-

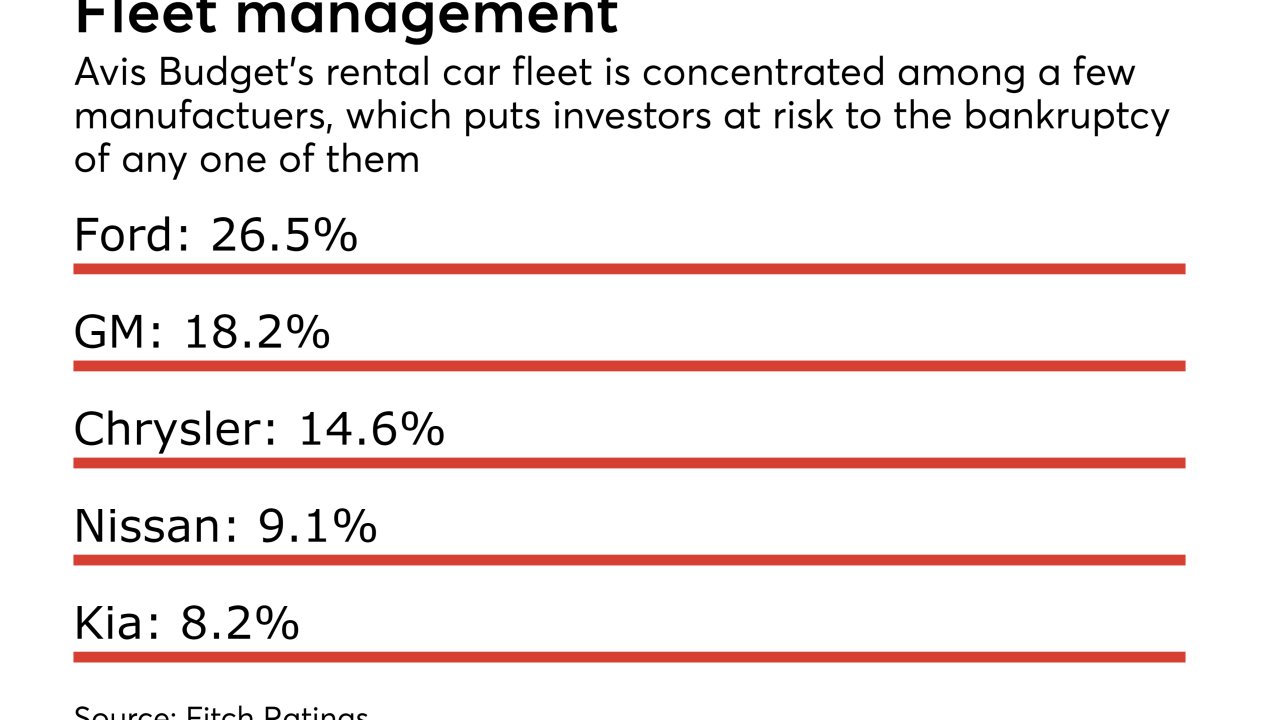

The issuer, Avis Budget Rental Car Funding, is a master trust, and the $400 million of notes to be issued in the Series 2017-2 transaction rank pari passu with the issuer’s other outstanding series of notes.

December 1 -

Keith Krasney joins this week from Locke Lord, where he chaired the securitization group. He advises clients on secondary market transactions involving mortgage loans.

December 1 -

Introducing limits on federally guaranteed loans to graduate students, instead of letting them borrow whatever schools charge, would create a multibillion-dollar opportunity for private lenders.

