-

Just over half of the collateral for the $883 million deal is eligible to be purchased by Fannie or Freddie; the bank itself contributed nearly half.

December 12 -

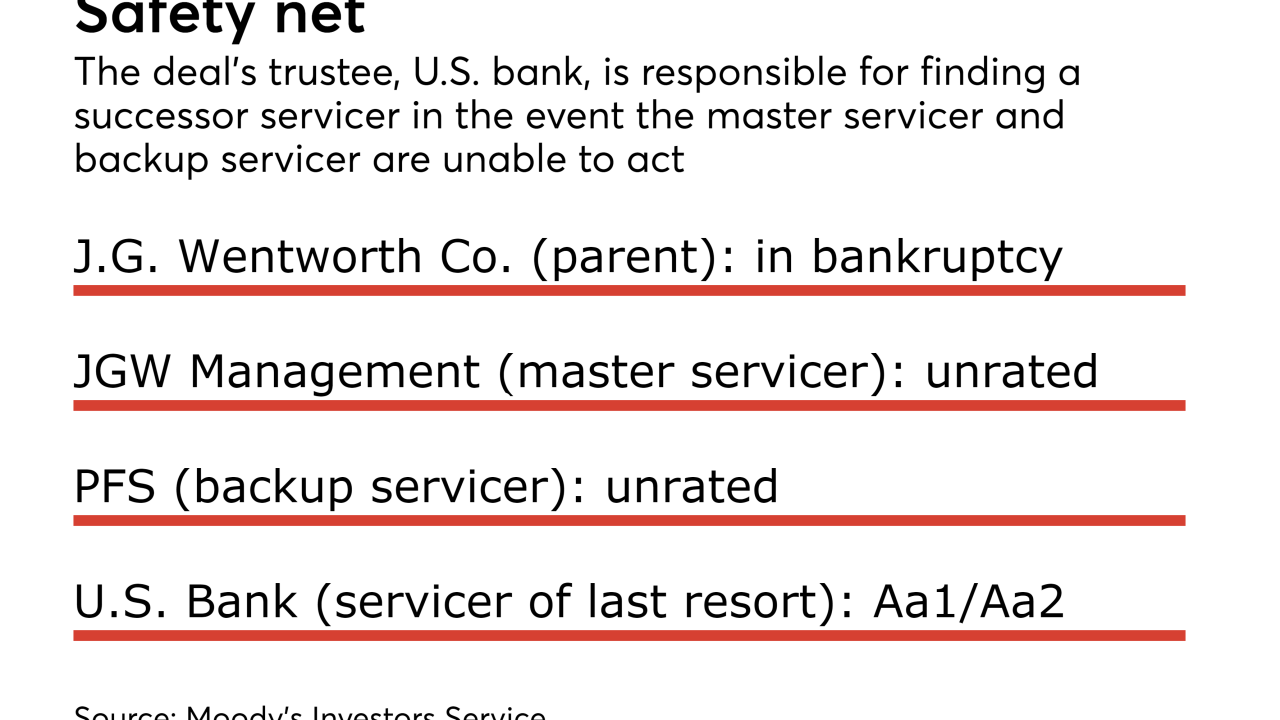

A prepackaged restructuring will not disrupt servicing of the company's assets-backeds because the servicing subsidiary is not part of the filing.

December 11 -

HUD's decision to stop endorsing Property Assessed Clean Energy will have little impact; the widest segment of FHA borrowers "would not qualify anyway."

By Glen FestDecember 11 -

ReliaMax is an unusual kind of marketplace lender that says it can help regional and community banks take advantage of business opportunities in private student lending.

December 11 -

Securitization of nonperforming home equity conversion loans was pioneered by Nationstar; FAC's inaugural deal may be outstanding longer.

December 7 -

Roughly 52% of the properties backing Tricon American Homes 2017-SFR2 were obtained through the May acquisition; 19.4% were previously securitized by Silver Bay.

