ELAD Group, a New York-based developer of luxury residential property, is tapping the U.S. commercial mortgage bond market to help finance its acquisition of Canada’s Agellan commercial REIT.

In November, ELAD, part of the Israel’s Tshuva Group, entered into an agreement to take Agellan private for or C$14.25 ($10.69) a unit; a deal that values the Canadian REIT at C$680 million ($510.14 million), including debt. The acquisition gives ELAD its first industrial assets in the U.S.

ELAD subsequently obtained $403.4 million of debt from Morgan Stanley on a portfolio of 42 properties, 38 industrial and four offices, totaling 5,746,649 square feet: a $321 million first mortgage and two mezzanine loans of $41.2 million each, according to DBRS. (Either of the mezzanine loans can be prepaid in whole or in part without a corresponding pro rata prepayment of the mortgage or other mezzanine loan.)

The first mortgage is being used as collateral for an offering of mortgage bonds called Morgan Stanley Capital I Trust 2019-AGLN.

Based on the sponsor’s acquisition cost of the collateral properties (excluding non-collateral minority interests in other properties), there is $119.6 million of equity behind the total financing package, according to DBRS.

The rating agency expects to assign an AAA to the senior tranche, which benefits from 58.349% subordination.

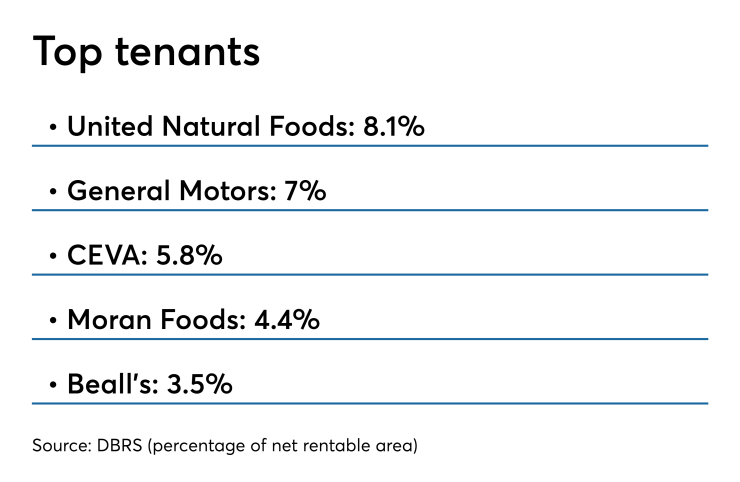

Among the strengths of the deal, the portfolio is currently 96.5% leased to over 250 tenants. Tenant industries include grocery, health care, business services, biotech, manufacturing, insurance and retail, among others. The largest tenants are United Natural Foods Inc. (8.1% of net rentable area), General Motors (7.0% of NRA) and CEVA (5.8% of NRA). No other tenant occupies more than 50% of total portfolio individually.

The properties are located across eight states and 10 different markets. They were built from 1979 to 2006; industrial properties have an average year built of 1990, and office properties have an average year built of 2002.

The largest concentration by state is Texas with 45.3% of aggregate appraised value, followed by Illinois with 18.5%, Florida with 12.3% and Georgia with 11.4%. The remaining four states comprise no more than 7.6% of the net rentable area.

The largest property by value is Naperville Woods Office Center, an office property in Naperville, Illinois, which accounts for 12.7% of the total portfolio appraised value of $472.5 million. Only four additional properties account for more than 5% of aggregate appraised value. Since 2013, the portfolio has had a strong average occupancy rate of 94.0%.

The U.S. industrial market is coming off another strong year in which demand outpaced new construction, pushing vacancy lower in most markets. In fact, Cushman & Wakefield reported that 2018 was the fifth consecutive year in which absorption topped 204 million square feet. This growth, however, comes with an ever-increasing pace of new construction and, especially, speculative construction. Of the 275.9 million square feet of active construction, 191.9 million square feet is speculative. "This could slow rent growth and result in an uptick in vacancy in some areas," the presale report states.

DBRS puts the loan-to-value ratio on the entire debt load of $403.4 million "very high," at 125.1%; this is based on the rating agency's adjusted appraisal ($322.4 million) and cap rate ($8.94). The LTV based solely on the debt held in the securitization trust is still "high" at 99.6%. Despite the high mortgage leverage, however, DBRS considers the risk that the borrower will default during the life of the loan to be "modest," given its calculation of the debt service coverage ratio of 1.77x.