November 30 -

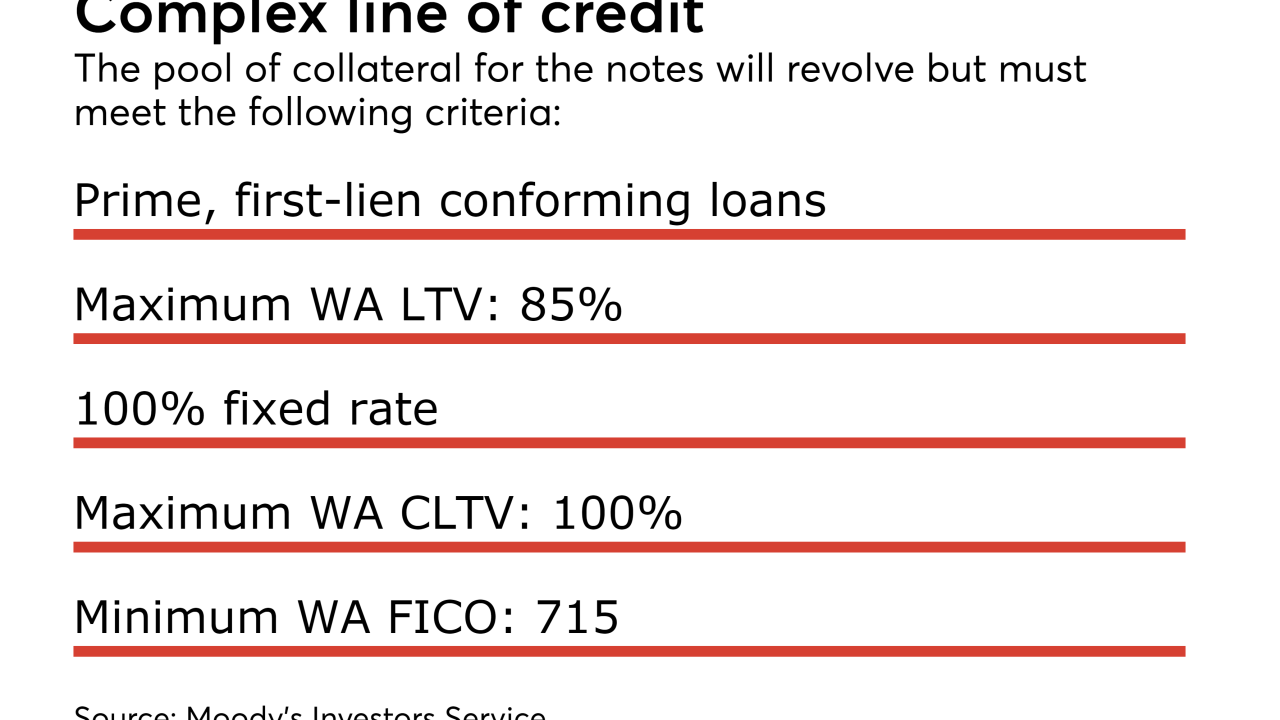

The deal is similar to several sponsored by Jefferies that used the same moniker, Station Place, but were backed by revolving pools of mortgages originated by multiple lenders.

November 30 -

This time it’s the JW Marriott Phoenix Desert Ridge Resort & Spa, a 950-room, full-service resort. A $365 million first mortgage on the property from Morgan Stanley is being securitized via MSC 2017-JWDR.

November 28 -

A $40 million slice of the original, $600 million mortgage on the 2 million-square-foot portfolio is one of the largest of 38 loans used as collateral in UBS 2017-C6, a $684.7 million conduit.

November 28 -

The Show Me State passed legislation enabling residential and commercial PACE financing in 2010; however, Renovate America only started funding assessments through the Missouri Clean Energy District three months ago, in August 2017.

November 27 -

For now, performance continues to improve, but the percentage of borrowers of traditional private student loans seeking temporary payment relief rose to 2.5% from 2.0% as a result of Hurricanes Harvey and Irma.

November 22 -

The senior tranche of Angel Oak 2017-3 benefits from 46.25% credit enhancement, up significantly from 37.75% for the sponsor’s July transaction, but in line with its April deal.