December 7 -

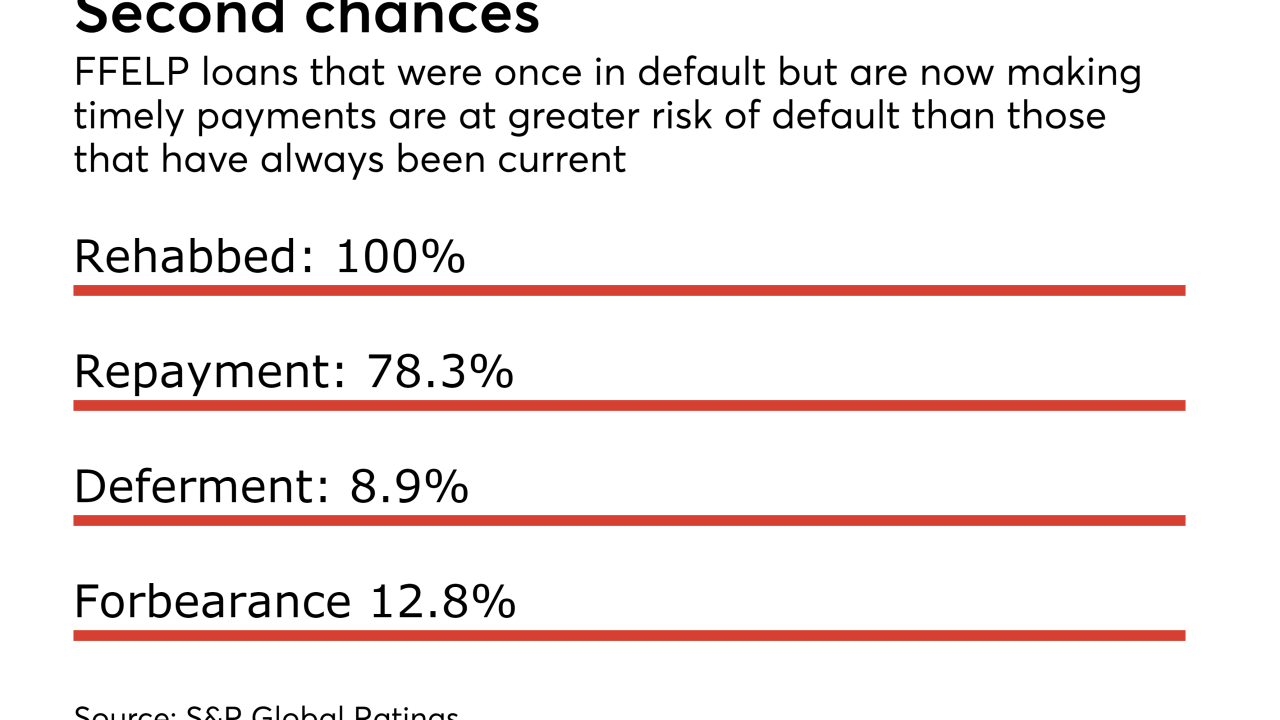

By comparison, rehabilitated loans accounted for just 19.5% of the collateral for the servicer’s July offering and 10% of its May offering.

December 6 -

The deal, BXMT 2017-FL1 weighs in at $1 billion, making it more than twice as large as most CRE-CLOs issued this year; its size isn't the only unusual feature, however.

December 5 -

The Trepp CMBS delinquency rate is now 5.18%, a decrease of three basis points from the October level; declines were limited to the industrial, multifamily and office subindexes.

December 5 -

The $160 million cell tower deal is the first since T-Mobile and Sprint abandoned merger talks that could have reduced lease renewals.

