-

The jump is from a very low base; absolutely delinquency rates on mortgages referenced in GSE credit risk transfer deals are still likely to remain under 1% and much of the effect is likely to be temporary.

November 17 -

The properties have a total of 1,228 rooms, or "keys" located across four major U.S. cities: San Francisco (346 keys; 39.4% of allocated loan amount), Chicago (429 keys; 26.4%), Boston (178 keys; 18.2%) and Philadelphia (275 keys; 16%).

November 16 -

That’s an about-face from the bank’s previous transaction, completed in October, which was backed by fixed-rate mortgages, nearly half of which were underwritten to standards for purchase by Fannie Mae or Freddie Mac.

November 16 -

The private equity firm obtained a $540 million loan on the JW Marriott Grande Lakes and the Ritz-Carlton Grande Lakes, which are situated on 500 acres at the headwaters of the Everglades, from Barclays and Wells Fargo.

November 15 -

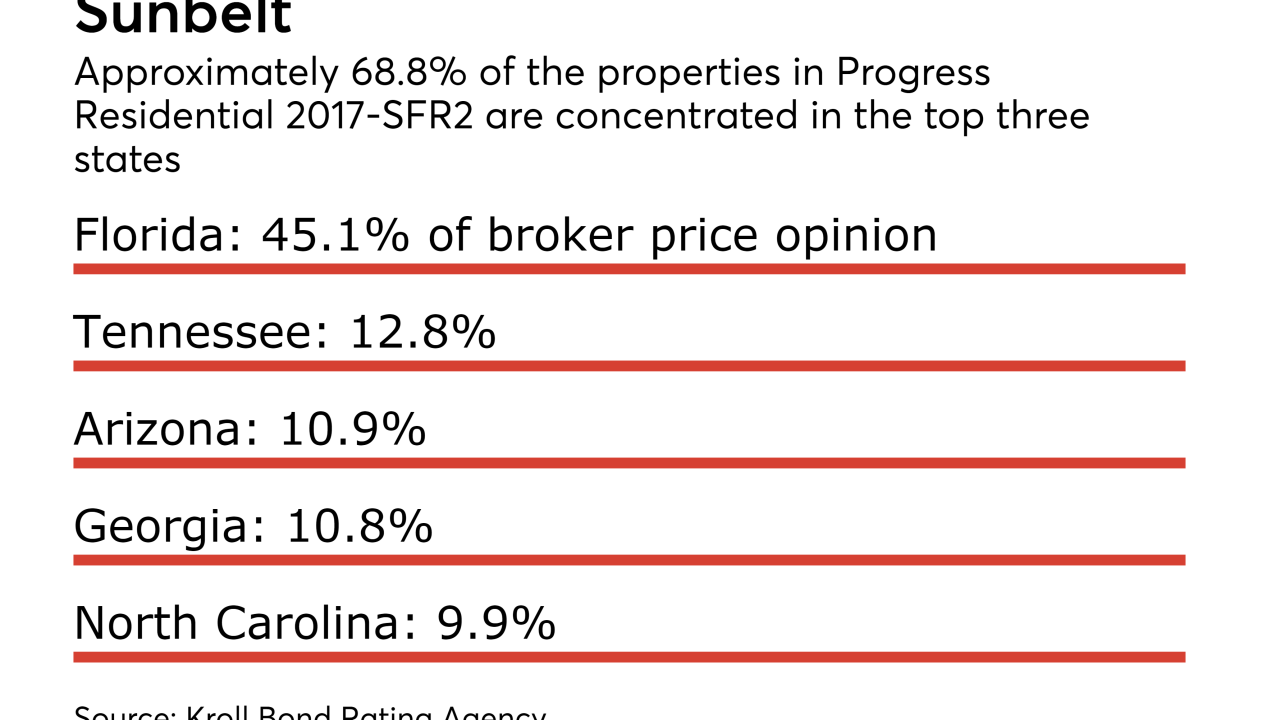

A total of 191 properties, or 11.4% of the 1,598 in the pool, were previously securitized in transactions completed in 2014 and 2015 and repaid using a portion of the proceeds from a 2016 transaction.

November 14 -

Both transactions are backed primarily by narrowbody aircraft; WorldStar's finances a third of its fleet; Aergen is refinancing its entire fleet and obtaining $100 million of delayed draw funding.