November 21 -

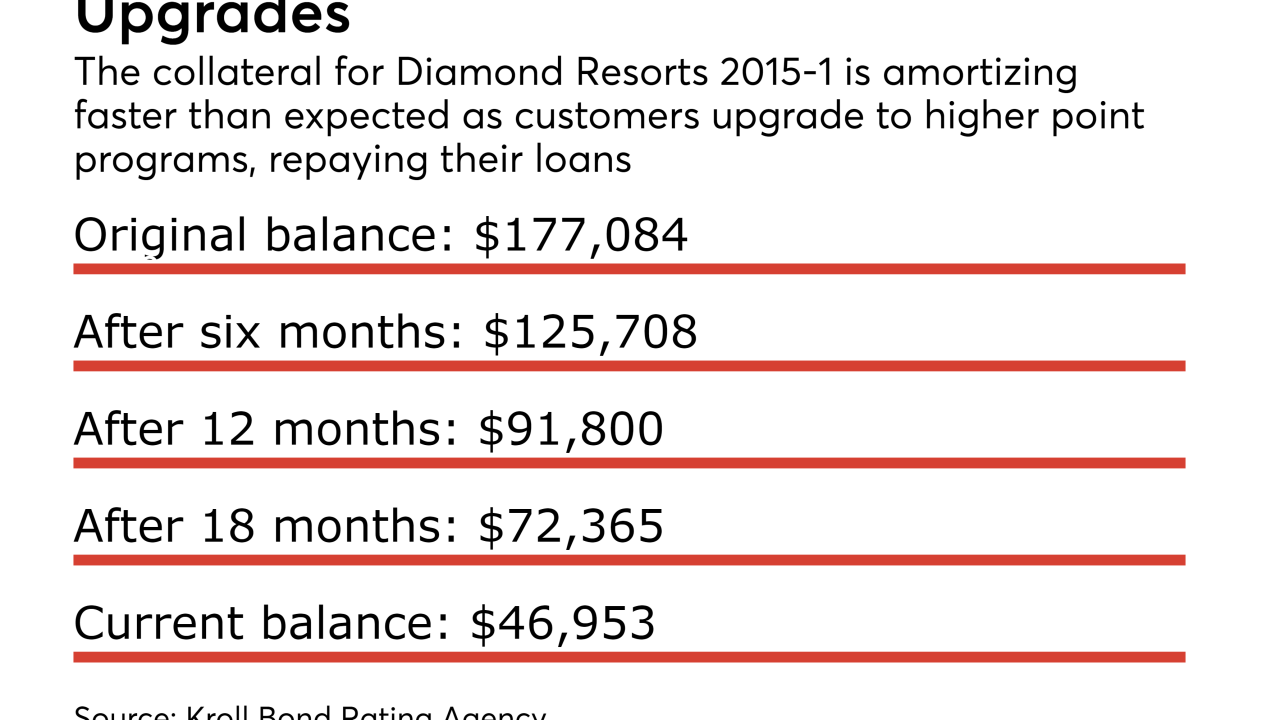

The move convinced Kroll Bond Rating Agency to upgrade $95 million of securities, some of which had been under review for a possible downgrade for over a year; Kroll affirmed the ratings of another $63 million of bonds.

November 20 -

The jump is from a very low base; absolutely delinquency rates on mortgages referenced in GSE credit risk transfer deals are still likely to remain under 1% and much of the effect is likely to be temporary.

November 17 -

The properties have a total of 1,228 rooms, or "keys" located across four major U.S. cities: San Francisco (346 keys; 39.4% of allocated loan amount), Chicago (429 keys; 26.4%), Boston (178 keys; 18.2%) and Philadelphia (275 keys; 16%).

November 16 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

The private equity firm obtained a $540 million loan on the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes, which are situated on 500 acres at the headwaters of the Everglades, from Barclays and Wells Fargo.