December 5 -

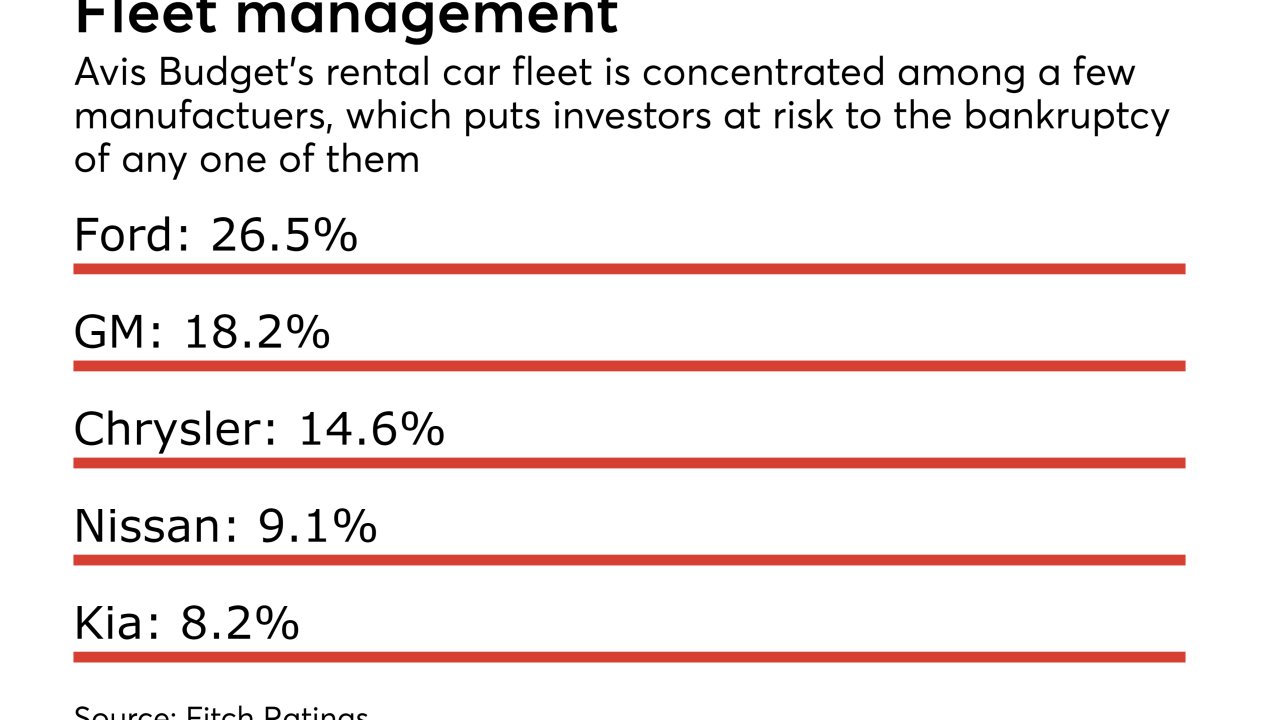

The issuer, Avis Budget Rental Car Funding, is a master trust, and the $400 million of notes to be issued in the Series 2017-2 transaction rank pari passu with the issuer’s other outstanding series of notes.

December 1 -

Keith Krasney joins this week from Locke Lord, where he chaired the securitization group. He advises clients on secondary market transactions involving mortgage loans.

December 1 -

Introducing limits on federally guaranteed loans to graduate students, instead of letting them borrow whatever schools charge, would create a multibillion-dollar opportunity for private lenders.

