Colony Capital, the investment firm run by Tom Barrack, is tapping the European commercial mortgage bond market as part of an effort to unload a portfolio of 206 industrial properties in France.

Over the next several years, Colony hopes to improve and then sell the buildings, which compromise 417,202 square meters and are leased primarily to Électricité de France, an electric utility largely owned by the government, and ENEDIS, a wholly owned subsidiary. In the meantime, the investment firm has obtained a €249.6 million first-lien mortgage from Bank of America Merrill Lynch International. There is a €53.3 million existing mezzanine loan in place secured by the shares and the partnership interests in the corporate entities that control the individual properties.

The first mortgage, which pays a floating rate of 2% over Euribor (subject to a floor of zero) and has a five-year term, is being used as collateral for an offering of mortgage bonds called Taurus 2019-1 FR DAC. Five classes of rated notes (A, B, C, D and E) will be issued in the transaction; Bank of America will retain a sixth, unrated tranche in order to comply with risk retention requirements. Kroll Bond Rating Agency expects to assign an AAA to the Class A notes.

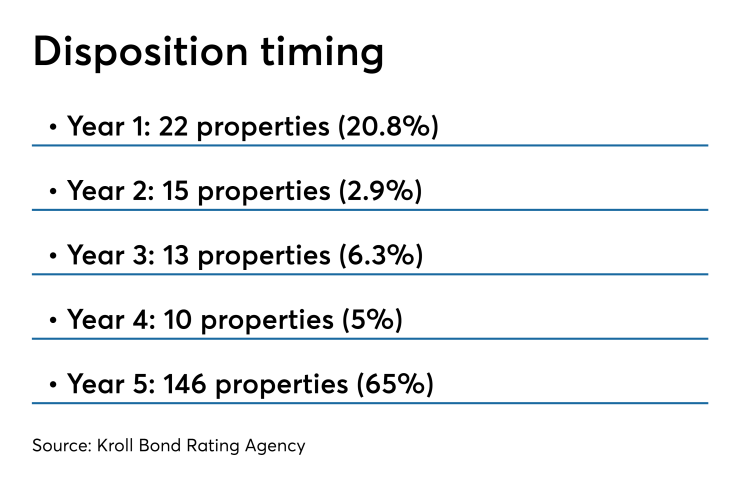

The loan does not require scheduled repayment of principal during the first three years of its term. However, Colony is expected to repay principal during this period as it sells assets. If the senior loan is not paid down to €234.8 million after the first year, €222.5 million in the second year, and €205.1 million in third year, excess cash from net operating income from the properties (after paying interest on the loan) will be used to repay principal on the senior loan. In addition, the loan is scheduled to amortize by 1% of the outstanding senior loan and mezzanine loan balance (both applied to the senior loan) in the fourth and fifth years of its term. The senior loan would amortize down by 5.9%, 10.9%, and 17.8% of the original loan amount in the first, second and third year, respectively, if the target principal payments are made.

The transaction includes €12 million a liquidity facility, representing 4.8% of the senior loan that will be available to cover property protection (taxes, insurance, etc.); certain securitization fees and expenses; and interest shortfalls to the Class A, B, and C notes, in certain circumstances.

Unlike many other securitizations of large loans to a single borrower, which are highly geographically concentrated, the properties backing Taurus 2019-1 FR DAC are spread across 167 cities and 11 regions across France, per Kroll. Additionally, none of the properties individually account for more than 2.6% of the pool aside from the two largest properties, which account for 11.2% and 10.4%, respectively. The properties are generally located in urban or densely developed suburban areas.

And, while EDF and ENEDIS, which lease 89% of the portfolio, are not rated, Kroll believes that the two companies have credit characteristics “consistent with a high investment grade rating.” During the loan term, Colony will spend some €34 million (€123 per square meter) on upgrades and tenant incentives to secure lease extensions.

Constructa Asset Management, a family-owned real estate company based in France, is the property and asset manager. Situs Asset Management is the servicer and the special servicer

Kroll considers the deal to have “moderate” leverage; it calculates the loan-to-value ratio, based on the first mortgage held in the securitization trust, to be 91.3%. Based on the appraised value, the LTV is lower, at 65%. That’s relatively in line with 13 European CMBS transactions in 2018, which had average LTVs of 64.7%.

There are some idiosyncratic risks to the deal, however. Among them, Bank of America will grant an English law-governed security interest over the senior loan (which is governed by French law) and its related security (which is governed by French and Luxembourg law). “There is uncertainty as to the validity and effectiveness of an English security interest over French assets,” the presale report states.