November 15 -

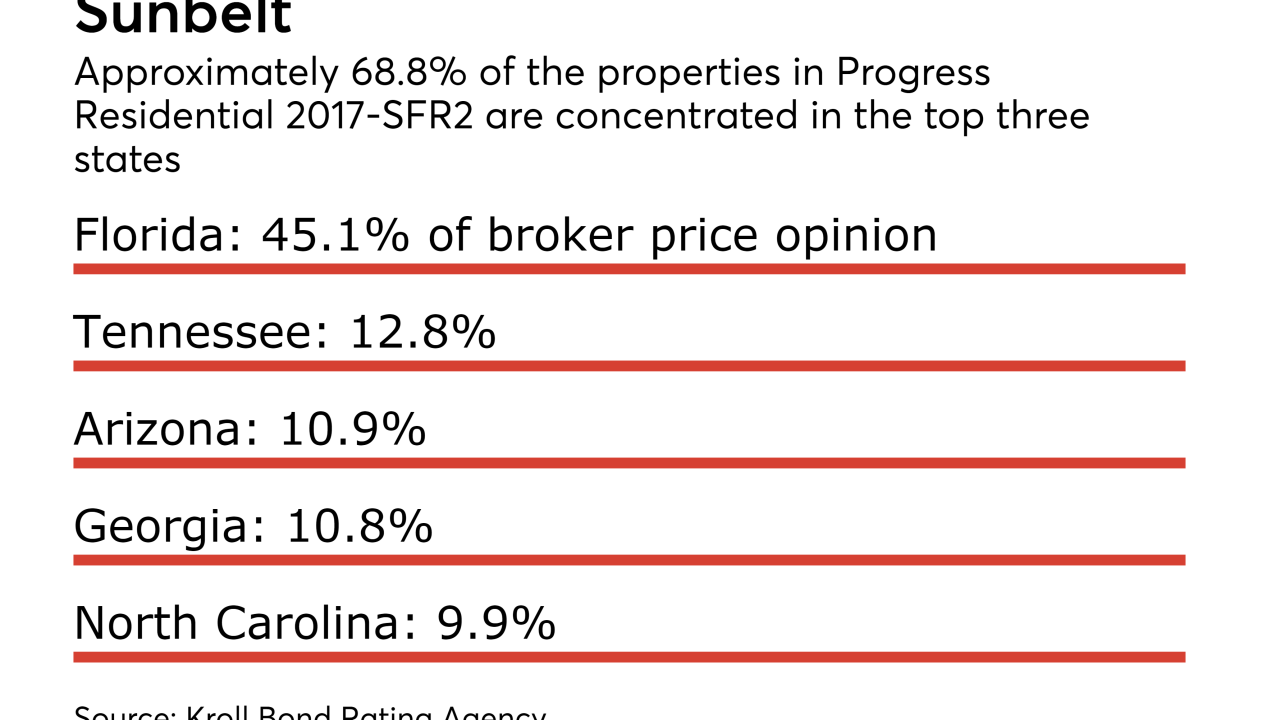

A total of 191 properties, or 11.4% of the 1,598 in the pool, were previously securitized in transactions completed in 2014 and 2015 and repaid using a portion of the proceeds from a 2016 transaction.

November 14 -

Both transactions are backed primarily by narrowbody aircraft; WorldStar's finances a third of its fleet; Aergen is refinancing its entire fleet and obtaining $100 million of delayed draw funding.