November 30 -

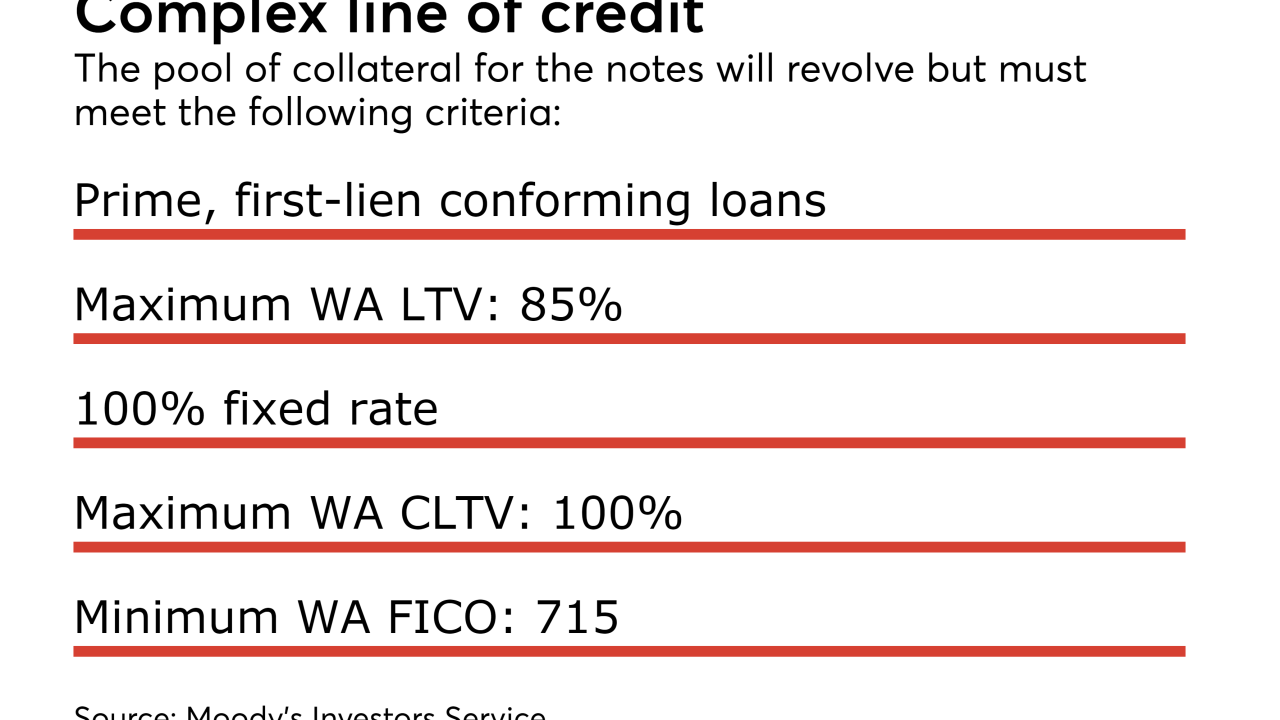

The deal is similar to several sponsored by Jefferies that used the same moniker, Station Place, but were backed by revolving pools of mortgages originated by multiple lenders.

November 30 -

This time it’s the JW Marriott Phoenix Desert Ridge Resort & Spa, a 950-room, full-service resort. A $365 million first mortgage on the property from Morgan Stanley is being securitized via MSC 2017-JWDR.

November 28 -

A $40 million slice of the original, $600 million mortgage on the 2 million-square-foot portfolio is one of the largest of 38 loans used as collateral in UBS 2017-C6, a $684.7 million conduit.

November 28 -

The Show Me State passed legislation enabling residential and commercial PACE financing in 2010; however, Renovate America only started funding assessments through the Missouri Clean Energy District three months ago, in August 2017.

