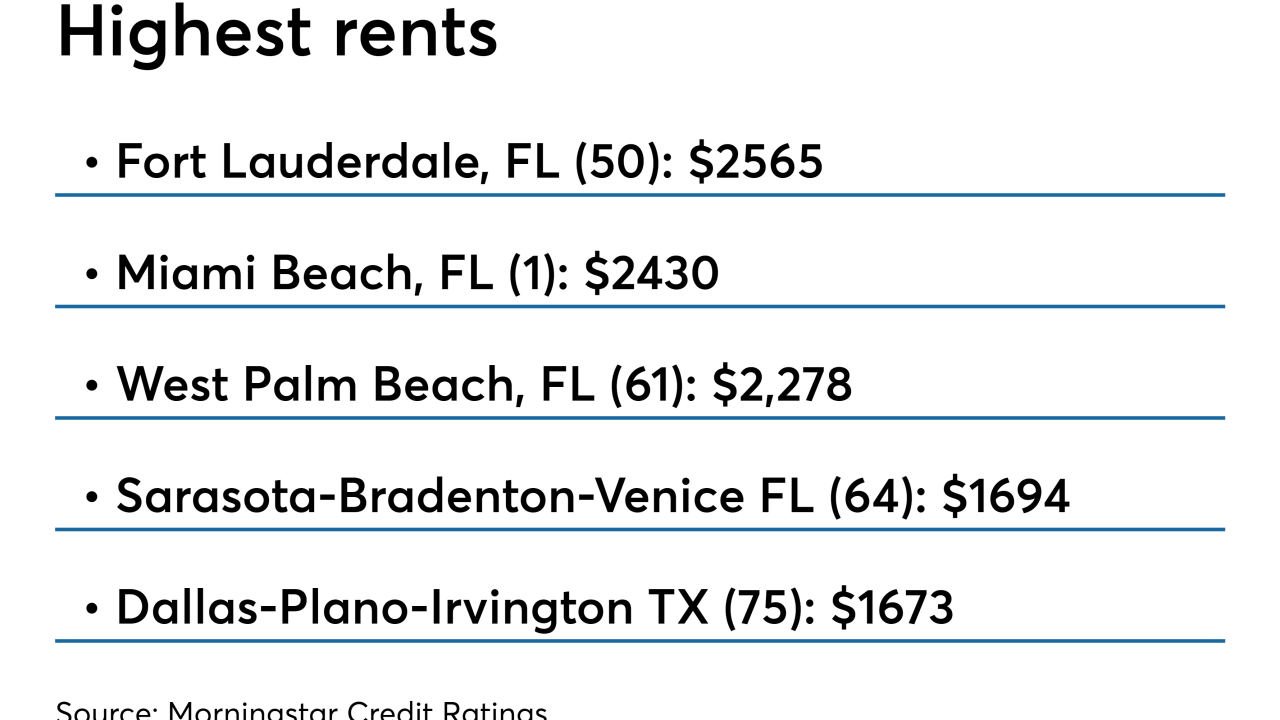

The $746.2 million PFP 2019-1's biggest exposure by property type is to multifamily, but the single largest asset is a $71 million portion of a mortgage on a Dallas office building.

April 10 -

The $479 million Progress Residential 2019-SFR2 Trust is backed by 2,459 single-family residences, 2,452 of which were previously securitized in Progress 2016-SFR2.

April 9 -

The senior notes to be issued in the $867 million transaction also amortize more quickly, reducing investor exposure to a potential decline in the valuation of the assets.

April 8 -

The $687 million XAN 2019-RSO7 has 36 months to fund additional lending against properties in the collateral pool, six months longer than a 2018 transaction.

April 5 -

This time, investors required Radian to hold on to the first 2.5% of losses it covers on the pool; by comparison, the insurer’s previous deal, Eagle Re 2018-1, had a lower “attachment” point of 2.25%.

April 3 -

A joint venture between the New York firm, Migdal Insurance and the Arden Group obtained a $311 million mortgage on 1735 Market Street from Deutsche Bank and Goldman Sachs.

April 2 -

The Structured Finance Industry Group wants Treasury and the IRS to issue a notice that a change from Libor to an alternative index would not be treated as a taxable exchange.

March 31 -

After spinning off its infrastructure-related businesses in November, it is more focused on rail manufacturing and leasing; the new deal is backed by 7% of its fleet.

March 27 -

While reinsurers are becoming more comfortable with the risk it is offloading, the GSE wants to maintain control of the workout process for loans that go bad.

March 27 -

Depending on market conditions and demand from whole loan buyers, it could fund 25% to 35% of fix-and-flip loans through deals like the $219 million one it just completed.

March 26 -

Origination is on the rise, but the Los Gatos, California company likes having the flexibility to come to market frequently with smaller deals.

March 26 -

At $230 million, GSMBST 2019-PJ1 is notably smaller than recent transactions from JPMorgan and Redwood Trust; borrowers also have less equity in their homes.

March 25 -

The €249 million Taurus 019-1 FR is backed by a single loan from Bank of America on a portfolio of 206 mixed-use properties leased to French electric utility EDF.

March 21 -

Many of the credit characteristics of Verus 2019-INV1 are similar to those of the deal Invictus completed in December, but the loans are less geographically concentrated.

March 21 -

Unusually, all of the loans in the $374 million transaction were purchased from a single originator, Impac Mortgage.

March 20 -

The loans in CIM Trust 2019-INV1 are conventional mortgages made to investors either for business purposes (85.6%) or cash-out refinancing for personal use (14.4%), according to DBRS.

March 19 -

Retail Value Inc, which was spun off from SITE Centers last year obtained a $900 million mortgage from three banks on the 25 assets in 14 states and Puerto Rico

March 18 -

The deal gives ELAD, part of Israel's Tshuva Group of companies, its first industrial assets in U.S.; the 48 properties are located across eight states and 10 different markets.

March 18