November 10 -

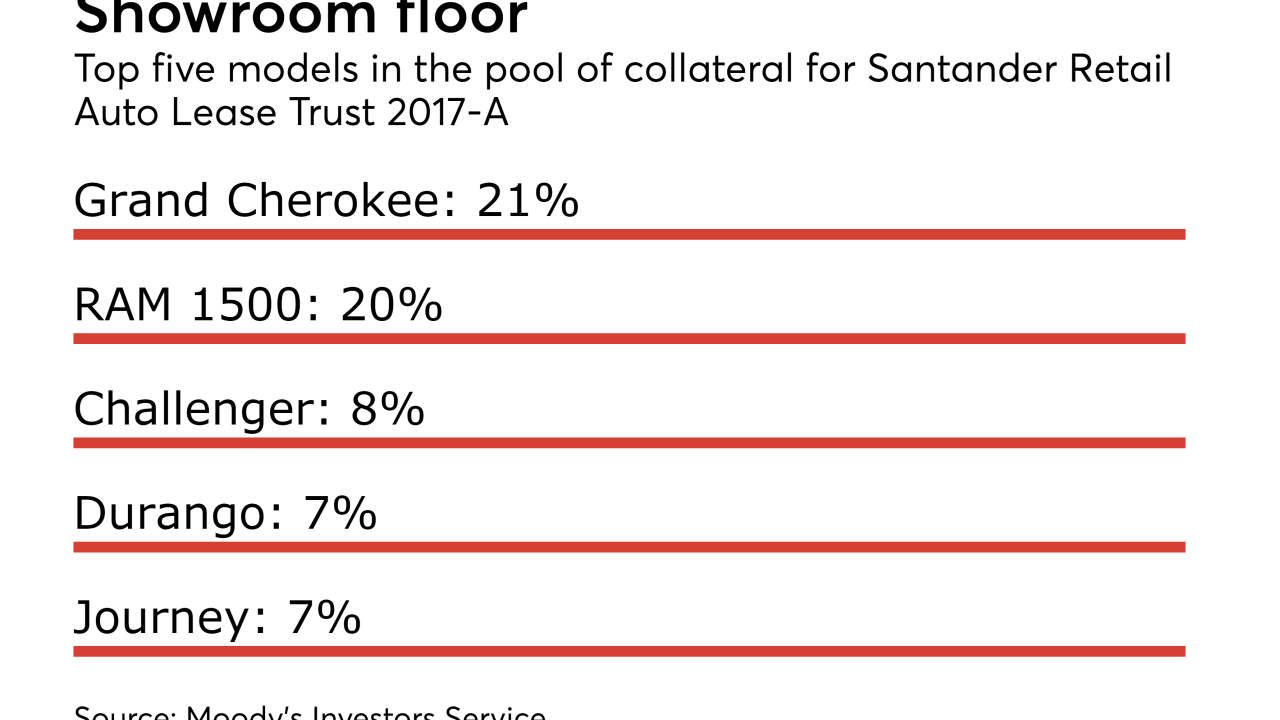

Unlike Santander’s existing retail auto loan platform, Santander Retail Auto Lease Trust 2017-A is backed by prime quality collateral. The leases were originated by its Chrysler Capital division, through dealers of Fiat Chrysler vehicles.

November 9 -

A mortgage on the marquee Caesars Palace Las Vegas is being used as collateral for $1.6 billion of mortgage bonds; proceeds will be used to repay existing indebtedness.