November 10 -

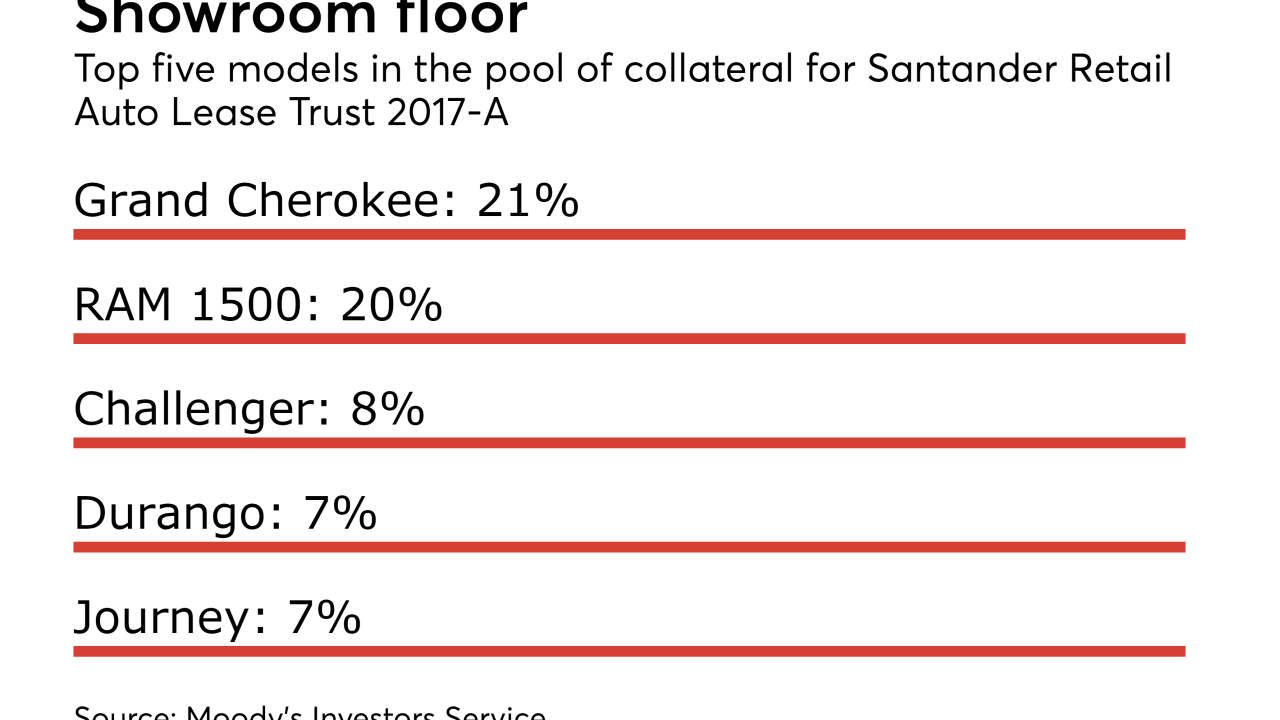

Unlike Santander’s existing retail auto loan platform, Santander Retail Auto Lease Trust 2017-A is backed by prime quality collateral. The leases were originated by its Chrysler Capital division, through dealers of Fiat Chrysler vehicles.

November 9 -

A mortgage on the marquee Caesars Palace Las Vegas is being used as collateral for $1.6 billion of mortgage bonds; proceeds will be used to repay existing indebtedness.

November 8 -

Residents' low incomes usually disqualify them for standard student loan refinancings, but SoFi and other lenders describe these borrowers as strong credits with high earnings potential who could offset some of the risks lurking in student loan pools.