November 27 -

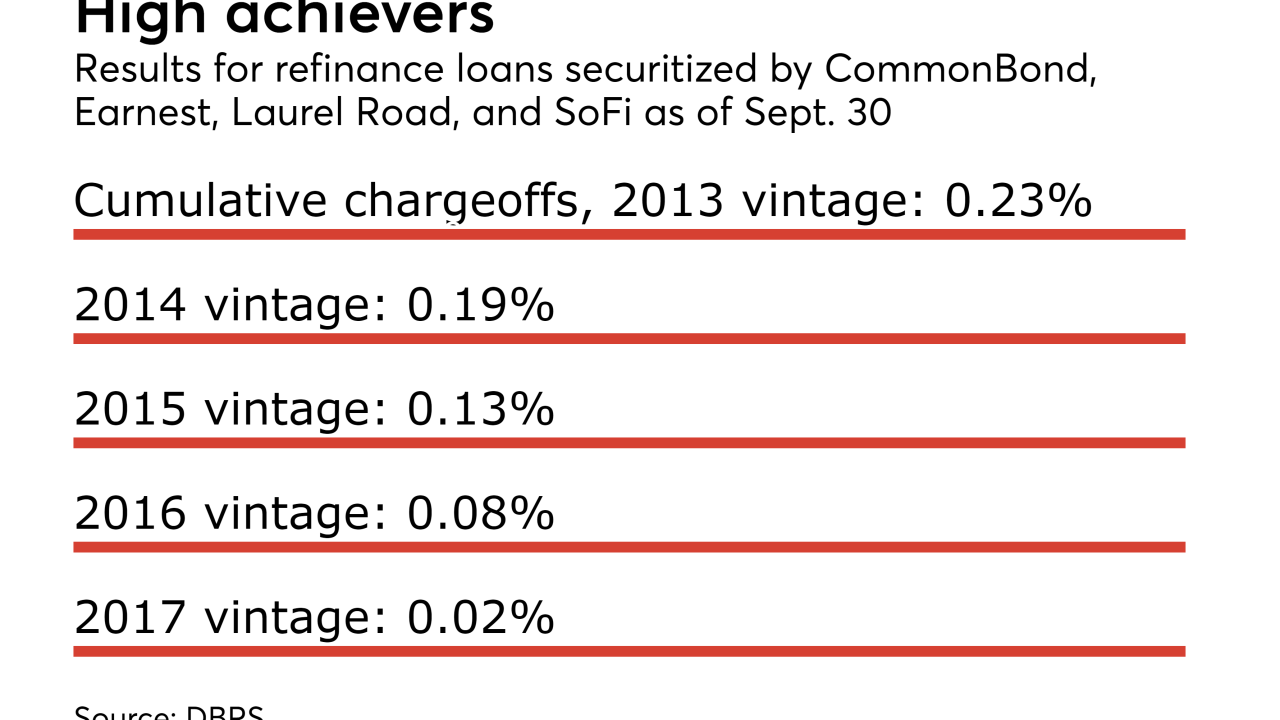

For now, performance continues to improve, but the percentage of borrowers of traditional private student loans seeking temporary payment relief rose to 2.5% from 2.0% as a result of Hurricanes Harvey and Irma.

November 22 -

The senior tranche of Angel Oak 2017-3 benefits from 46.25% credit enhancement, up significantly from 37.75% for the sponsor’s July transaction, but in line with its April deal.

November 21 -

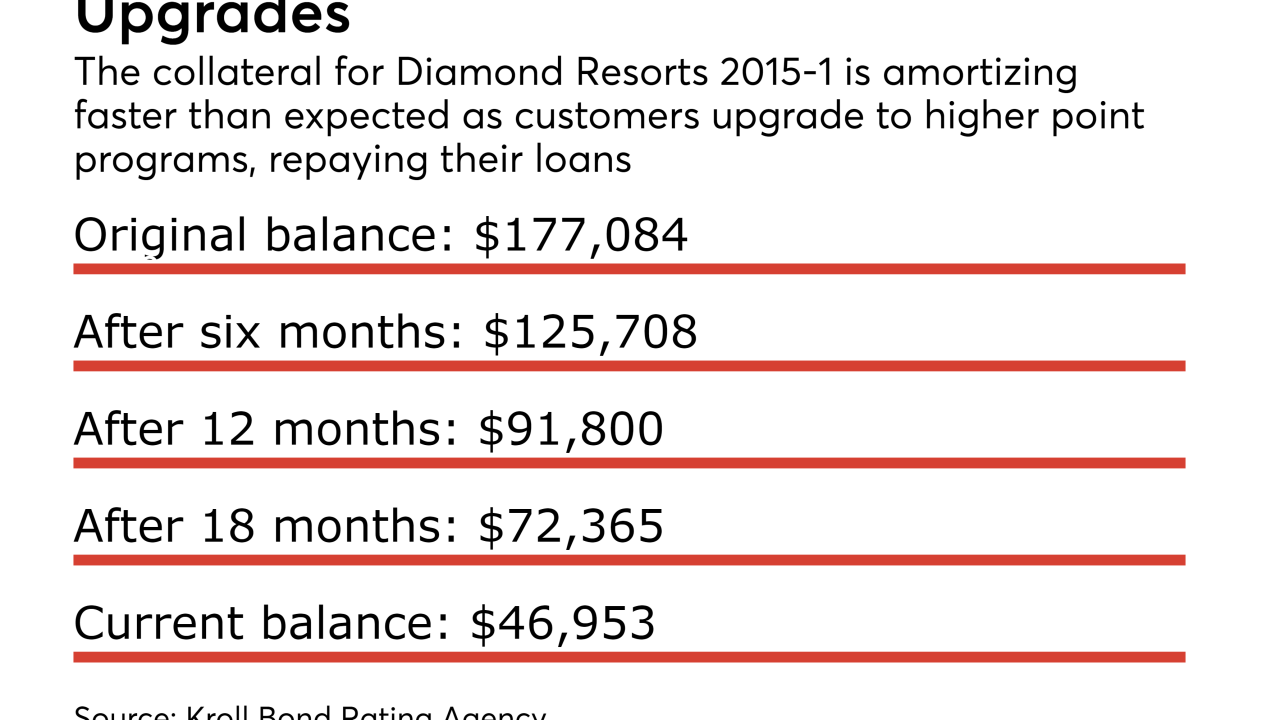

The move convinced Kroll Bond Rating Agency to upgrade $95 million of securities, some of which had been under review for a possible downgrade for over a year; Kroll affirmed the ratings of another $63 million of bonds.

November 20