November 8 -

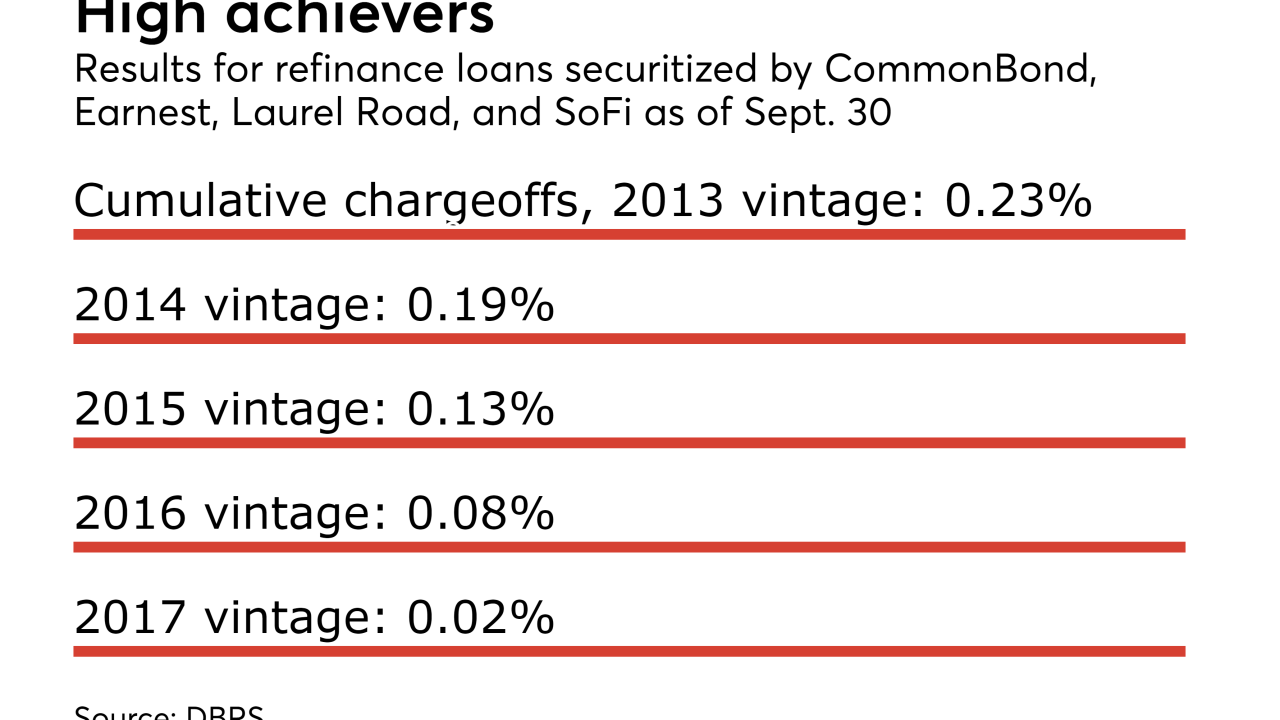

Residents' low incomes usually disqualify them for standard student loan refinancings, but SoFi and other lenders describe these borrowers as strong credits with high earnings potential who could offset some of the risks lurking in student loan pools.

November 7 -

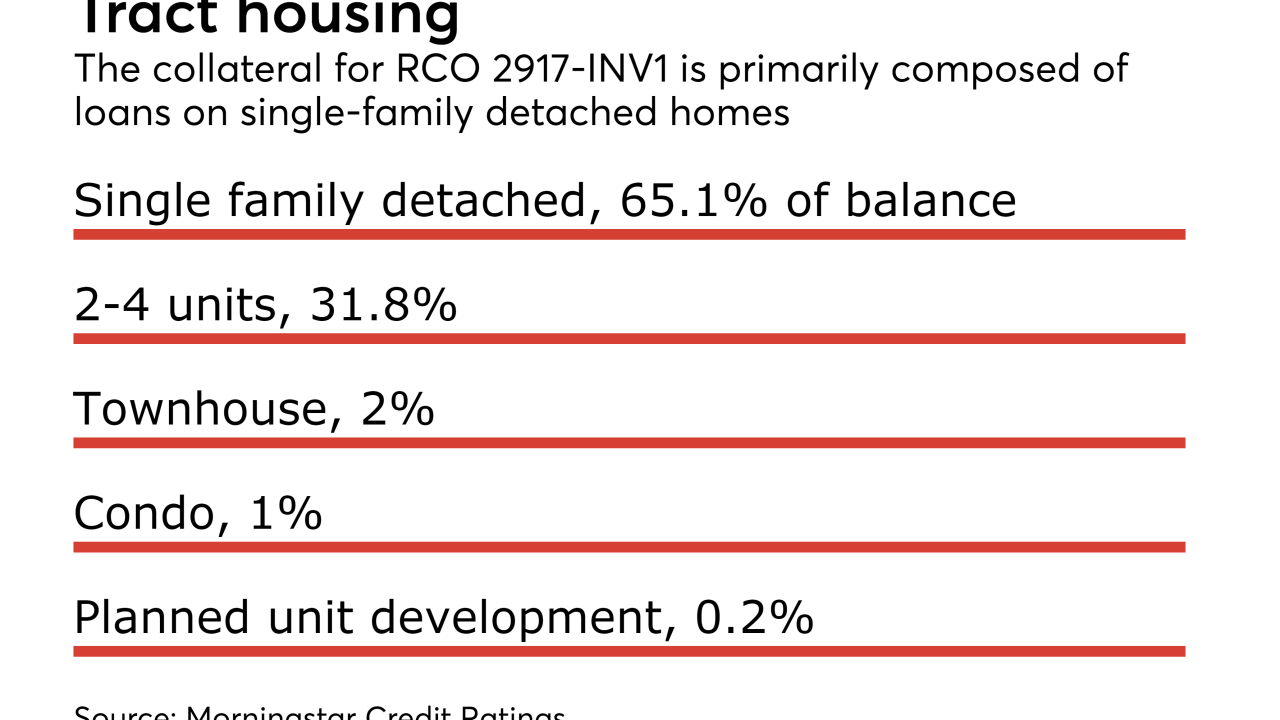

Similar to a transaction completed in December, the loans in the $127 million RCO 2917-INV1 were originated by Lima One Capital and Visio Financial.

November 6