November 7 -

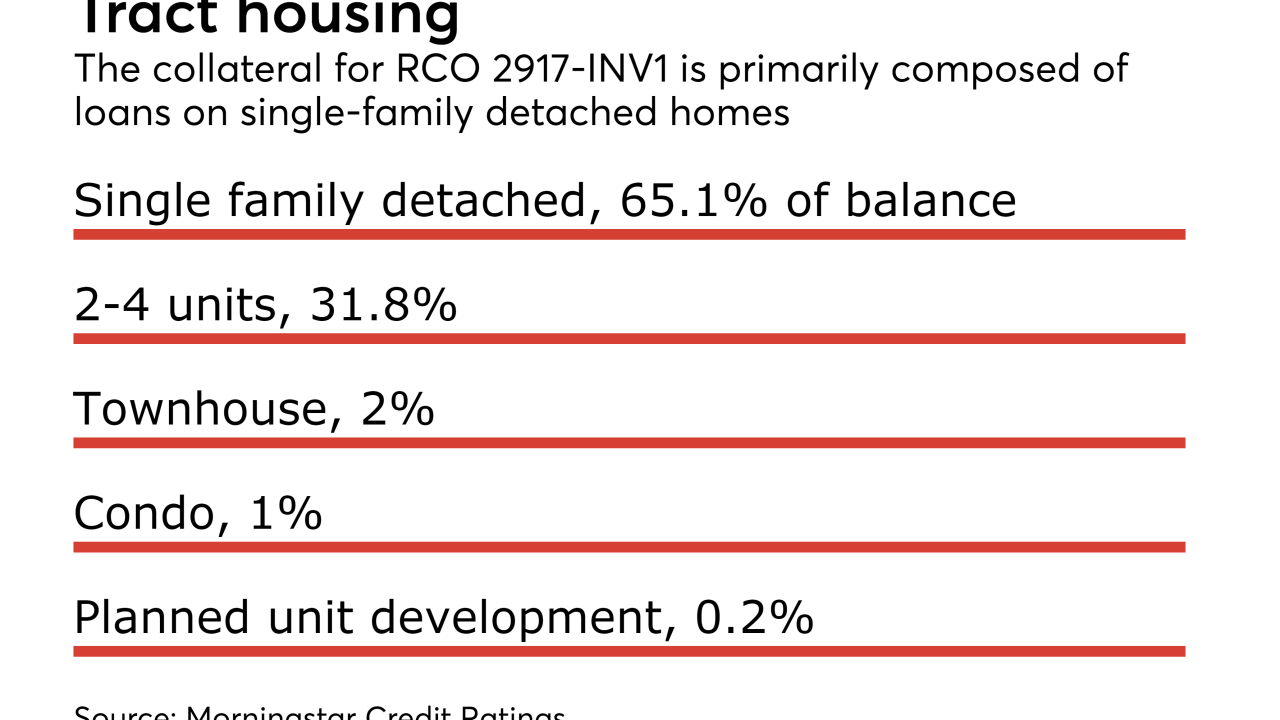

Similar to a transaction completed in December, the loans in the $127 million RCO 2917-INV1 were originated by Lima One Capital and Visio Financial.

November 6 -

The deal, DLL Securitization Trust 2017-A, is unusual in that it is backed almost entirely by agricultural equipment; other lessors such as CNH and John Deere securitize a mix of agricultural and construction equipment.

November 6 -

James Bennison, head of alternative capital markets at Arch Capital Group, says that a new insurance-linked security helps with regulatory capital requirements and provides information that can help the company to better manage risk.

November 3 -

To compensate for weakening used car prices, Hyundai has lowered the base residual value, or the amount it expects to be recovered when cars come off lease and are resold.

November 3 -

The $480 million transaction is backed by 19 primarily narrowbody aircraft with a weighted average life of 7.2 years on lease to 17 lessees located in 14 countries.

November 3 -

The $300 million deal is a first for the Swedish manufacturer. Nissan also plans to issue as much as $1.25 billion of retail auto dealer floorplan notes.

November 2 -

A large portion of the collateral for both IH 2014-SFR2 and IH 2014-SFR3 is being rolled into a new securitization, IH 2017-SFR2.

November 1 -

The delinquency rate for U.S. commercial real estate loans in CMBS is now 5.21%, a decrease of 19 basis points from the September level, according to Trepp. That is the second-largest rate drop measured in the last 19 months.

October 31 -

Initial credit enhancement on the senior notes to be issued has risen to 17.5% from 16.8% for the lender's previous securitization, but the target level is unchanged at 30%.

October 30 -

In addition to insurance premiums, borrowers in the pool use the loans for annual membership fees of sport or leisure facilities or professional bodies.

October 30 -

The two investment firms recently obtained $1.1 billion in loans from Goldman Sachs and Deutsche Bank to purchase a 48.7% stake in the property from New York REIT, which previously owned 98.8%.

October 30