Nationstar is getting some competition in a fairly obscure corner of the housing finance market — securitizing nonperforming reverse mortgages. Finance of America, a reverse mortgage lender, is throwing its hat in the ring.

Reverse mortgages are loans issued to borrowers 62 or older to convert a portion of their home equity into cash. All are insured by the Federal Housing Administration and securitized by Ginnie Mae. When these loans default (because the borrower no longer occupies the property, fails to make agreed-upon repairs, or fails to pay taxes or insurance), Ginnie Mae repurchases them from collateral pools and sells them.

To date, Nationstar, a mortgage servicing giant, has to date completed at least eight transactions of nonperforming reverse mortgages it has acquired from Ginnie Mae. The notes issued in reverse mortgage securitizations are repaid from the sale or repossessed homes.

Finance of America’s inaugural deal, Structured Securities Trust 2017-HB1, is backed by 2,306 mortgages and repossessed homes with a balance of $419 million. All were originated by Finance of America.

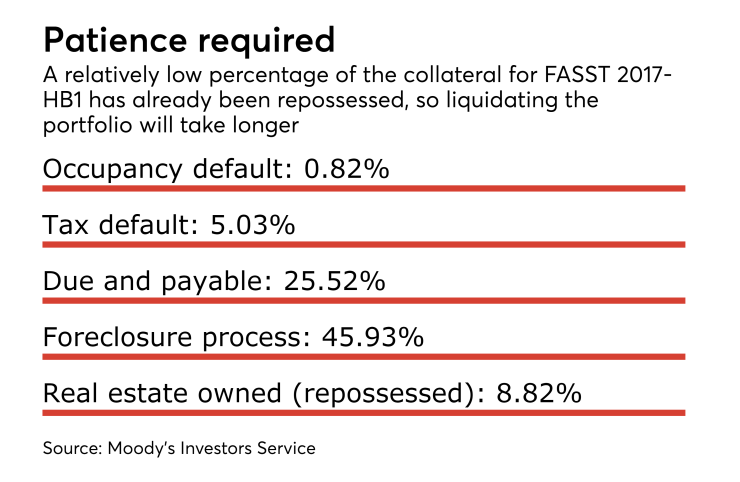

Compared with Nationstar’s transactions, investors in Finance of America’s deal may have to wait a lot longer to be repaid, according to Moody’s Investors Service, which is rating the deal. That’s because a lower percentage of the collateral is comprised of homes that have already been repossessed. This “suggests that a smaller percentage of assets will be liquidated shortly after closing compared to previous deals and therefore the weighted average life may be longer,” the ratings agency stated in its presale report.

Also, 12.2% of the mortgage assets (by unpaid principal balance) are backed by properties that may have been affected by Hurricane Maria in Puerto Rico. Another 8.2% are backed by properties in areas that have been affected by Hurricane Harvey or Hurricane Irma. All of these properties could take longer to liquidate.

On a positive note, a high concentration of the properties ultimately backing Finance of America’s deal, 55.2%, are in nonjudicial states, which have shorter foreclosure timelines: 11.79% are located in Texas and 10.07% are backed by properties in California. So while there are more properties in the transaction that have yet to be foreclosed on, it may not take as long to liquidate those in nonjudicial foreclosure states.

FASST 2017-HB1 also has low weighted average loan-to-value ratio compared to some of Nationstar’s nonperforming reverse mortgage transactions. This suggests that relatively few loans in the pool will suffer losses due to their insurance claims being capped by the FHA, Moody’s says.

However, the ratings agency also alerted potential investors that Finance of America, which oversees the servicing of the transaction is unrated, and that there is no backup servicer in place. It could take time and money for the trustee to find a new one in the event that Finance of America is terminated.

Also, RMS, which will subservice 49.3% of the mortgage assets on behalf of Finance of American, is a subsidiary of Walter Investment Management Corp., which has filed for bankruptcy. RMS is expected to remain out of the Chapter 11 filing, however.

To mitigate the risk, FAR has engaged Celink as a backup subservicer for RMS and Celink will assume RMS’s subservicing duties should RMS fail to perform its obligations under its subservicing agreement.